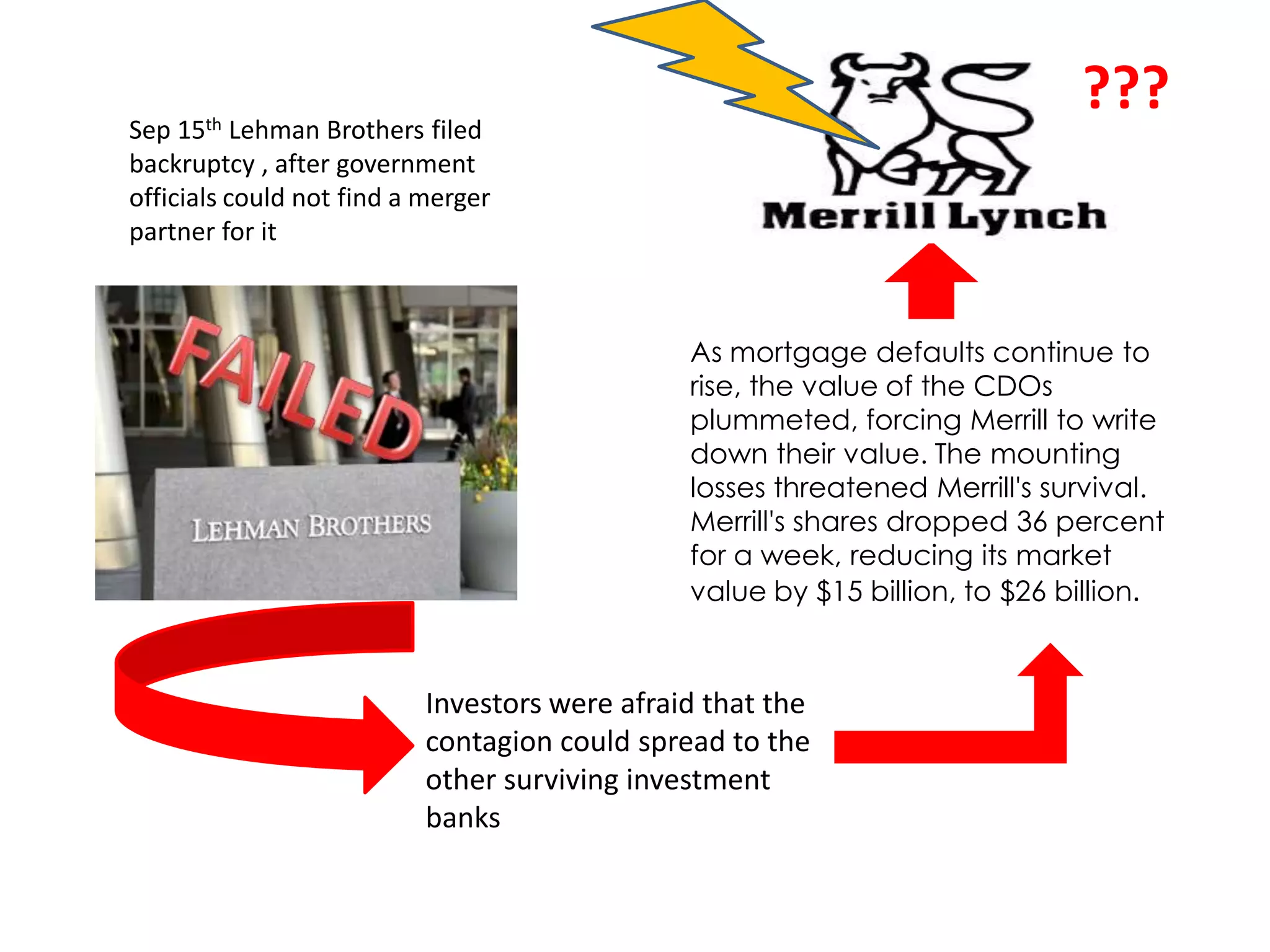

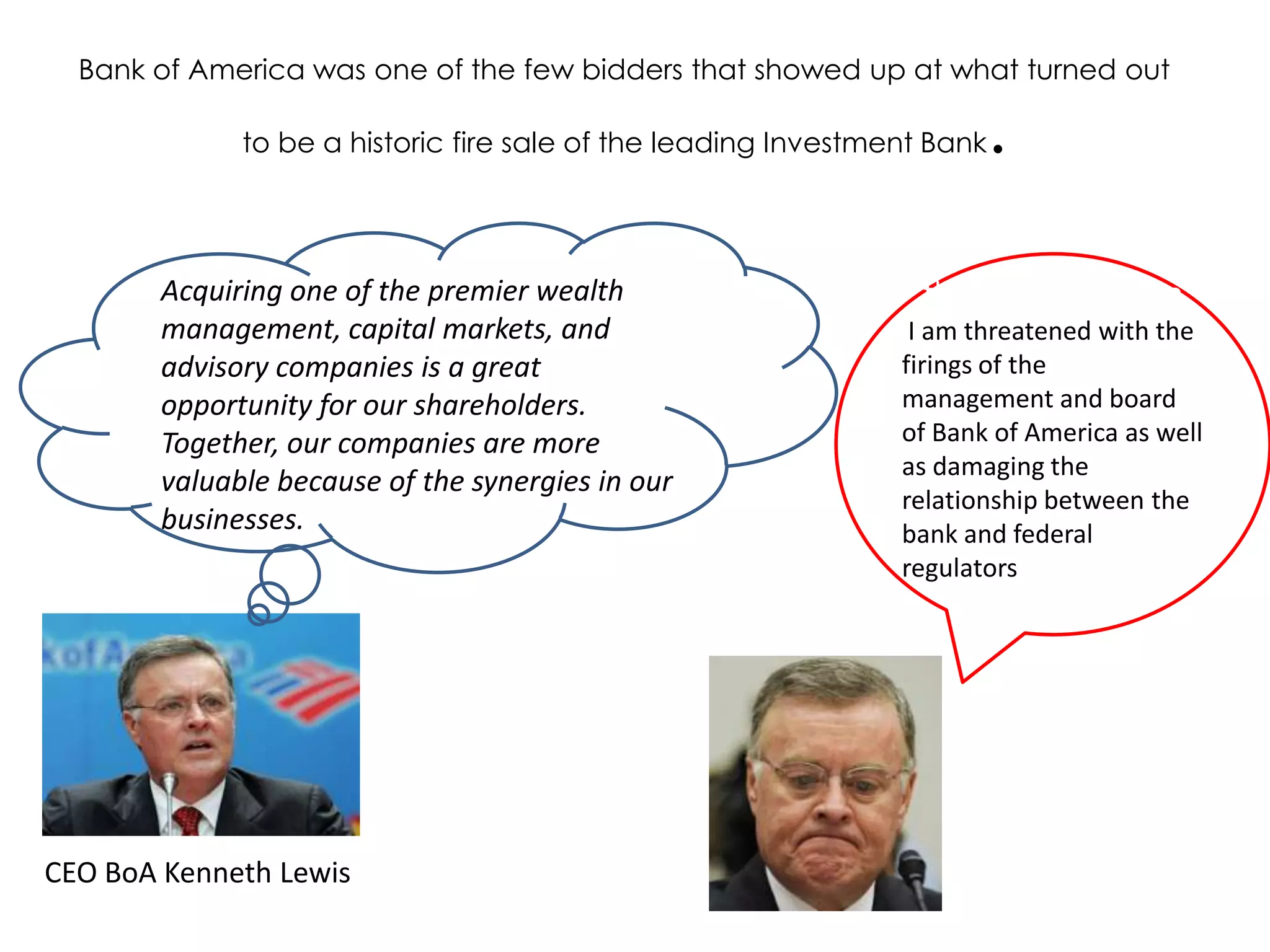

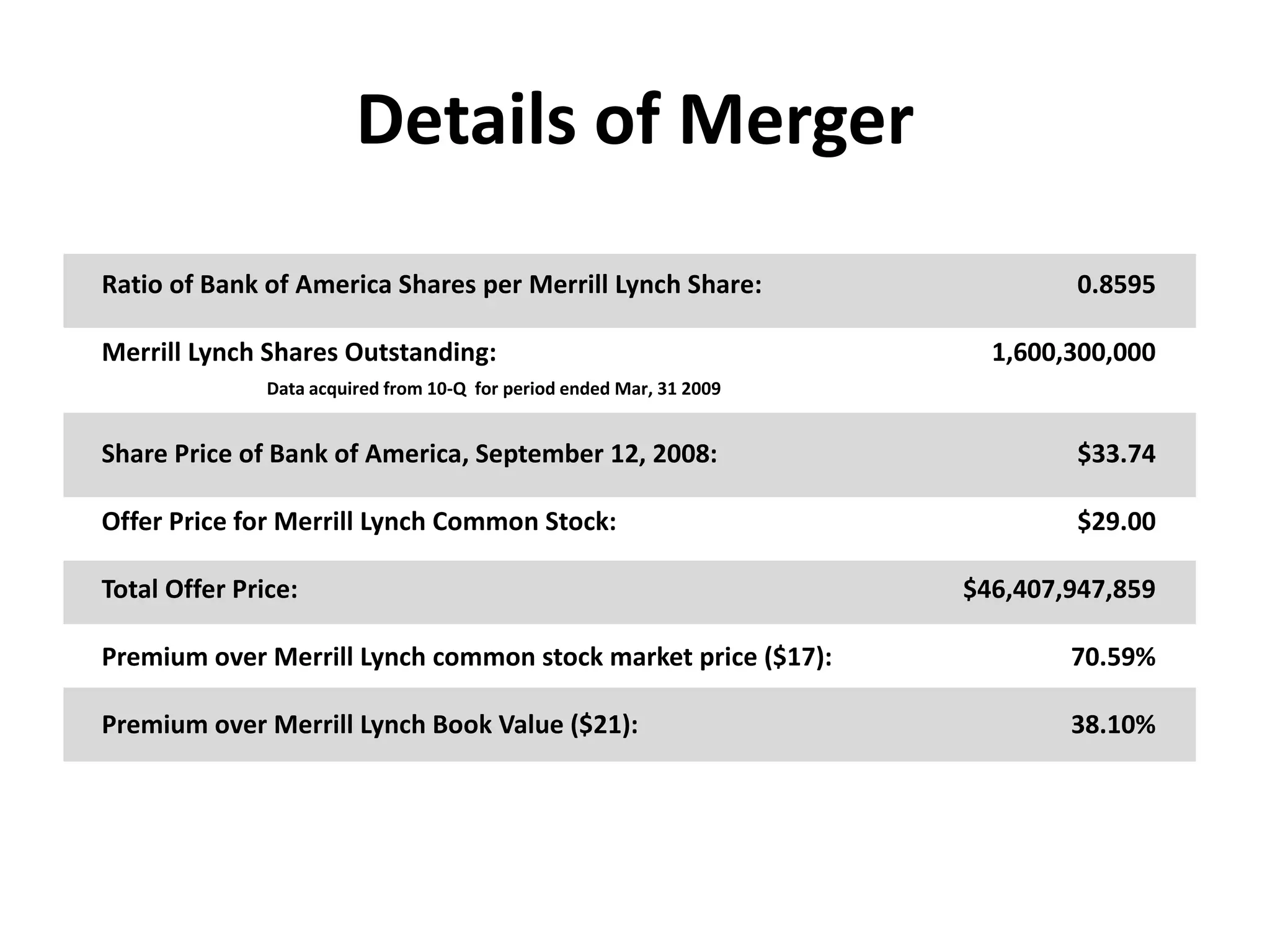

