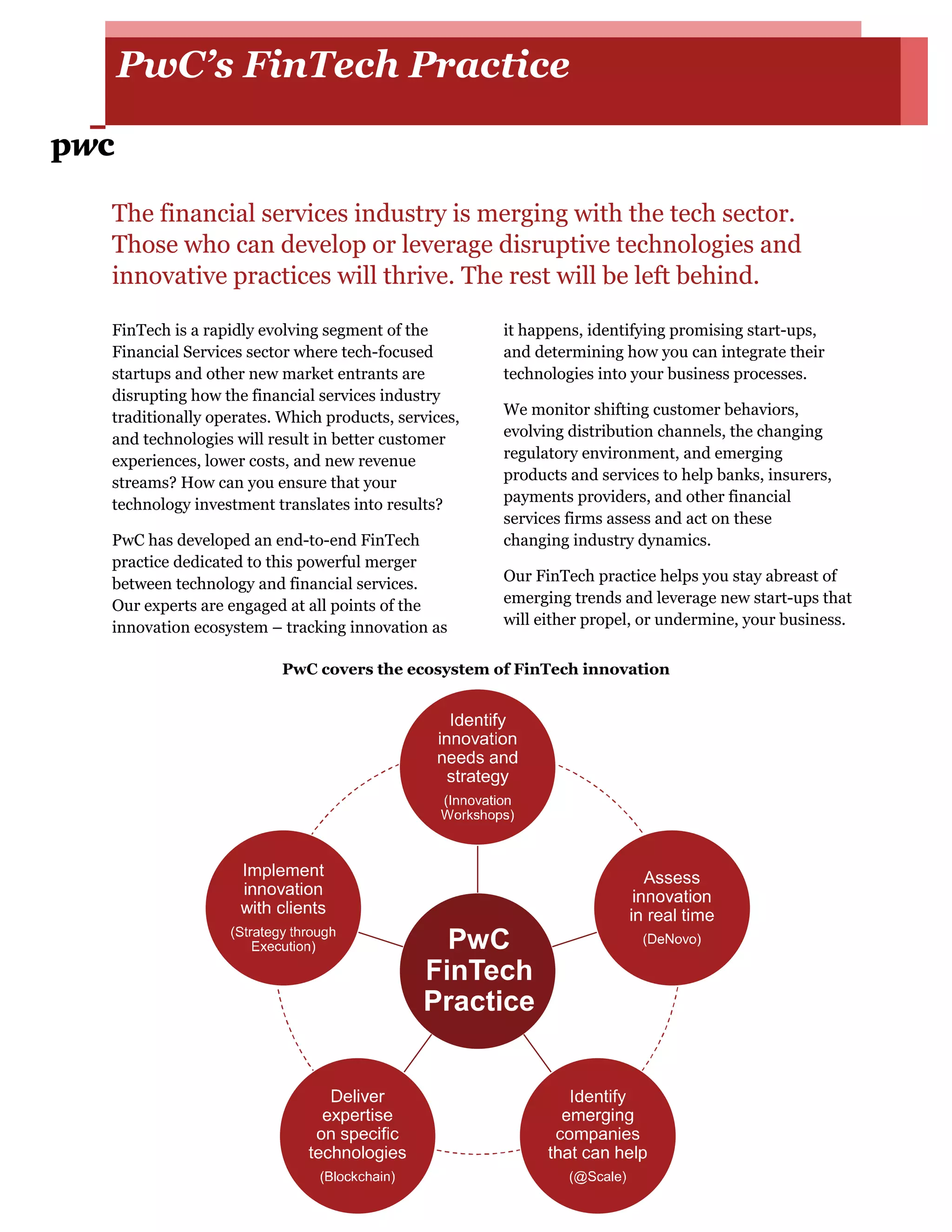

PwC's FinTech practice helps financial institutions assess and act on changing industry dynamics caused by the merger of financial services and technology. The practice monitors FinTech innovation, identifies promising startups, and determines how clients can integrate new technologies. PwC offers various services including strategy consulting, blockchain expertise, innovation workshops, vetting emerging companies, and helping clients define problems and design/deliver implementation plans to address disruptions from FinTech trends.