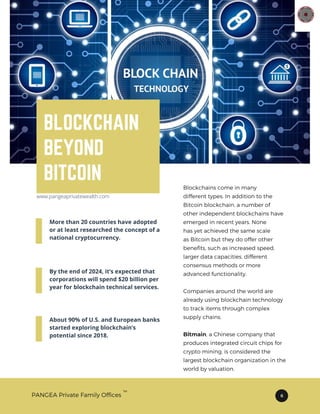

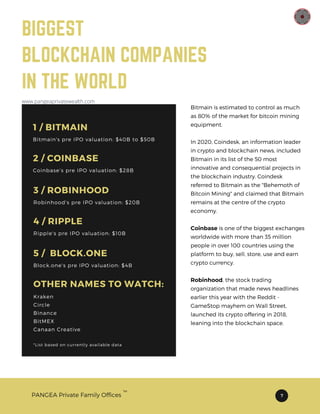

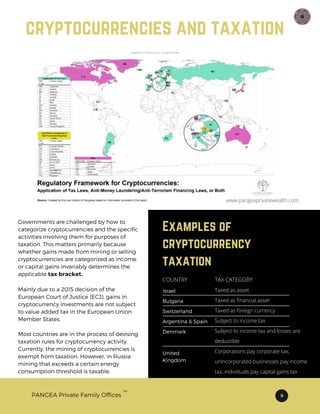

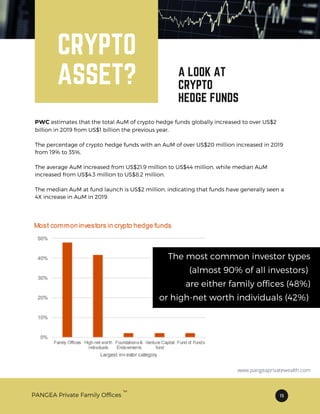

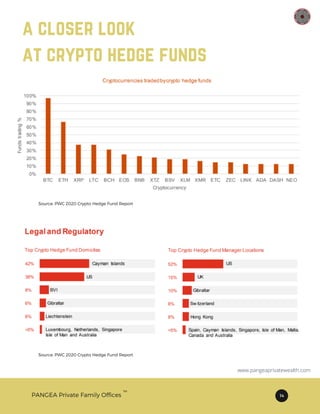

The document provides an in-depth analysis of the current state of cryptocurrencies, blockchain technology, and their potential as an emerging asset class. It highlights the significant growth and segmentation of the cryptocurrency market, the challenges of regulation and taxation, and the increasing acceptance of cryptocurrencies by institutional investors. Additionally, it discusses the role of blockchain beyond Bitcoin and the prospects for national cryptocurrencies globally.