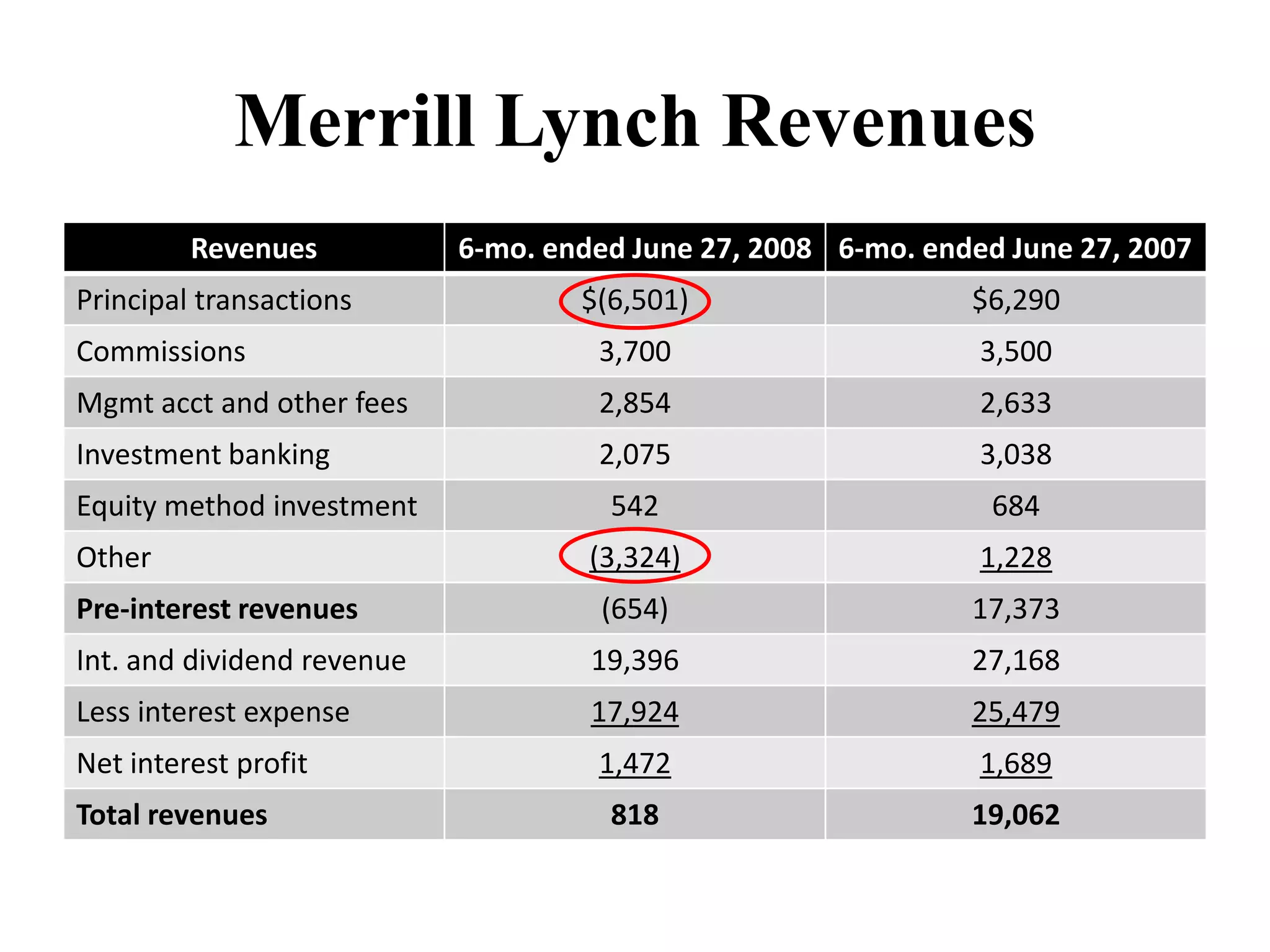

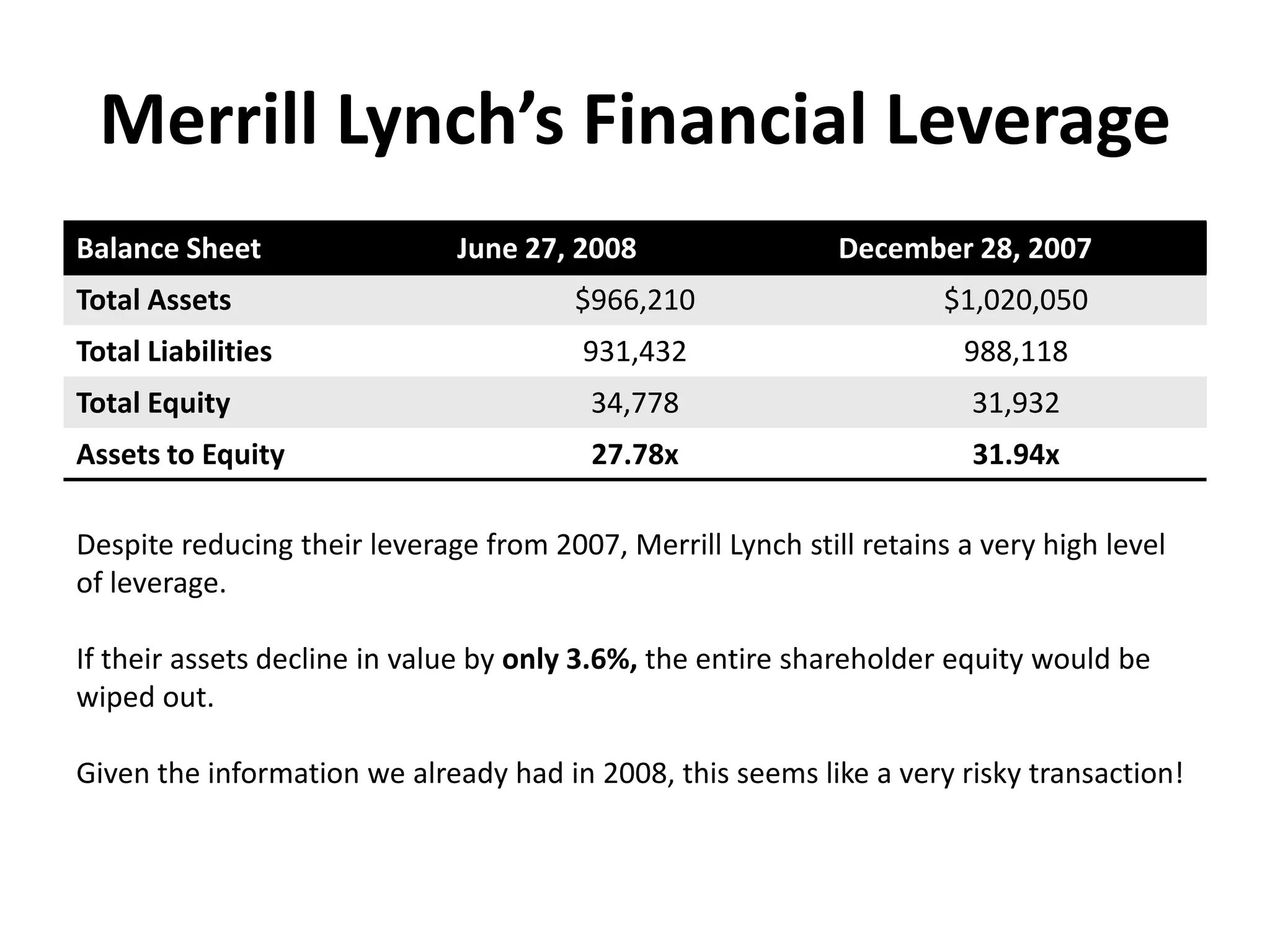

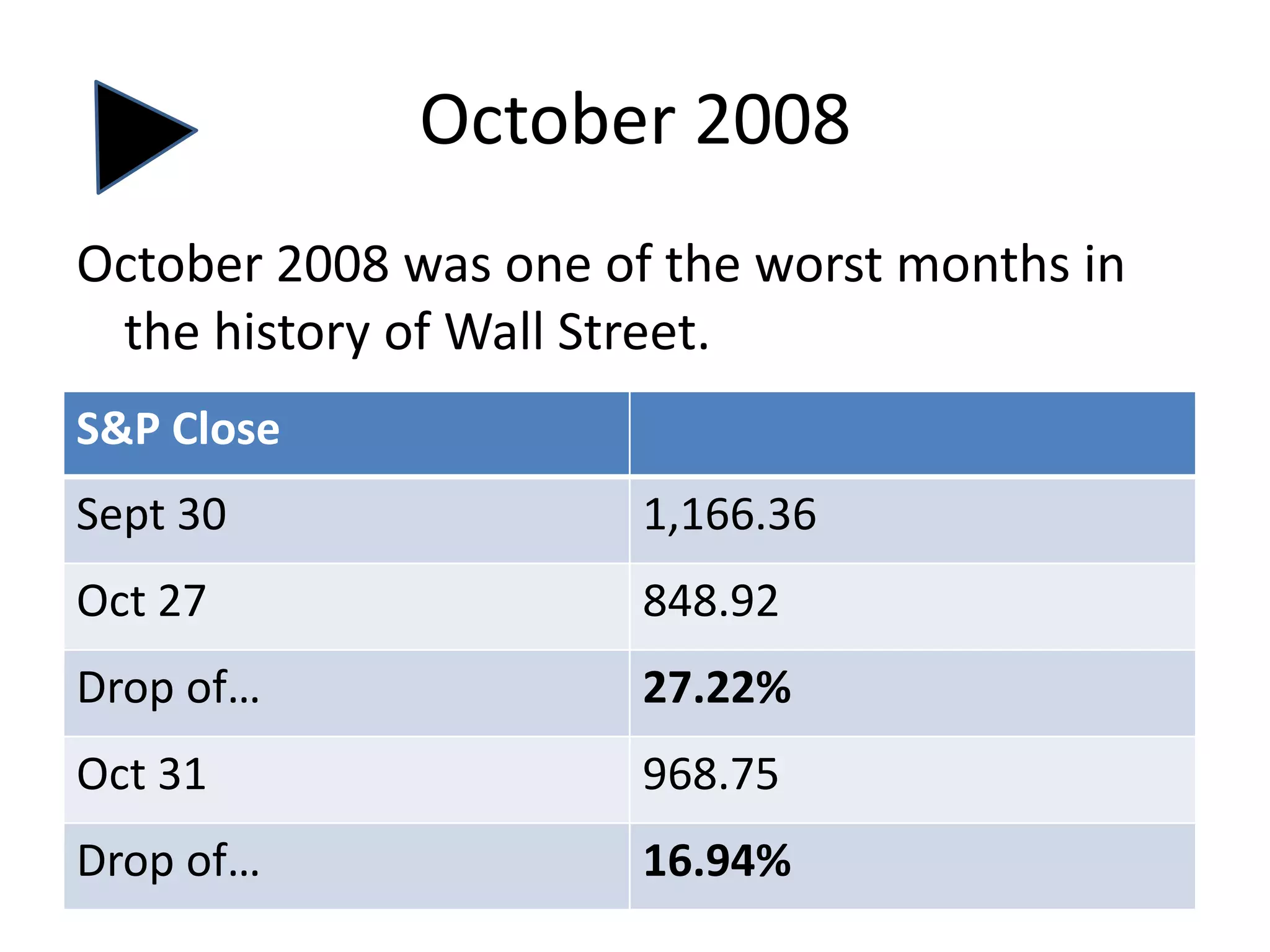

