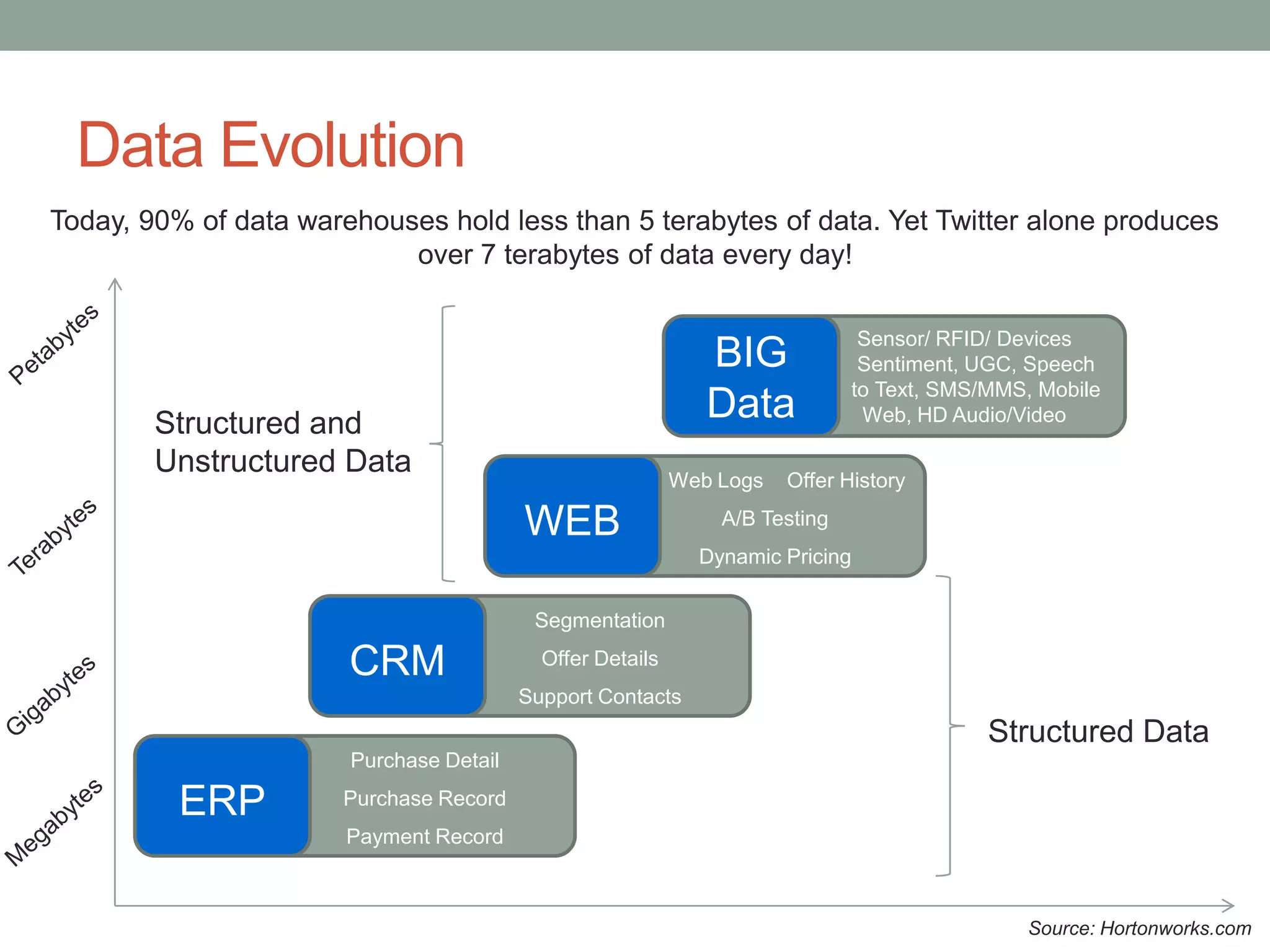

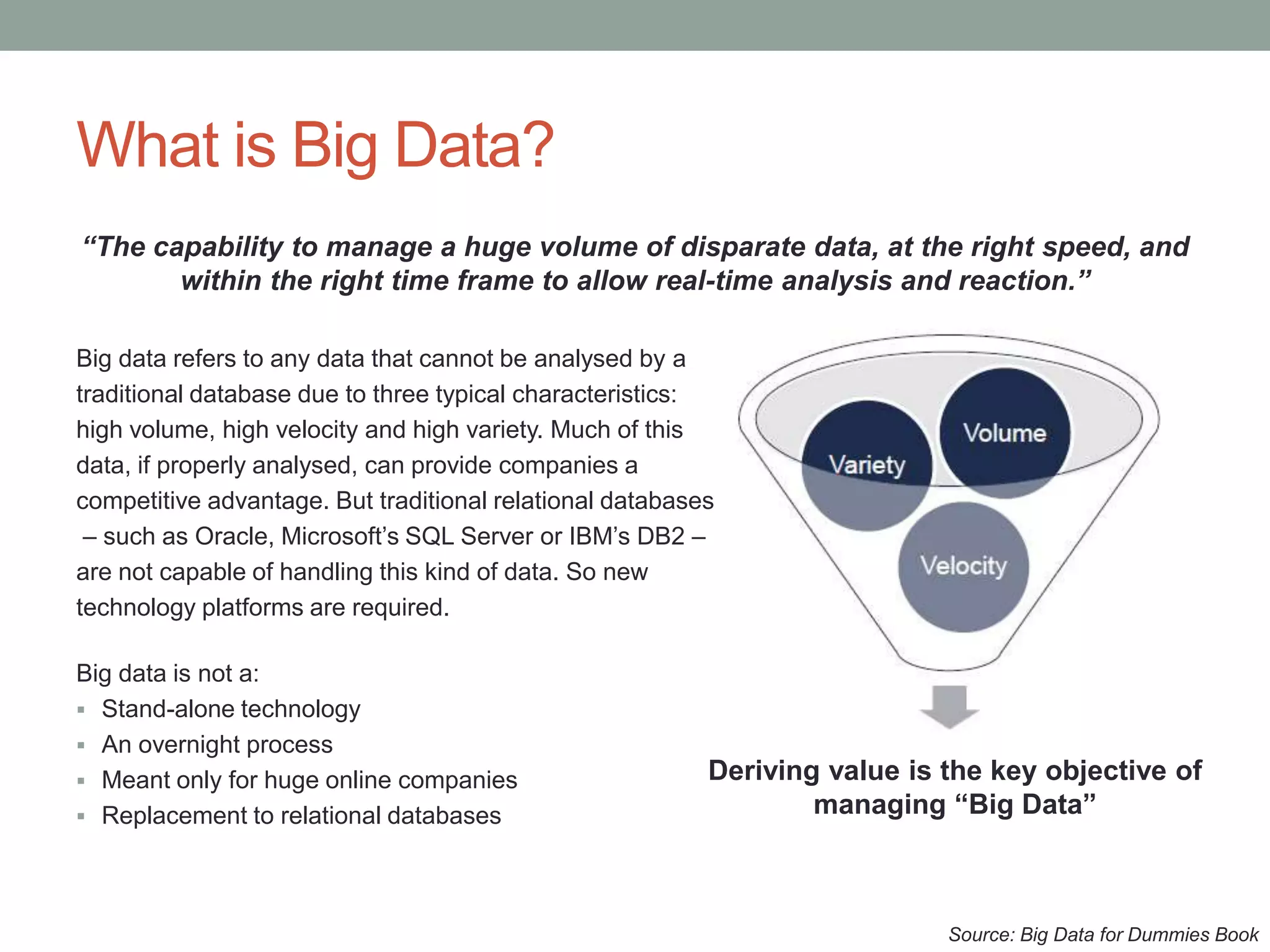

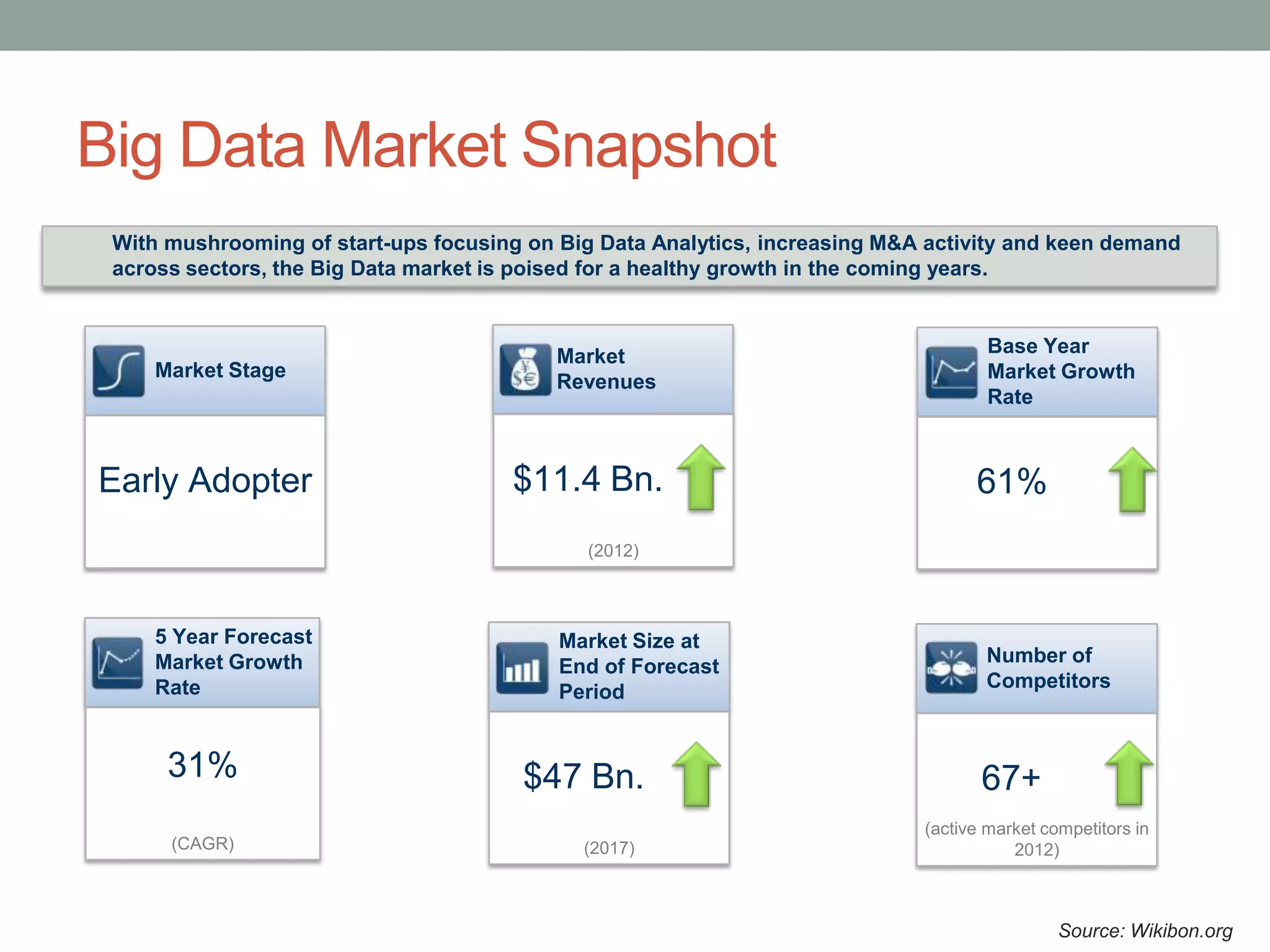

