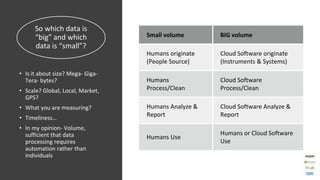

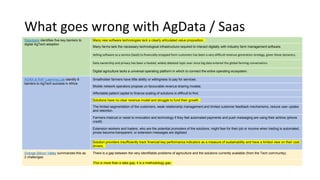

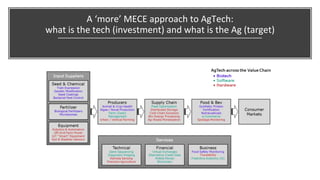

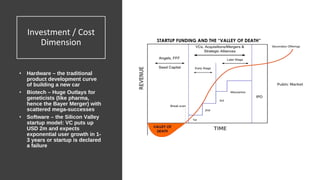

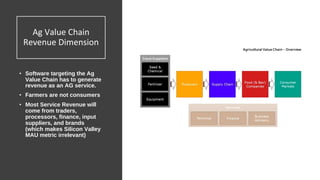

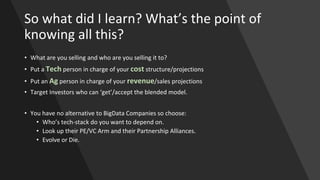

This document discusses big data in agriculture. It defines big data as large volumes of data that require automation to process rather than individual humans. It notes that data comes from people through surveys and sensors, as well as systems like communication networks. While some technologies aim to marginally increase yields, most big data solutions will need to generate revenue by serving the agricultural value chain through traders, processors, and other stakeholders rather than smallholder farmers directly. Success requires understanding both the technology costs and dimensions as well as the agricultural revenue targets and dimensions.