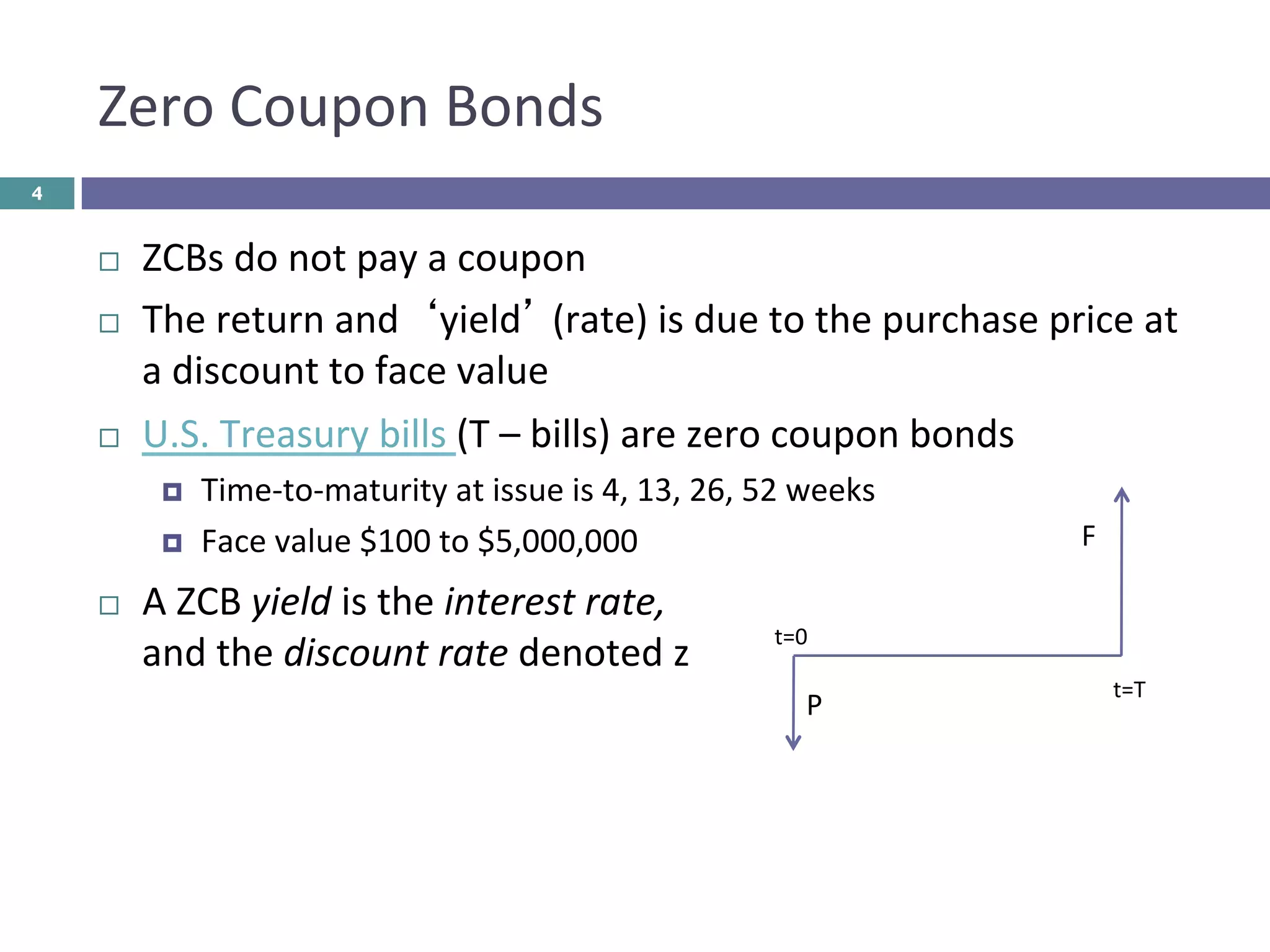

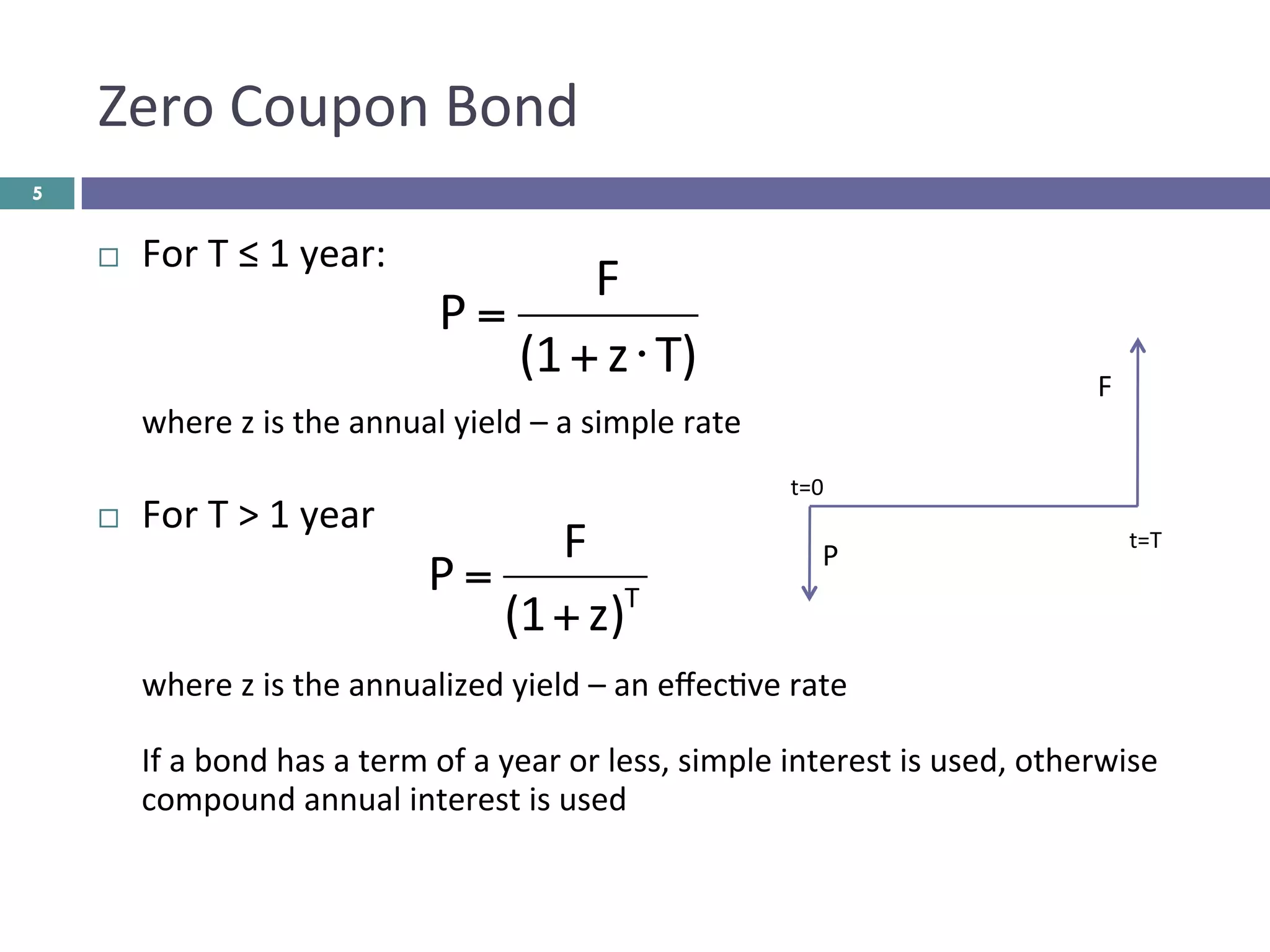

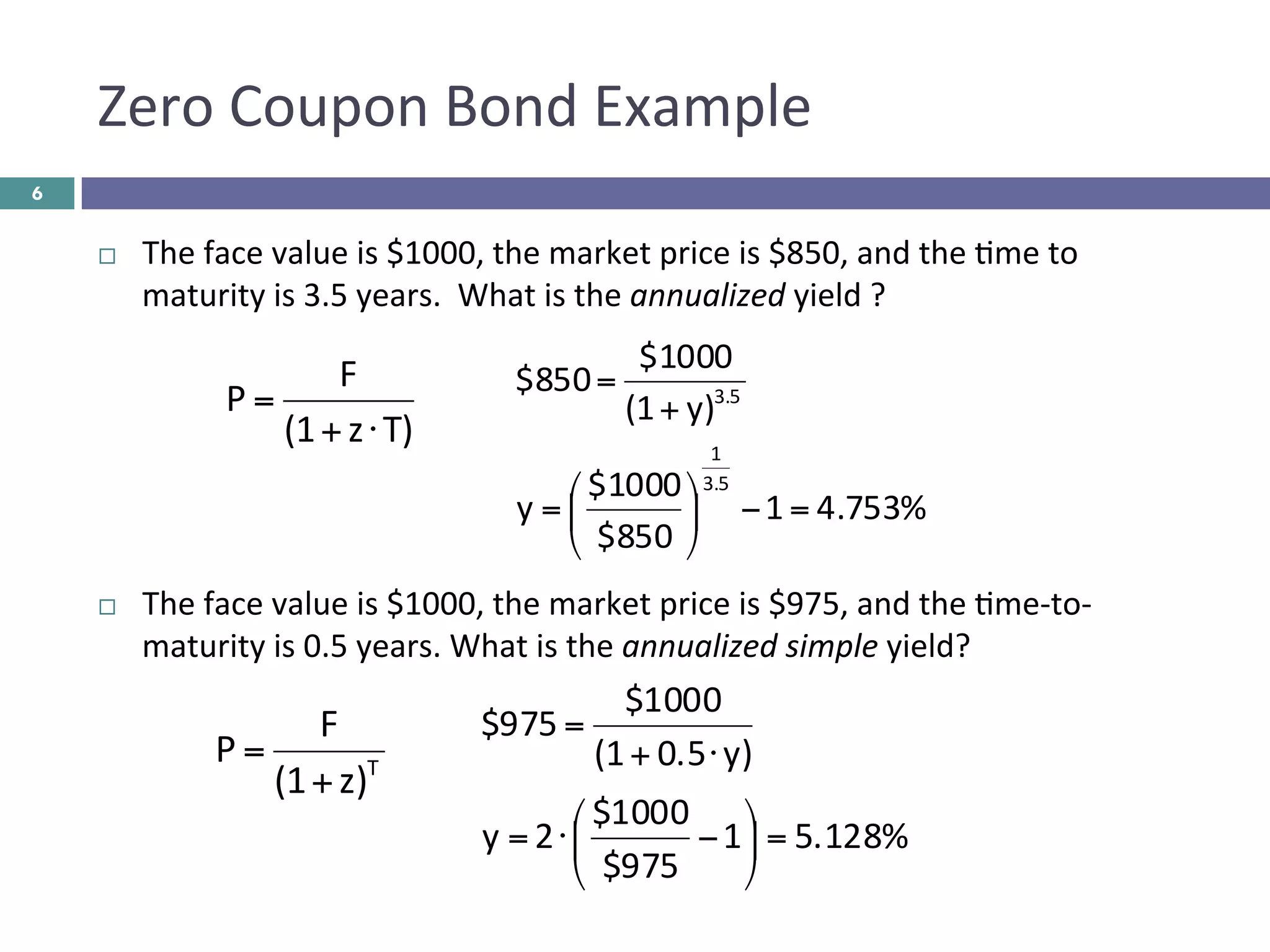

The document discusses bonds, including types of bonds and how bond prices and yields are calculated. It covers zero-coupon bonds and coupon bonds. For zero-coupon bonds, it shows the formulas to calculate price from yield and yield from price for terms less than and greater than one year. For coupon bonds, it explains how coupon payments are determined based on the coupon rate, payment frequency, and time to maturity. The purpose is to explain how to compute bond prices, yields, and related calculations.