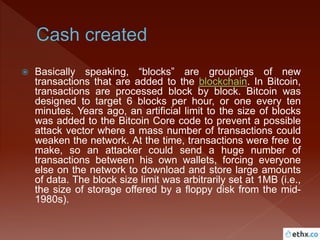

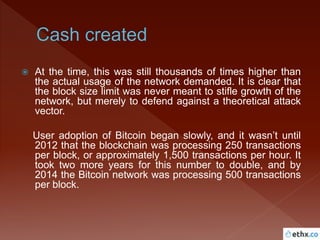

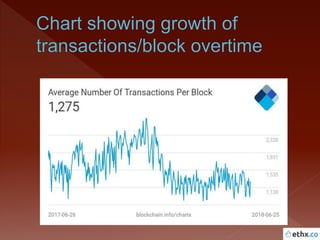

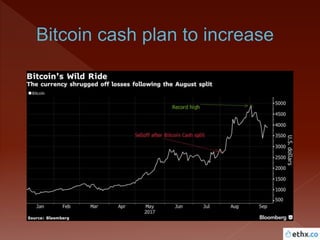

Bitcoin Cash is an upgraded version of the original Bitcoin, created on August 1, 2017, to address the high transaction fees and slow processing times of Bitcoin Core. It allows for larger block sizes, which facilitates faster and cheaper transactions, aiming to restore the original vision of Bitcoin as a peer-to-peer electronic cash system. Bitcoin Cash has gained support from various exchanges and allows users to set lower fees, making it more accessible for everyday transactions.