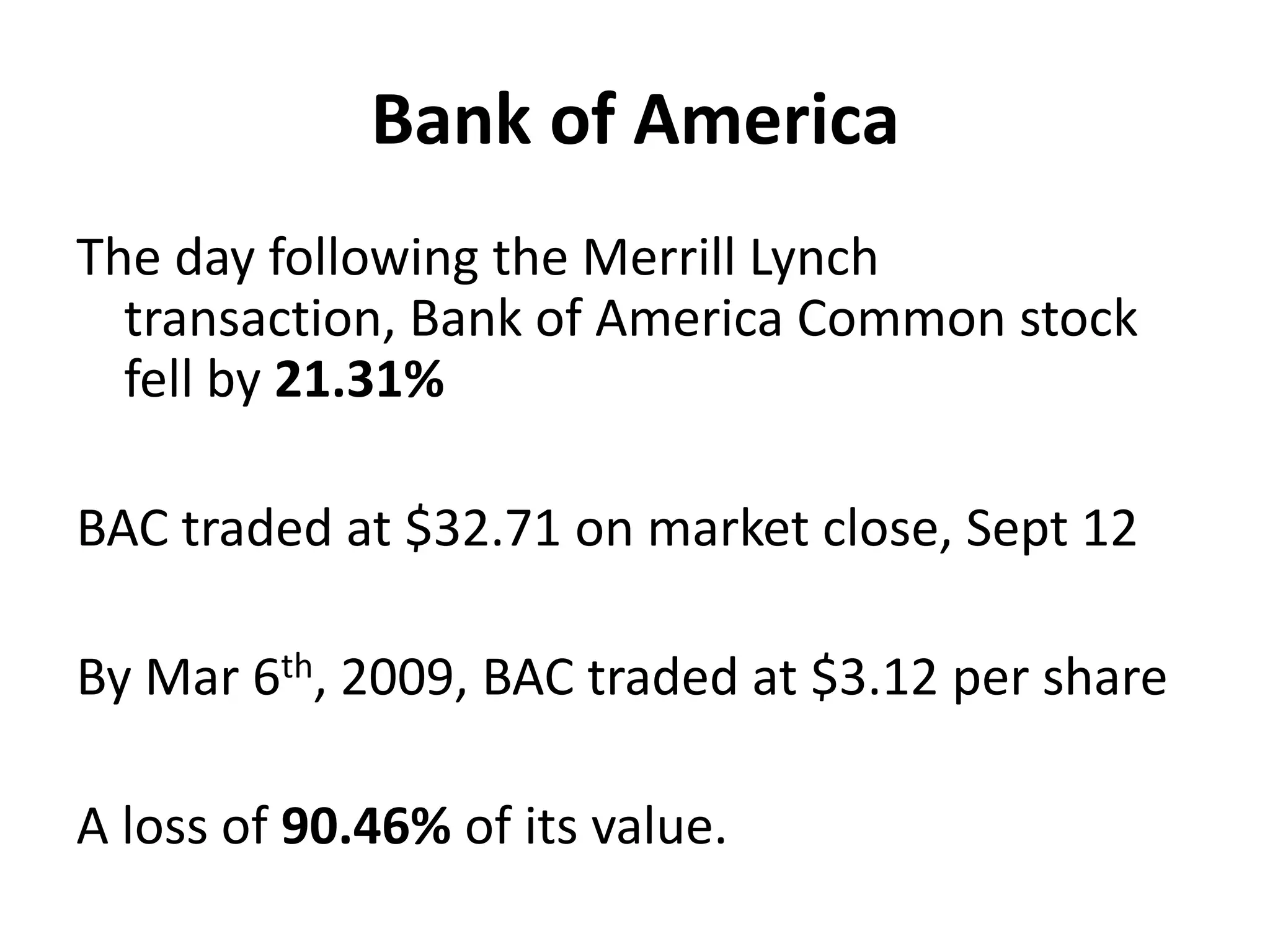

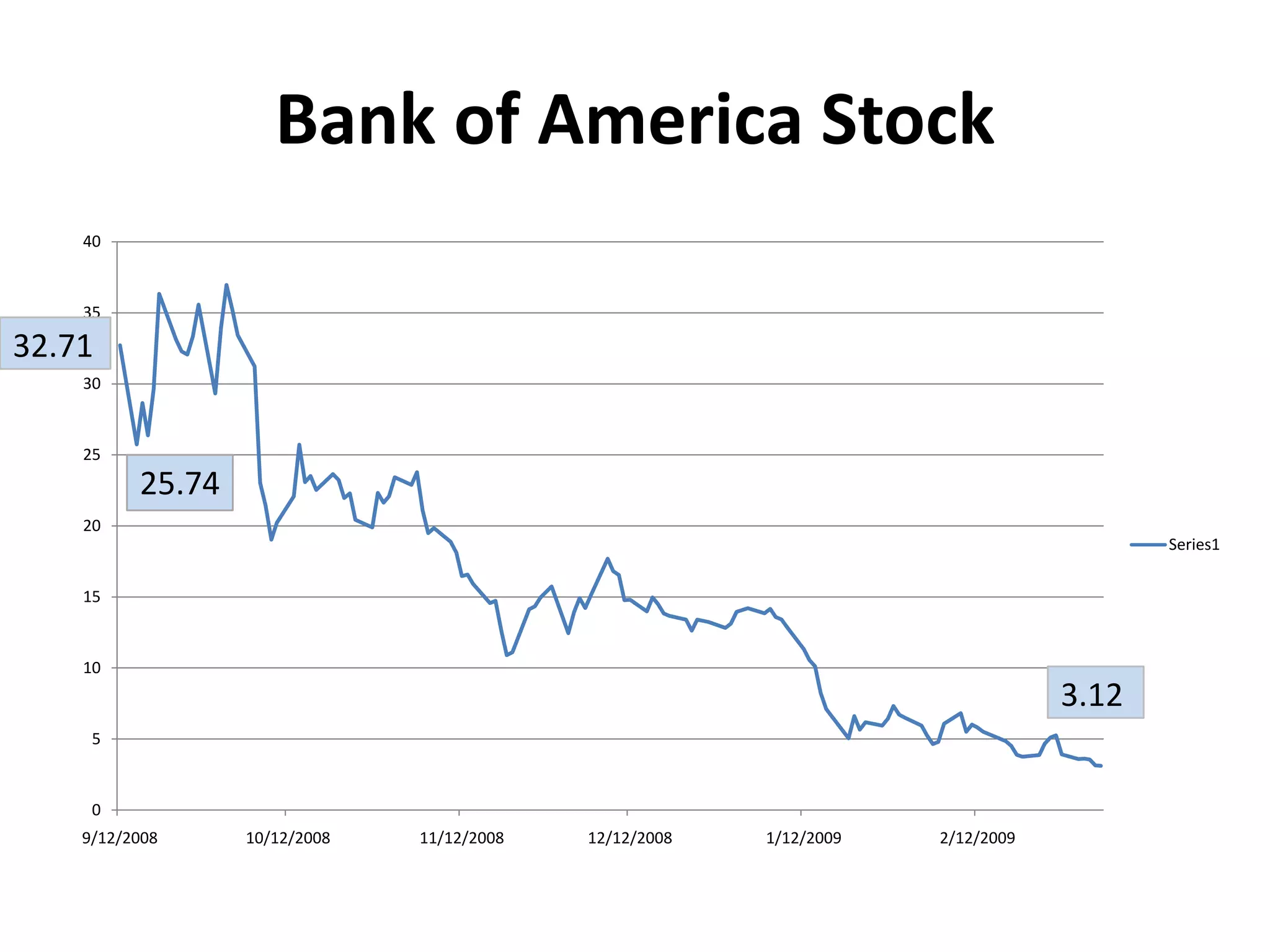

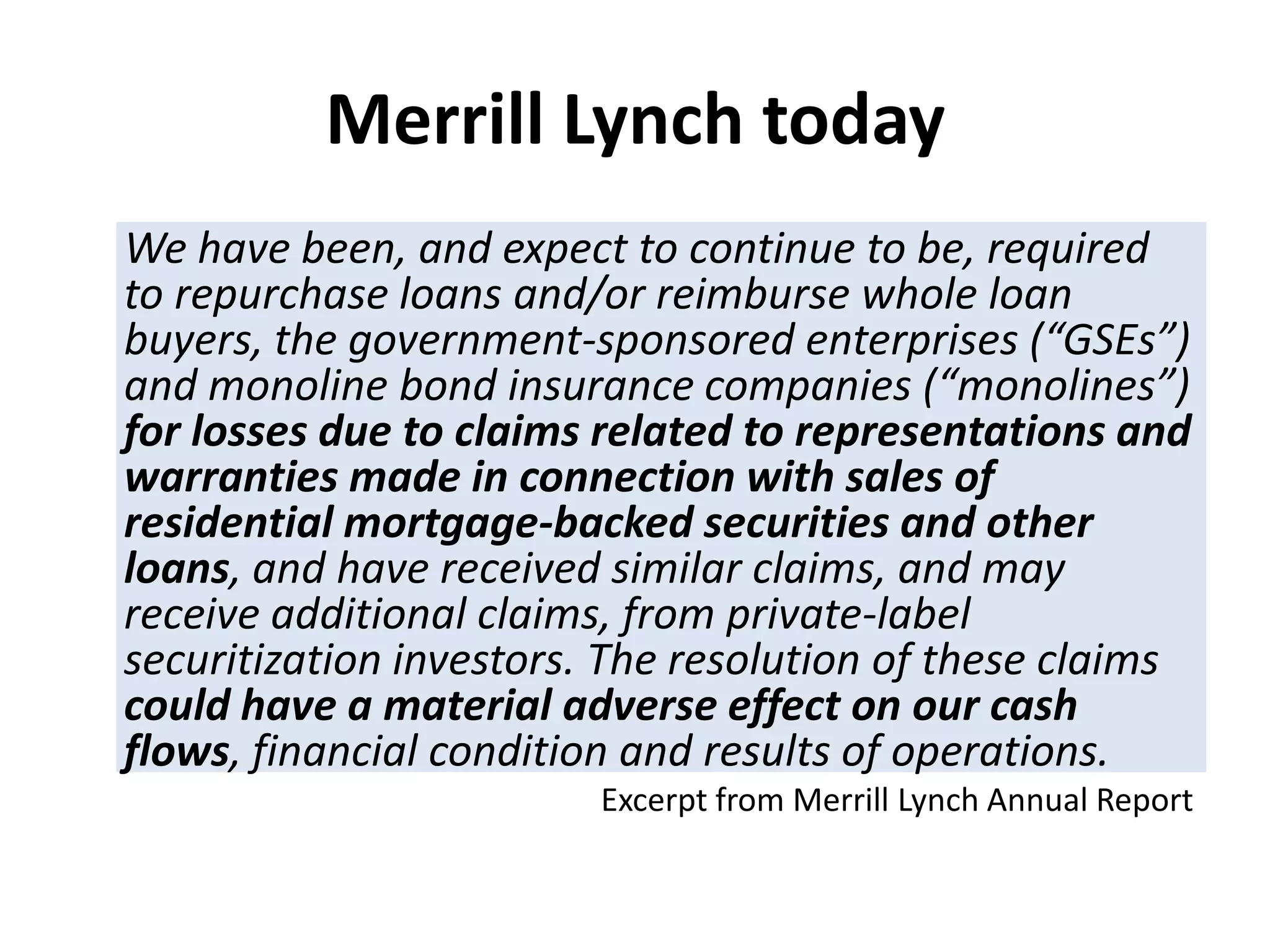

