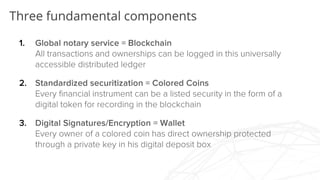

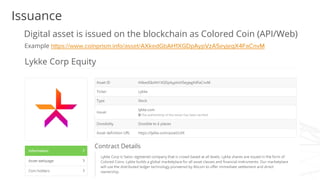

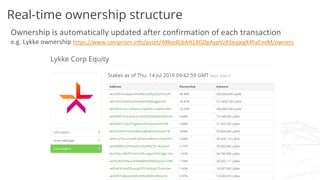

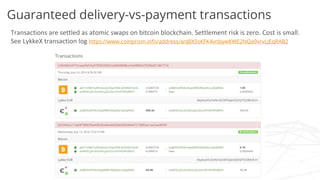

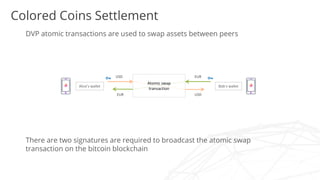

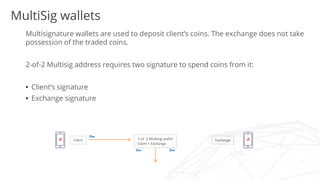

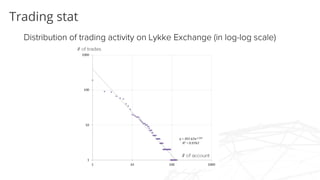

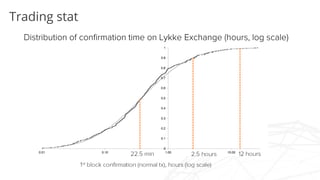

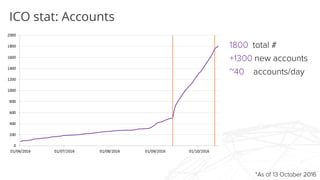

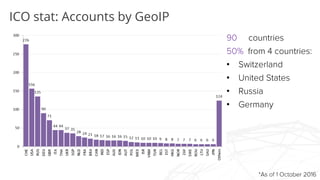

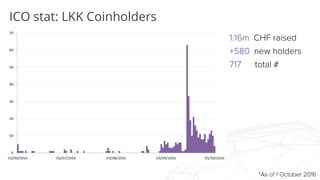

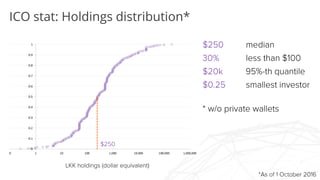

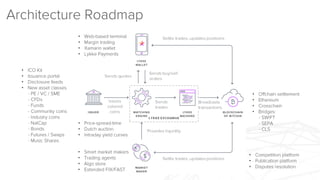

The document discusses Lykke, a blockchain-enabled exchange that aims to create a global marketplace for financial instruments with immediate settlement and direct ownership. It highlights the architectural components of the exchange, such as the global notary service, standardized securitization, and digital signatures for secure ownership. Additionally, it outlines their trading statistics and future roadmap for platform development, emphasizing the evolution of digital assets and the need for an efficient global marketplace.