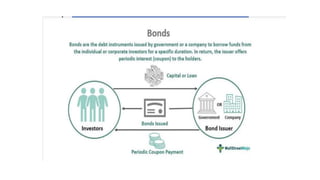

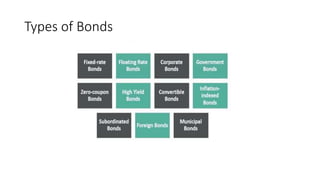

The document provides an overview of bonds, defining them as fixed-income securities issued by governments or corporations to raise funds from investors in exchange for periodic interest payments. It outlines various types of bonds, including fixed-rate, floating-rate, corporate, government, municipal, zero-coupon, and foreign bonds, along with factors influencing bond yields such as economic growth, inflation, and interest rates. Additionally, it describes bond valuation as a method for assessing the theoretical fair value of a bond based on its future cash flows and maturity value.