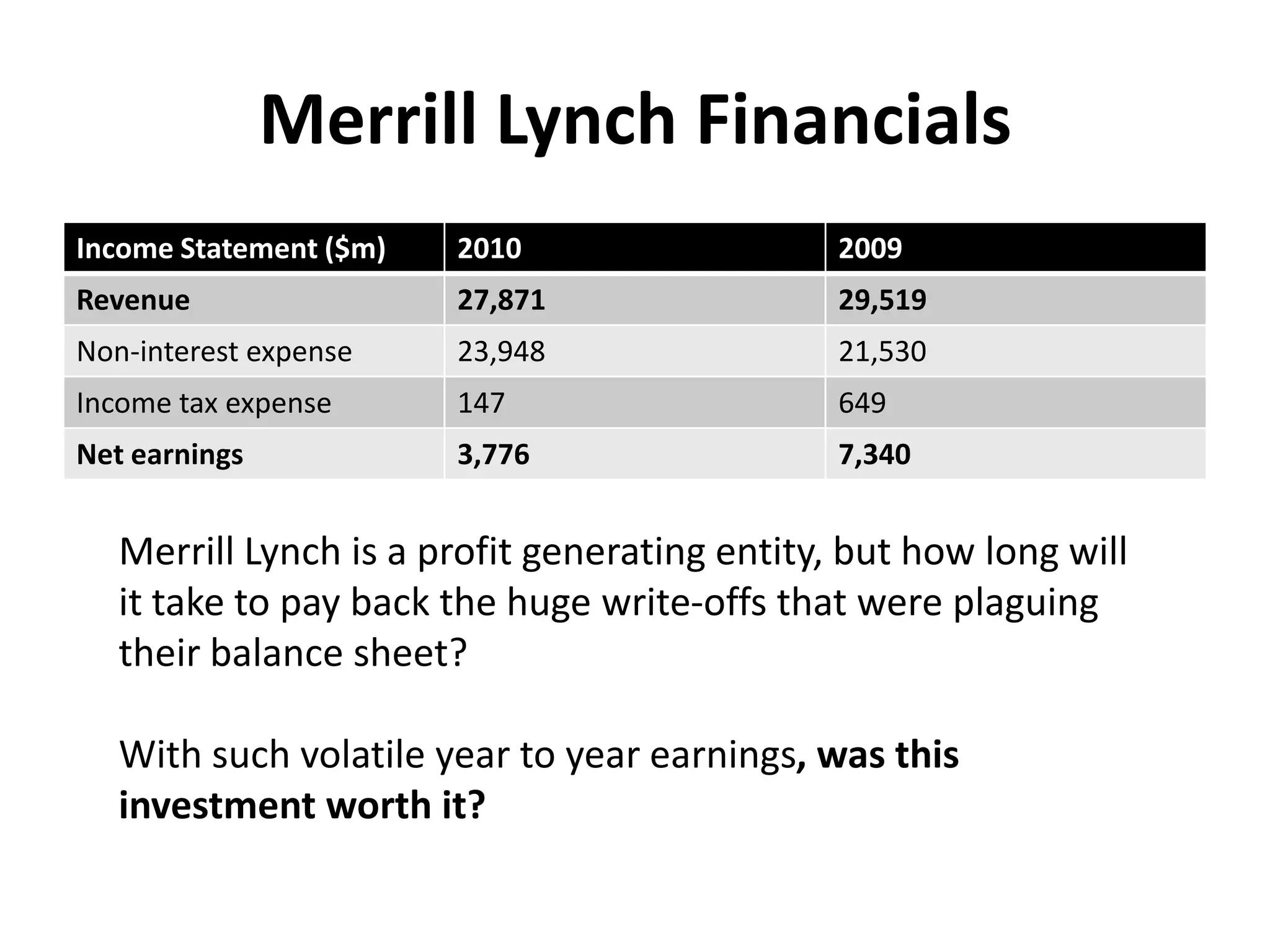

Bank of America acquired Merrill Lynch in a $50 billion deal in September 2008 during the financial crisis. Merrill Lynch was struggling with huge losses from subprime mortgage exposures. The deal was hastily completed in 2 days under pressure from the government. While it stabilized markets initially, losses for both companies mounted in subsequent months. Bank of America's stock lost over 90% of its value. Merrill Lynch continued facing lawsuits over mortgage securities. The long-term impact of the deal remains unclear given Merrill Lynch's volatile financial performance in addressing huge prior write-offs.