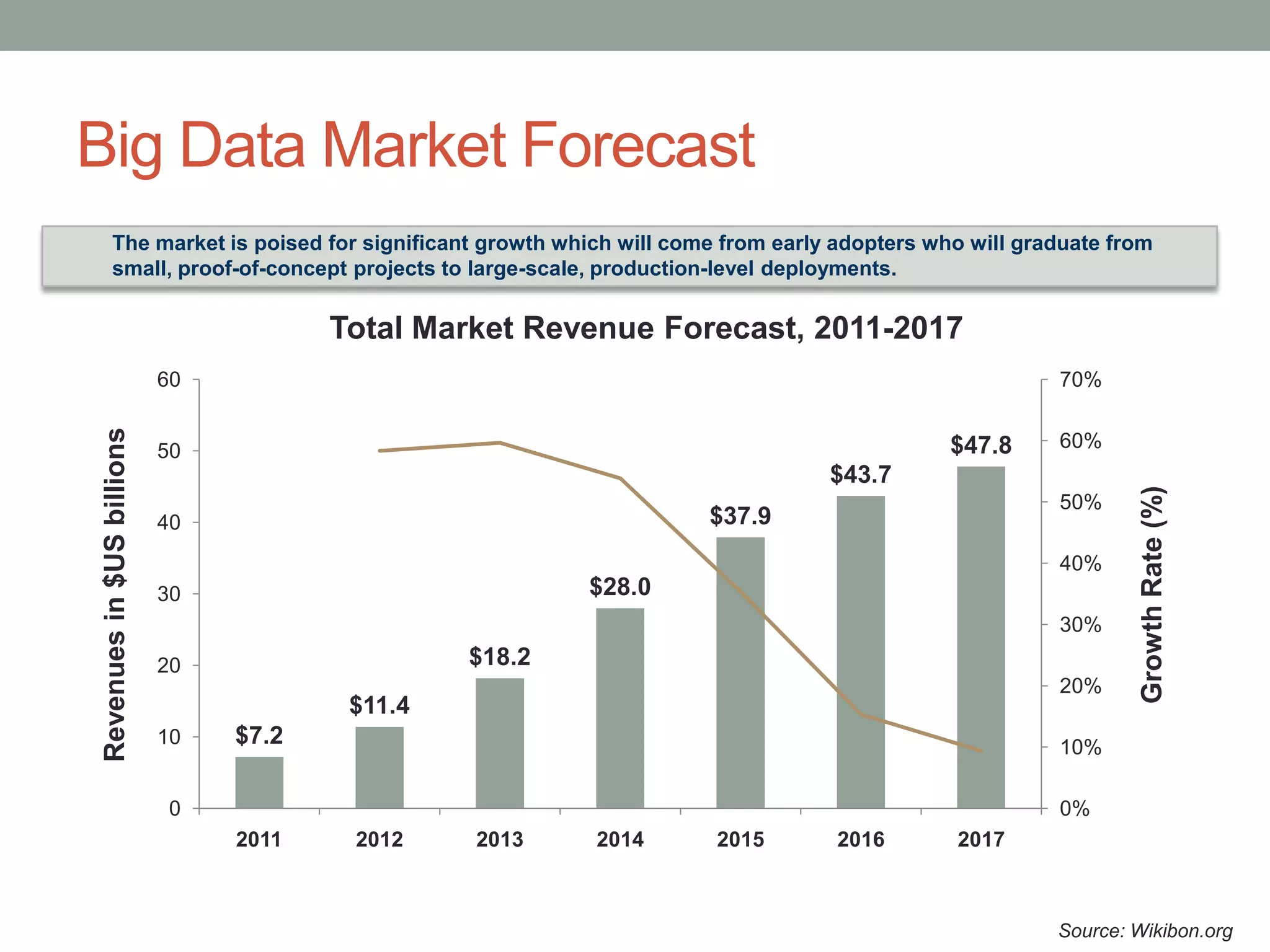

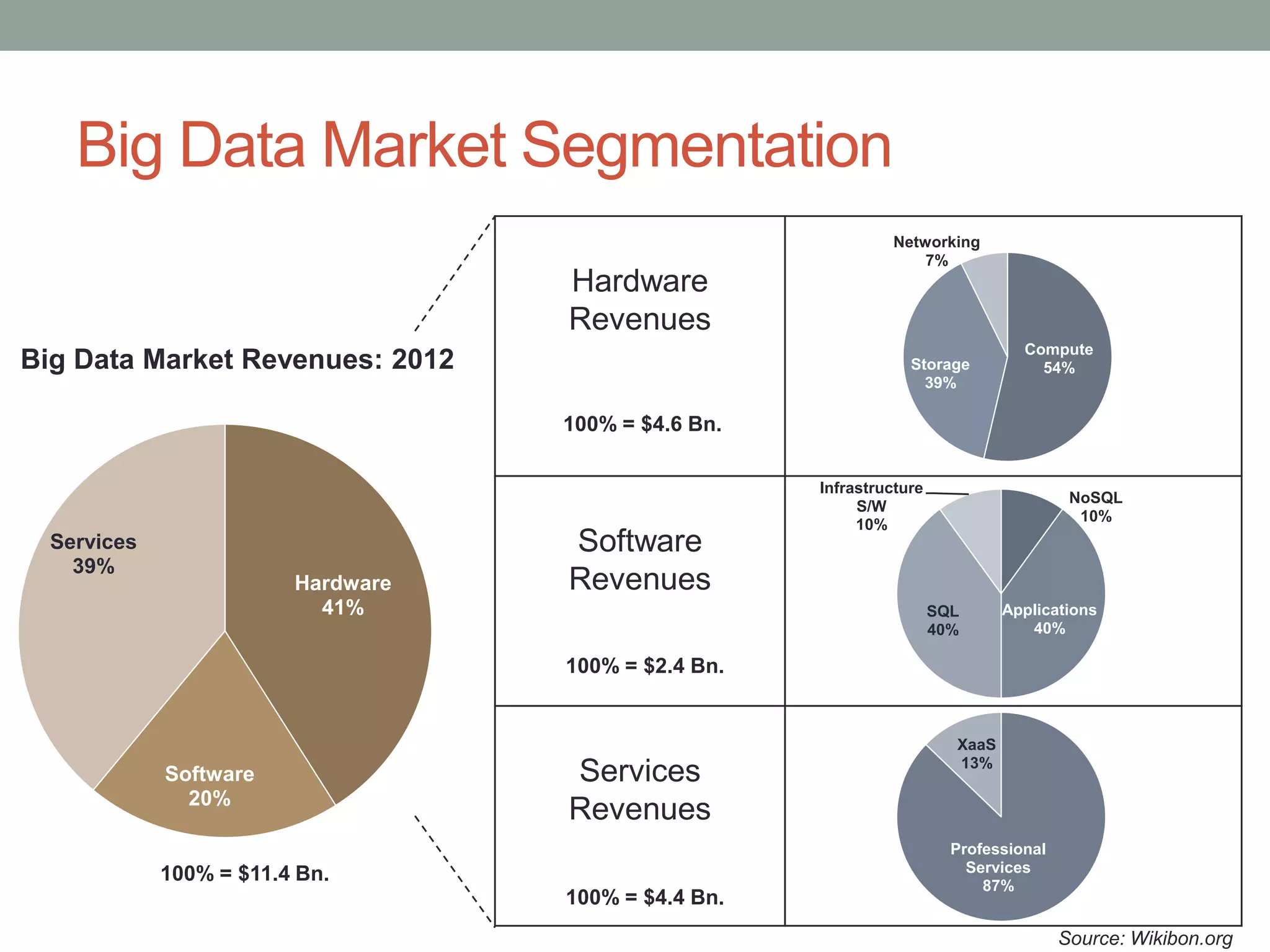

