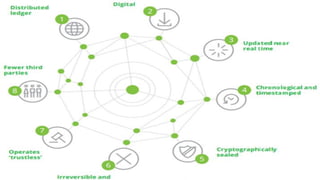

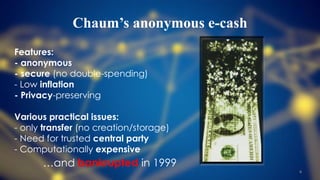

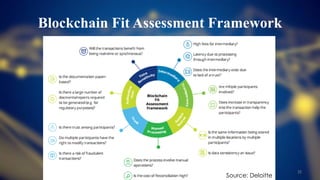

The document discusses blockchain and its applications in various business sectors, particularly highlighting cryptocurrencies like Bitcoin. It outlines the features, history, and challenges of blockchain, alongside potential adoption frameworks in areas such as finance, e-government, healthcare, and supply chains. Key challenges mentioned include transaction throughput, latency, and energy consumption related to Bitcoin mining.