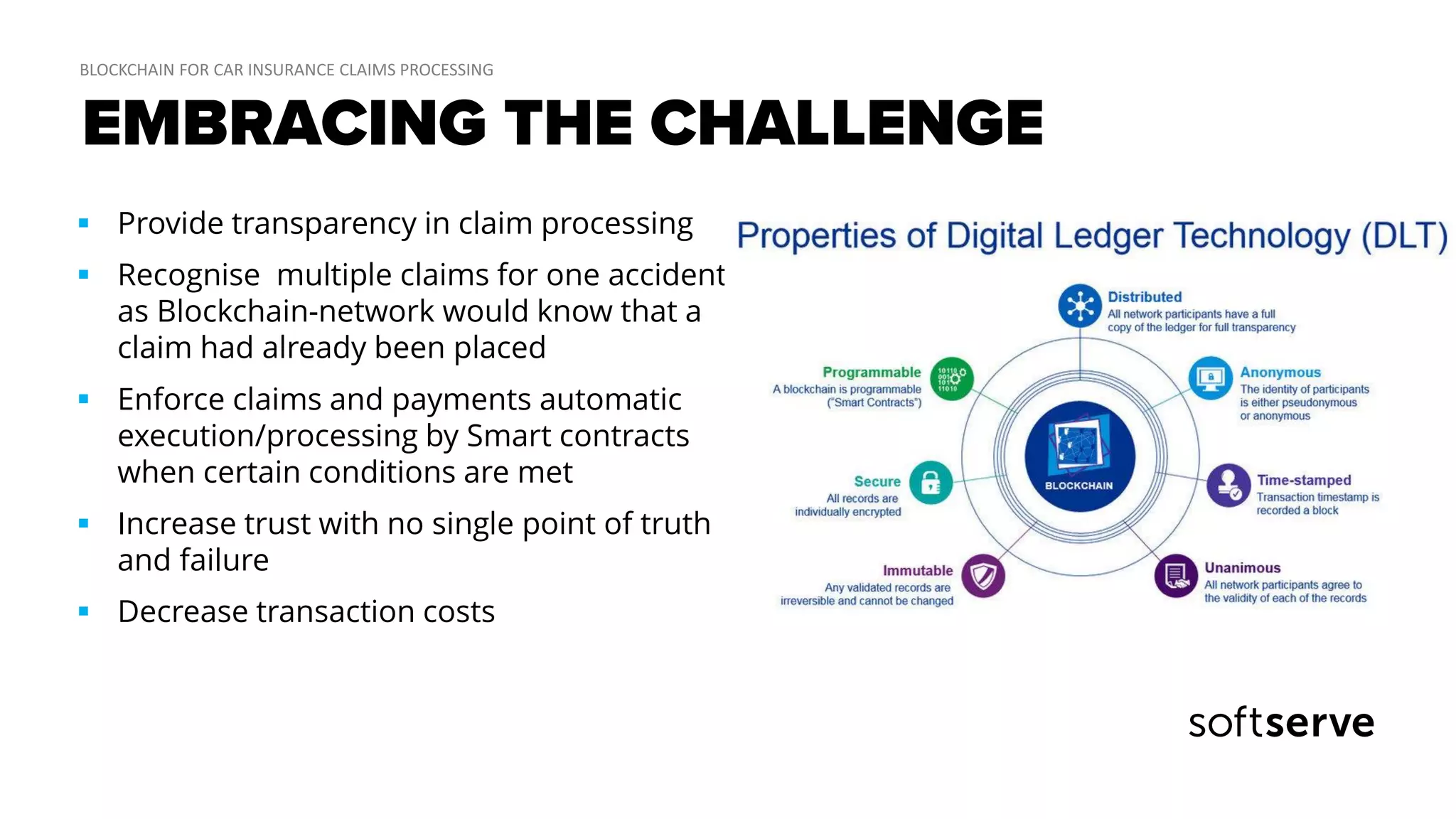

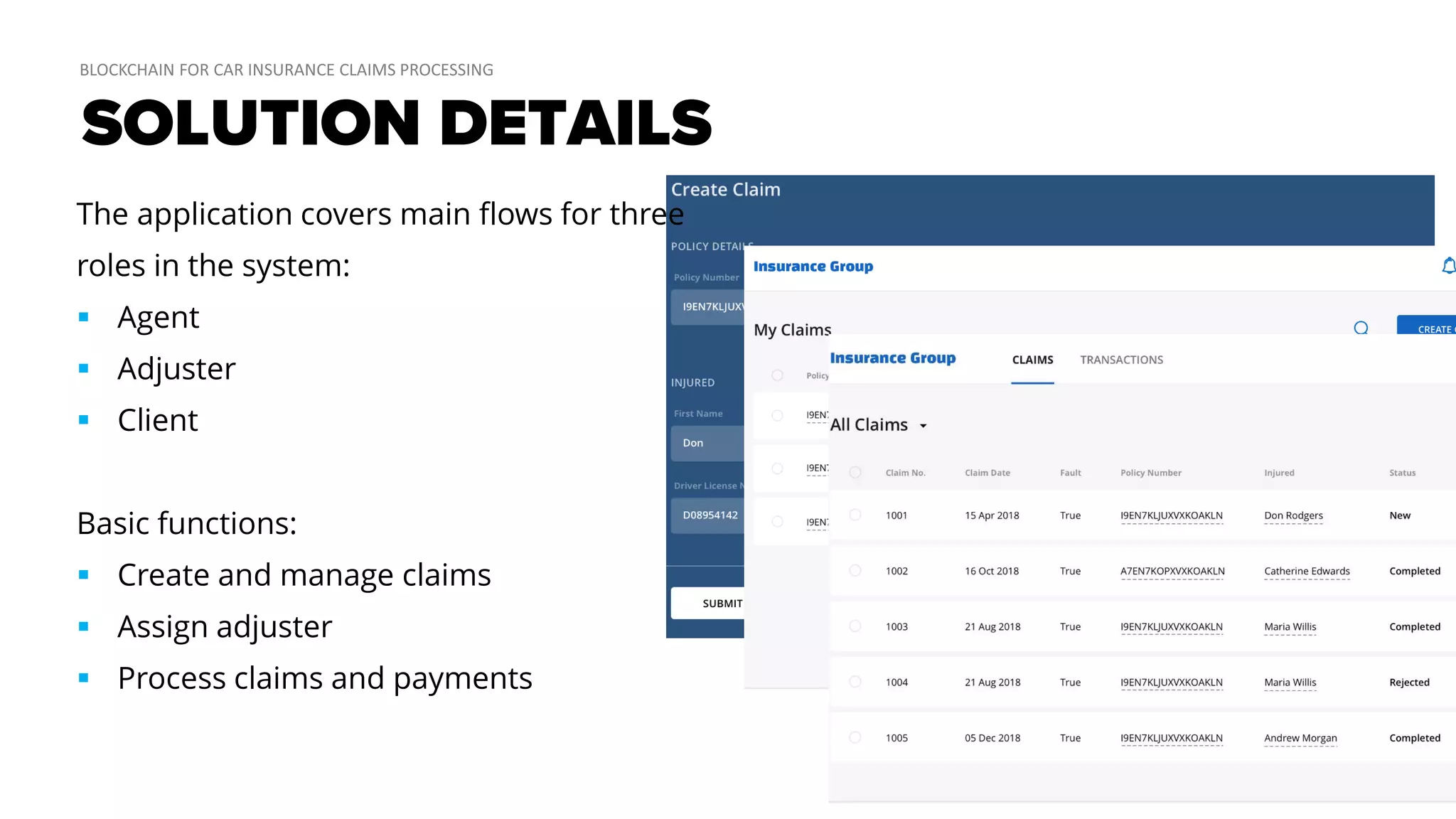

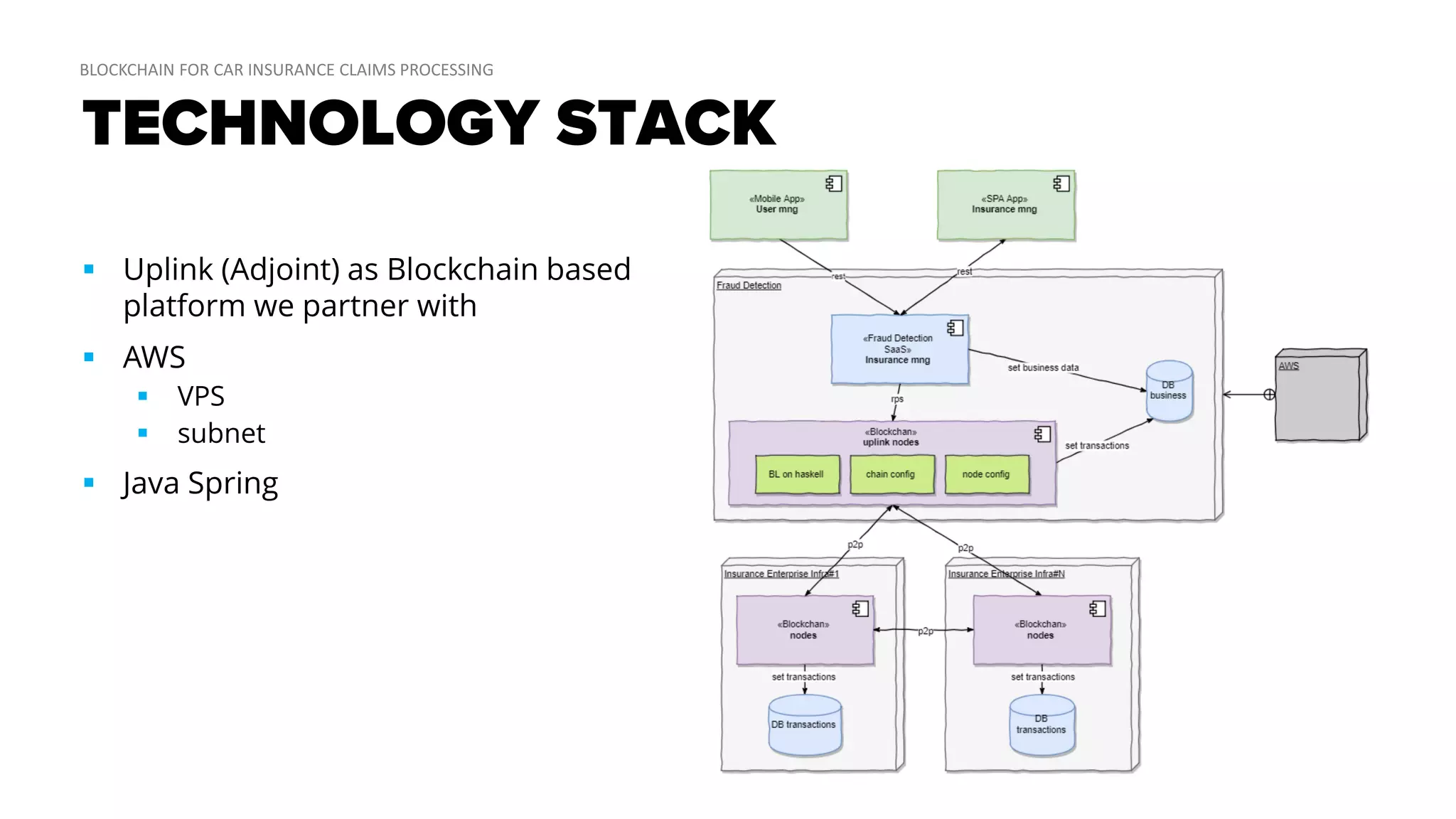

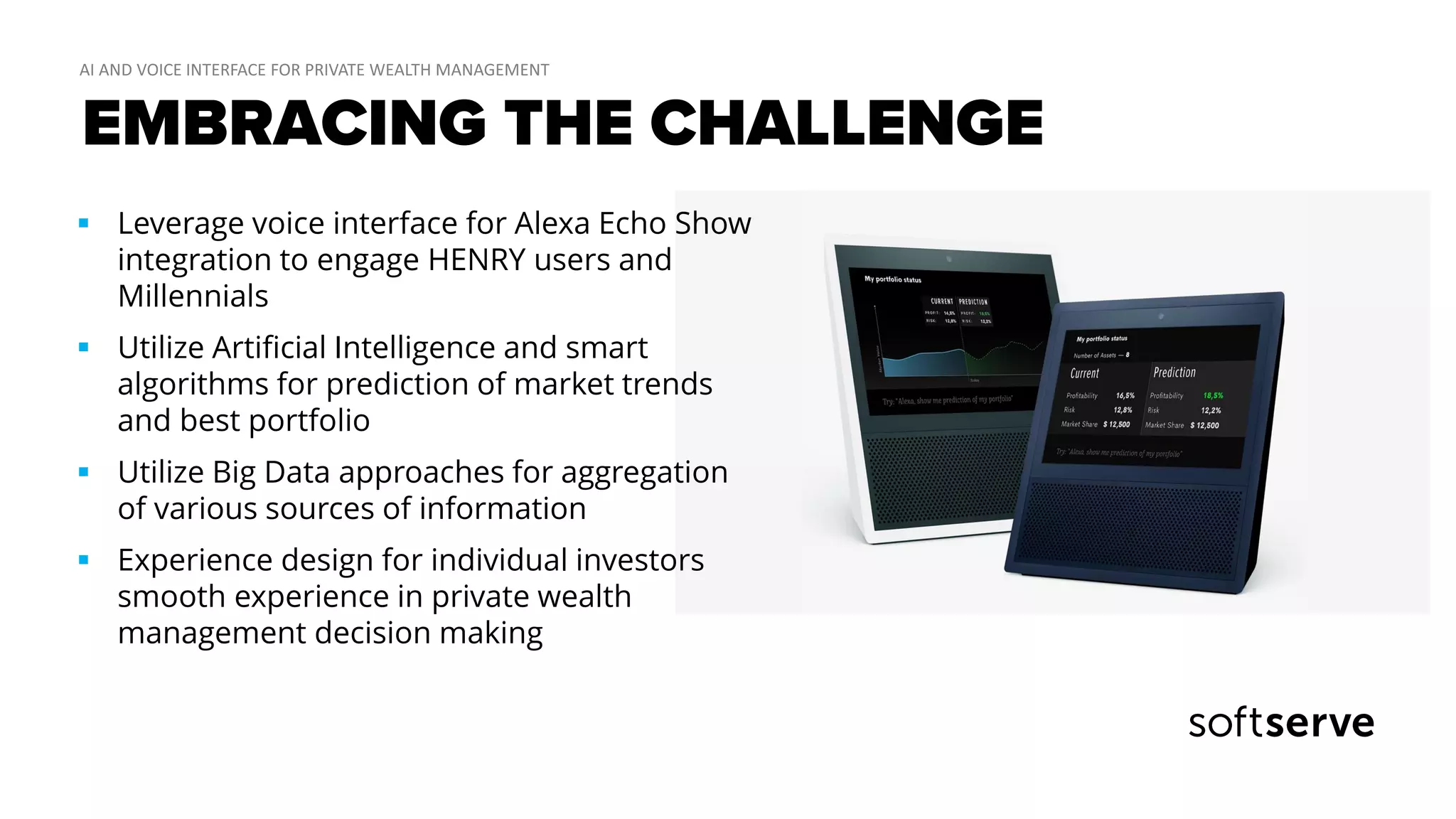