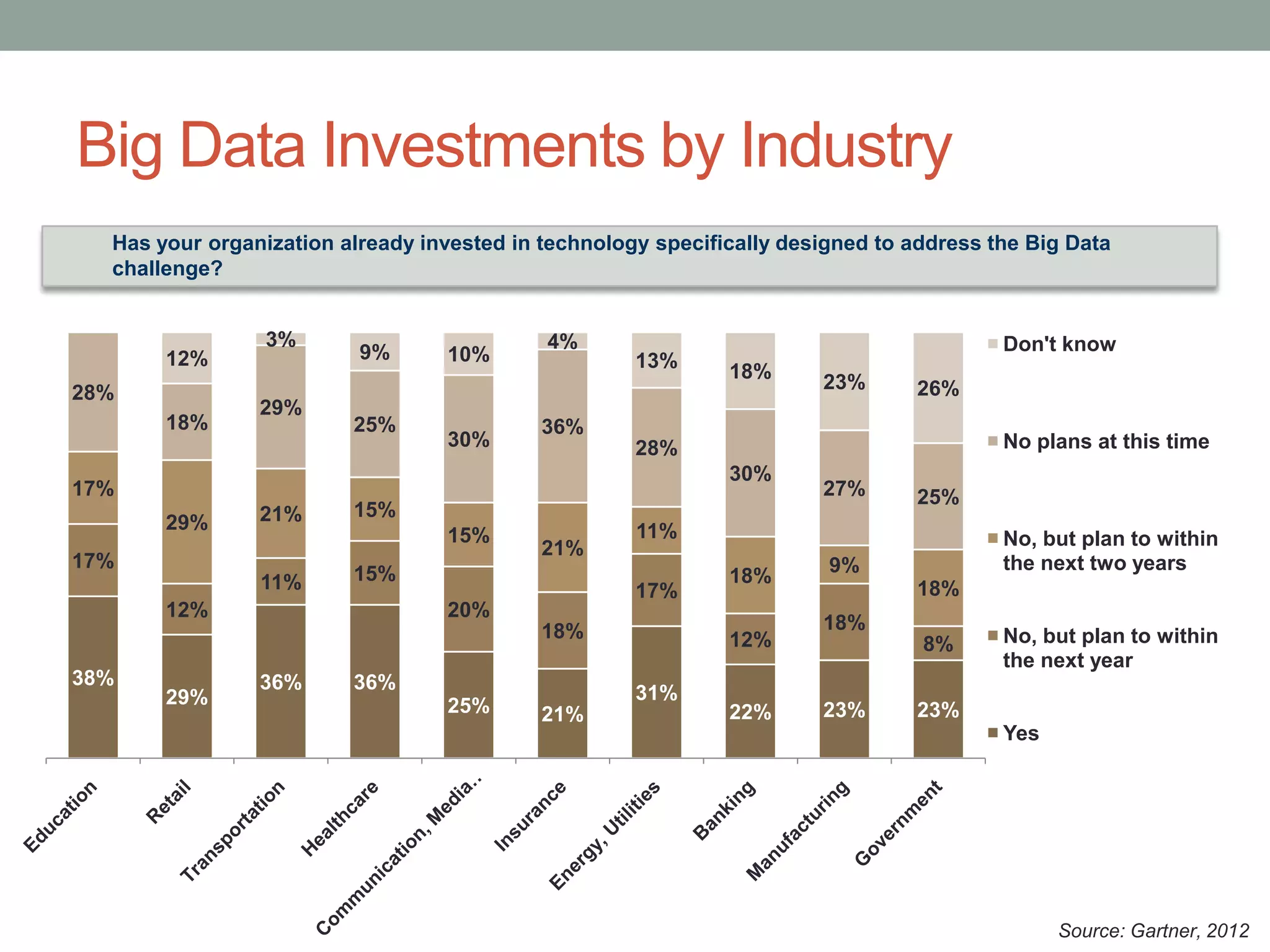

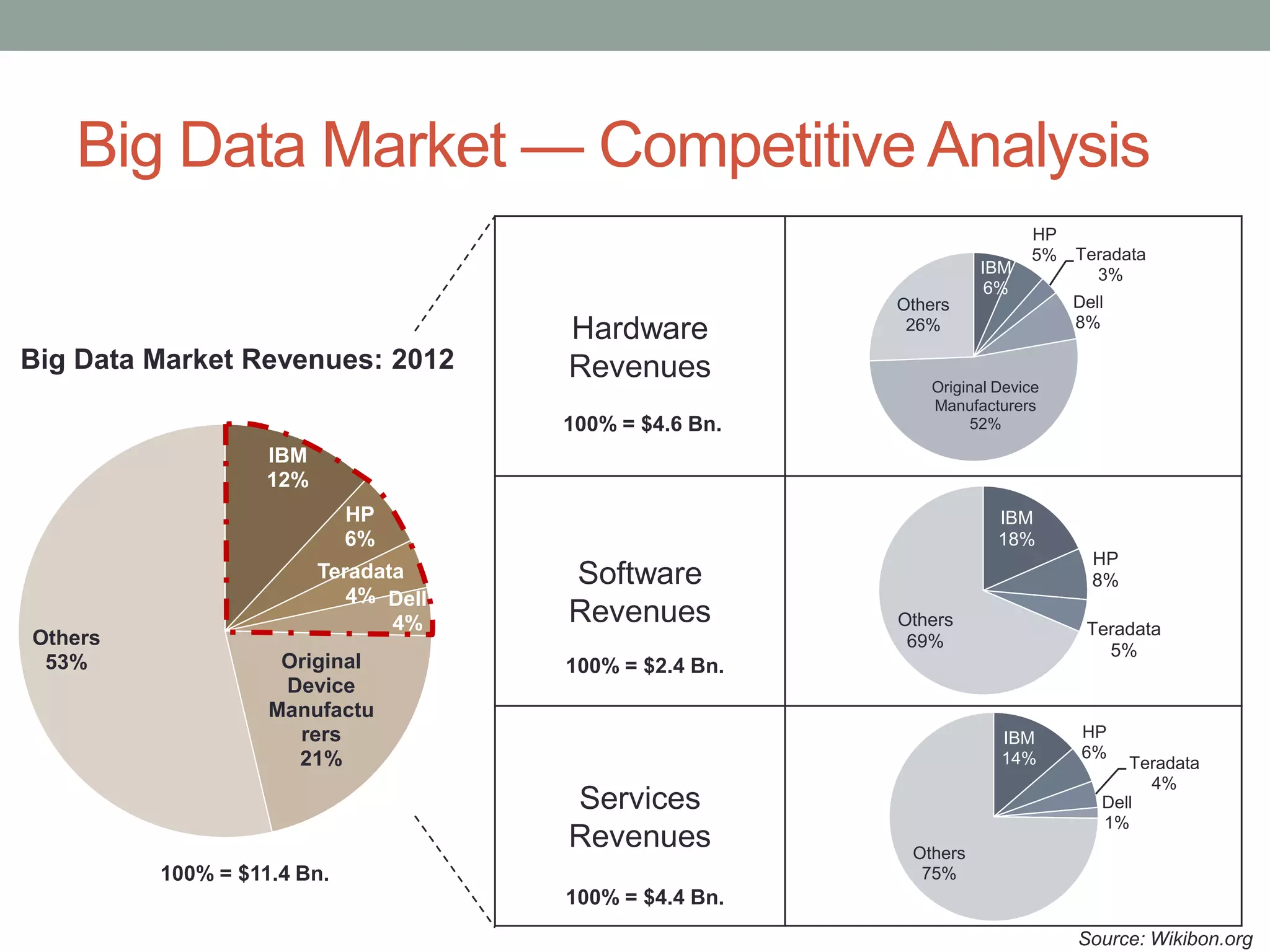

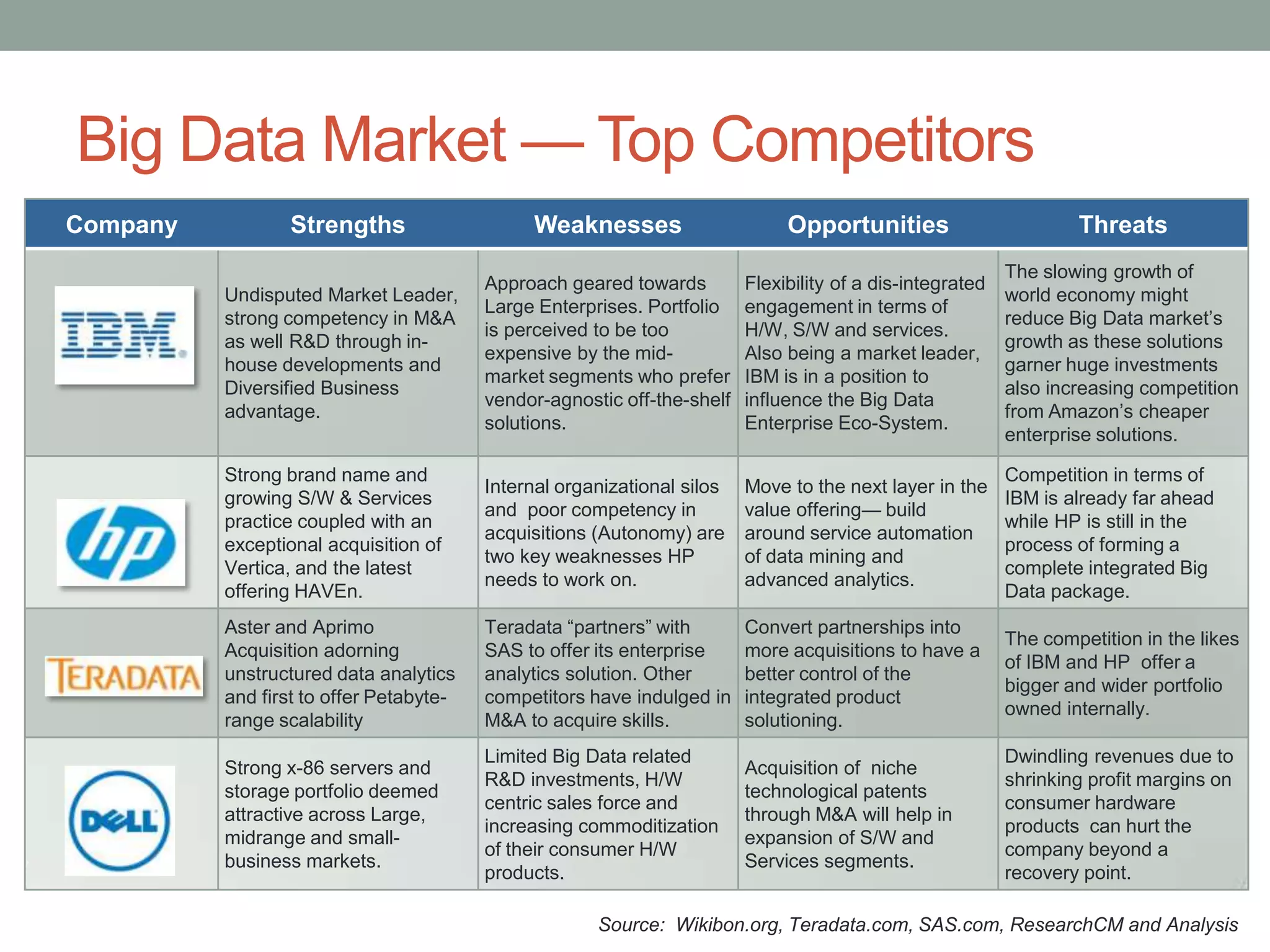

The document provides an overview of the big data landscape, including definitions of big data, characteristics of big data, the big data market size and forecast, segmentation of the big data market by hardware, software and services revenues, investments in big data by industry, and an analysis of the competitive environment. It notes that big data refers to data that cannot be analyzed by traditional databases due to its high volume, velocity and variety, and that the big data market is expected to grow from $11.4 billion in 2012 to $47.8 billion in 2017.