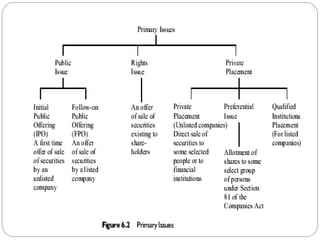

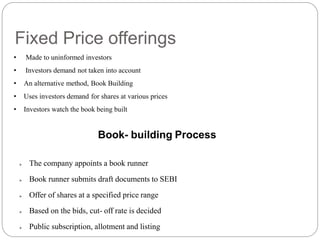

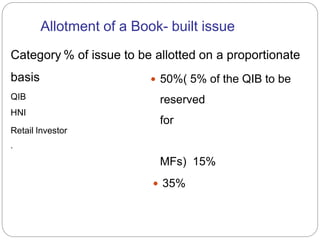

The document summarizes various aspects of primary market public issues in India. It describes the key differences between an IPO and an FPO, the book building process for public issues, intermediaries involved, pricing mechanisms, and allotment categories. It also provides details about a sample IPO for SiS including issue dates, size, price and lead managers.

![🠶 The object of the issue are:

1. Repayment and pre-payment of a portion of certain outstanding

indebtedness availed by the Company;

2. Funding working capital requirements of the Company; and

3. General corporate purposes.

🠶 Issue Detail:

🠶 »

» Issue Open:Jul 31, 2017 -Aug 2, 2017

»

» Issue Type:Book Built Issue IPO

»

» Issue Size:

› Fresh Issue of [.] Equity Shares of Rs 10 aggregating up to Rs 362.25 Cr

› Offer for Sale of 5,120,619Equity Shares of Rs 10 aggregating up to Rs [.] Cr

»

» Face Value:Rs 10 Per Equity Share

»

» Issue Price:Rs 805 - Rs 815 Per Equity Share

»

» Market Lot:18 Shares

»

» Minimum Order Quantity:18 Shares

»

» Listing At:BSE, NSE](https://image.slidesharecdn.com/primarymarket-221008014950-d6ff3363/85/primary-market-pptx-11-320.jpg)