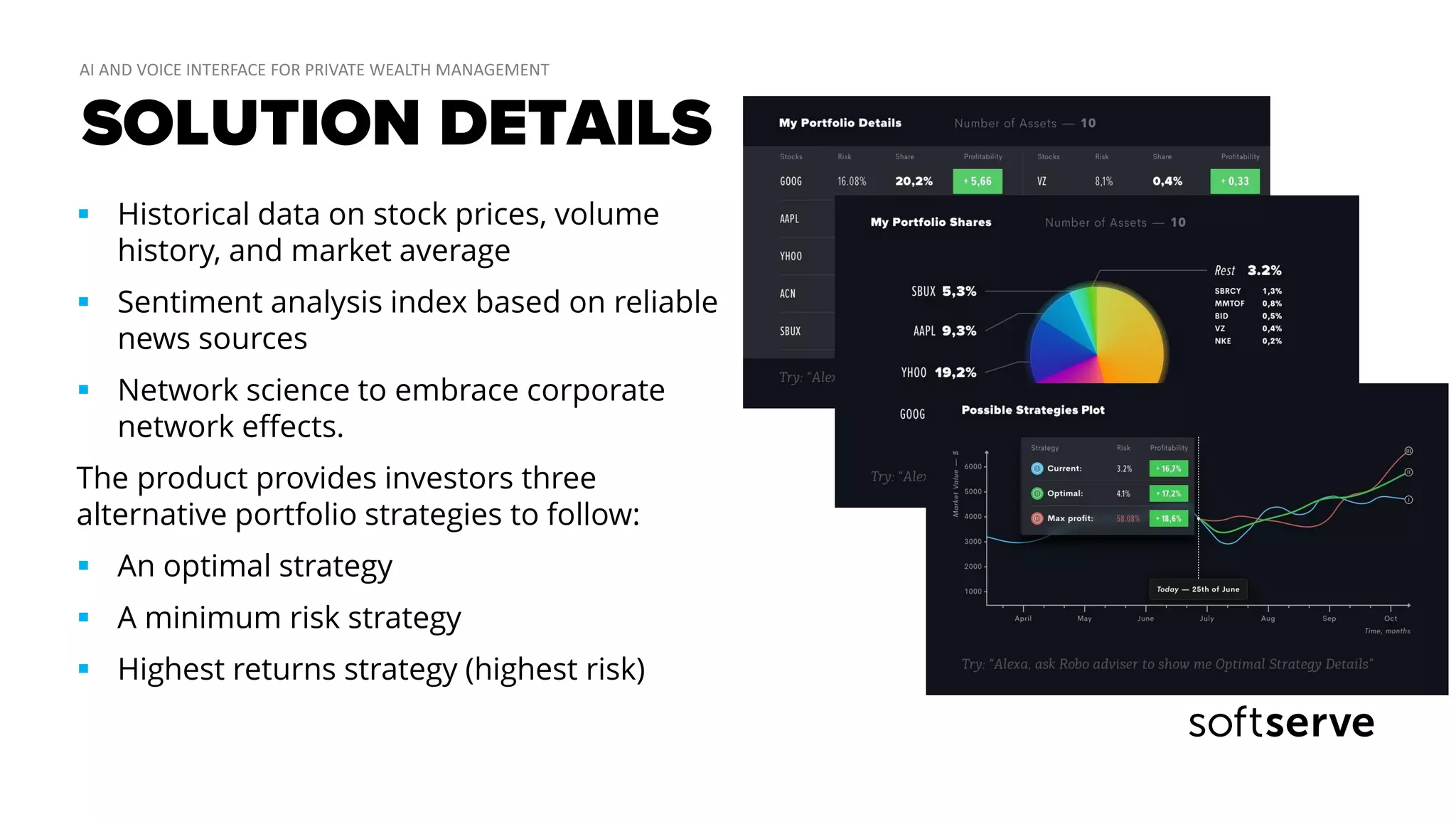

This document discusses developing success cases for financial services using blockchain, AI, and R&D. It provides two case studies as examples: one using blockchain for car insurance claims processing by providing transparency and detecting fraud, and one using AI and voice interfaces for private wealth management by leveraging algorithms and sentiment analysis to provide investment strategies and engage customers. The document emphasizes starting with the business need, problem, and goals to build solutions that simplify processes, increase trust, and decrease costs.