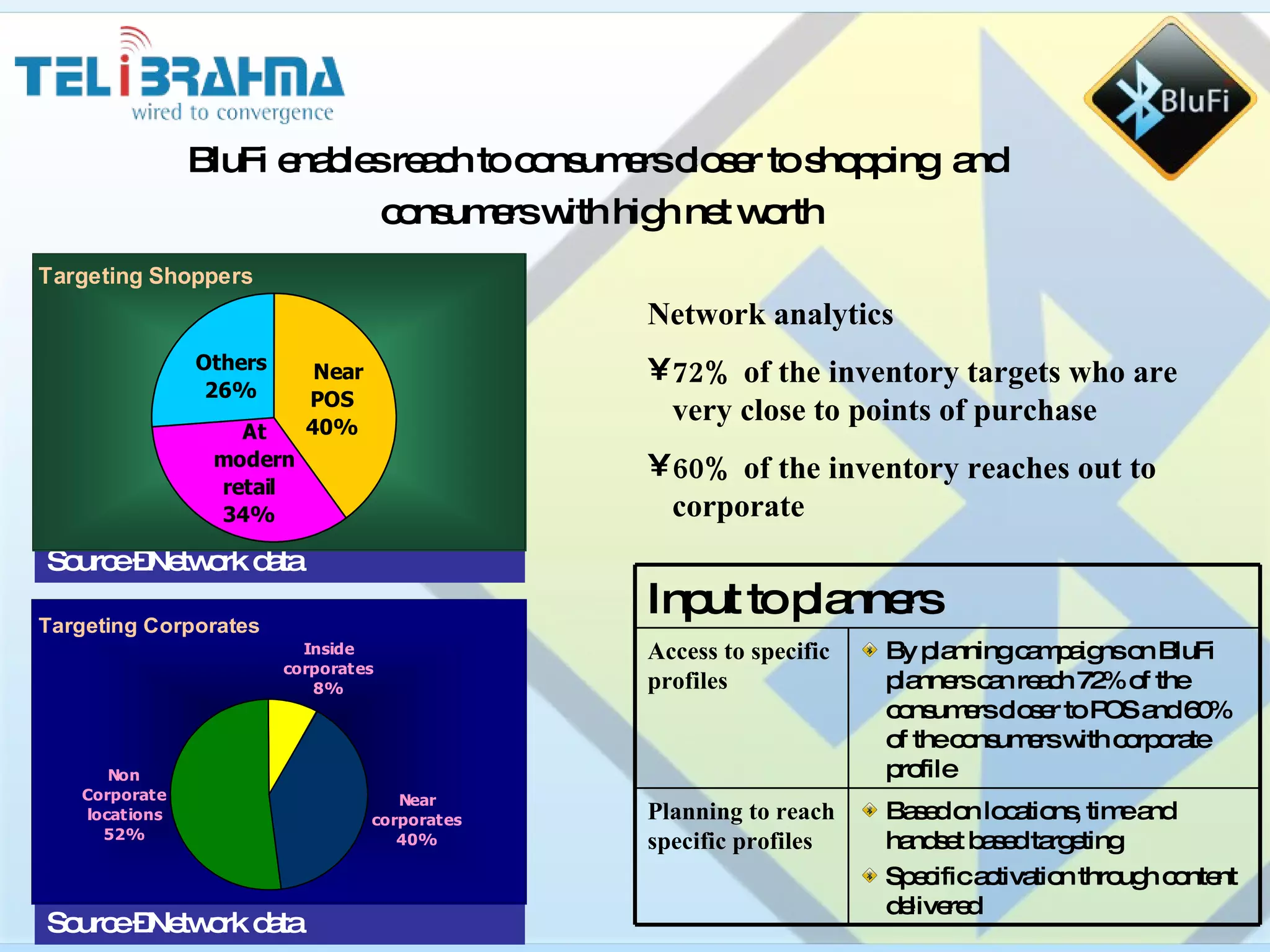

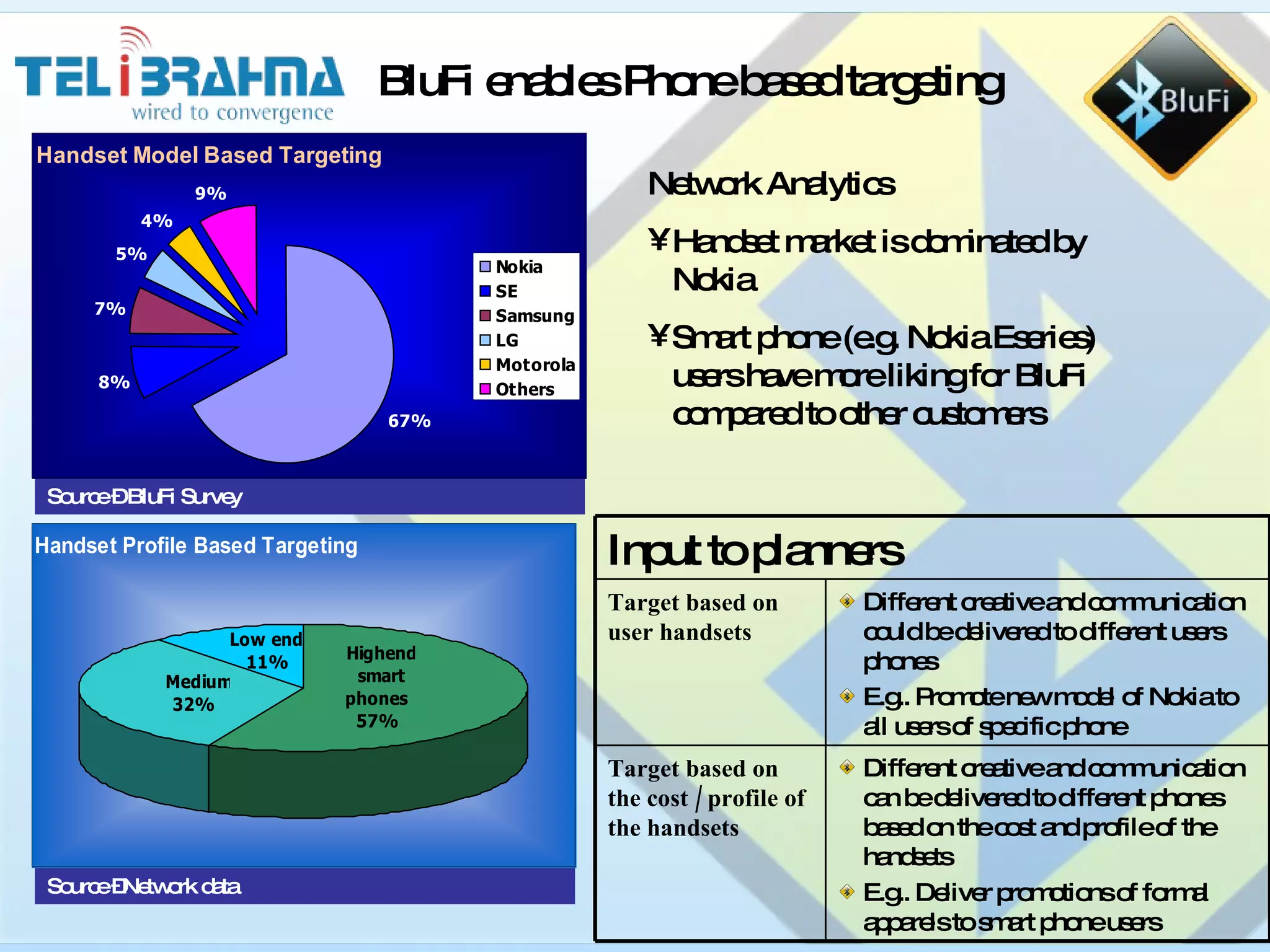

Blufi is a media platform that utilizes Bluetooth technology to target specific consumer segments across 20 cities in India, allowing brands to measure the effectiveness of their campaigns through real-time metrics. It enables precise targeting based on location and demographic profiles, particularly focusing on youth, who represent significant purchasing influence. The platform aims to deliver tailored brand communications and maximize impact with minimal media spillover, while also addressing challenges such as mobile platform issues.