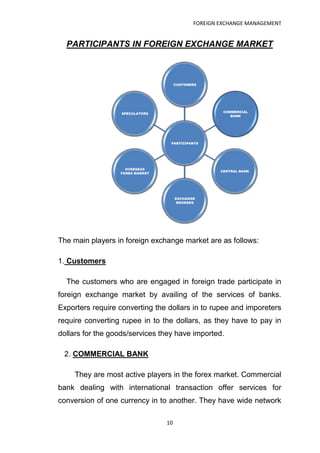

The document discusses foreign exchange management. It provides details about the foreign exchange market, including that it is a worldwide network of banks, brokers, corporations and central banks that buy and sell currencies. The market functions 24 hours a day. It also discusses the major participants in the market like commercial banks, customers, central banks, and speculators. Furthermore, it explains different types of transactions in the various markets like spot, forward and cash transactions. It also covers exchange rate systems used by different countries like the gold standard and floating exchange rates.

![FOREIGN EXCHANGE MANAGEMENT

exchange rate for clean outward remittance. The different rates

quoted for these two transactions are TT (Telegraphic transfer)

and bill selling.

Likewise bank will quote different buying rates for export bills and

for other clean inward remittance.

Following are the different rates, which are quoted to the

customers depending upon the nature of transaction.

BUYING RATES SELLING RATES

TT BUYING BILLS BUYING TT SELLING BILLS

SELLING

(A.1) (A.2) (B.1) (B.2)

A. BUYING RATES

A.1. TT BUYING RATE (nature of transaction)

Clean inward remittance for which cover has already been

provided in ADs Nostro account abroad.

Conversation of proceeds of instruments sent on collection

basis [ when collection are credited to Nostro account].

Cancellation of outward TT, DD,PO etc

Cancellation of forward sale contract.

Undrawn portion of an export bill realized.

23](https://image.slidesharecdn.com/blackbookpooja1-121212094346-phpapp02/85/Black-book-pooja-1-23-320.jpg)