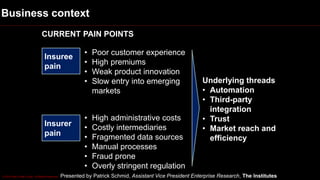

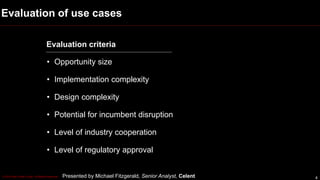

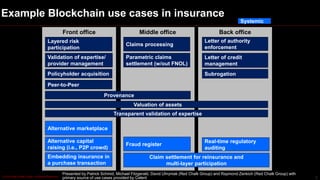

This document discusses the challenges and opportunities of implementing blockchain technology in the insurance industry. Key evaluation criteria for potential use cases include opportunity size, implementation complexity, and regulatory approval. It provides examples of blockchain applications in insurance, such as claims processing and real-time regulatory auditing.