Inprise/Borland Corporation provides an overview of its corporate strategy, products, and financial performance. Key points include:

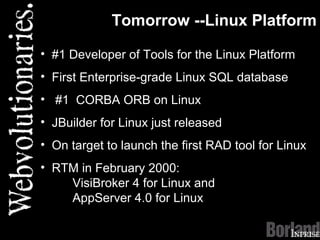

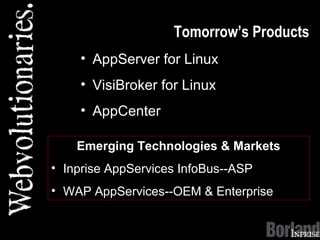

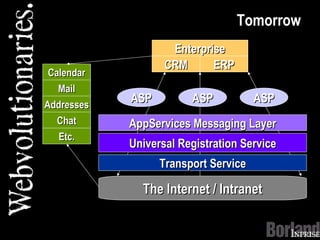

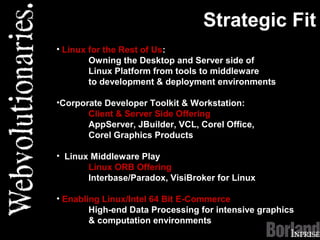

- The company positions itself as the leading developer of tools for emerging markets like Linux and application service providers (ASPs).

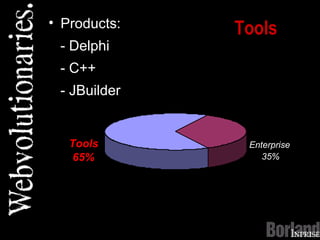

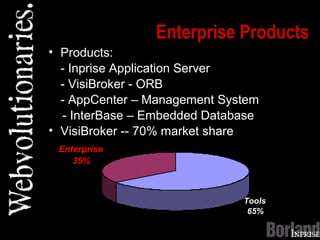

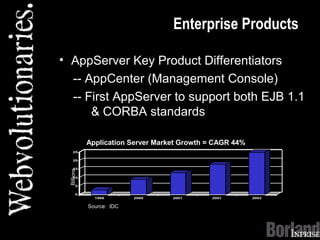

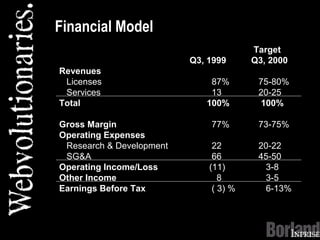

- Its main products are development tools and enterprise middleware like application servers and databases. It aims to use revenue from mature tools to fund growth in Linux and Java markets.

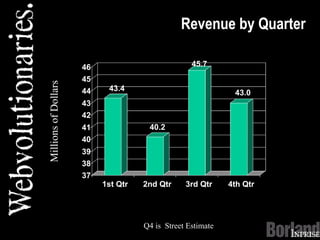

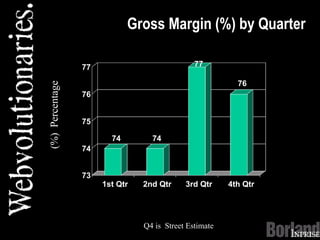

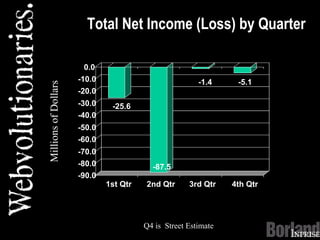

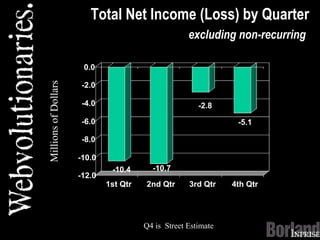

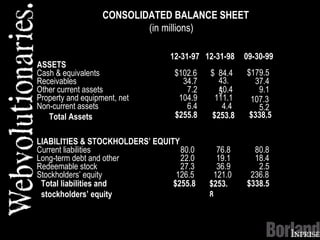

- Financially, the company expects revenue growth from licenses to slow but services revenue to increase. It targets improved gross margins and reduced operating expenses to achieve profitability and revenue growth.