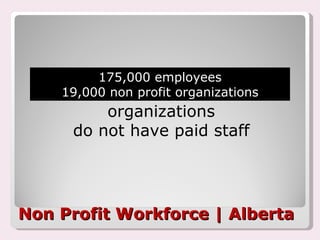

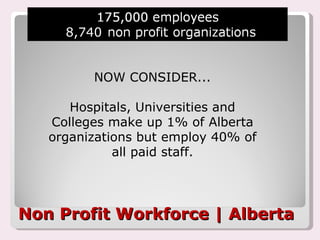

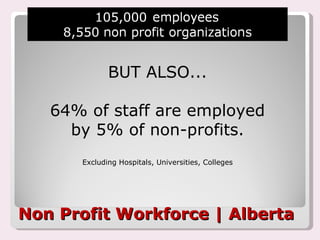

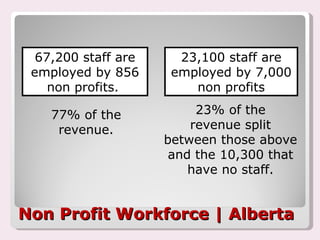

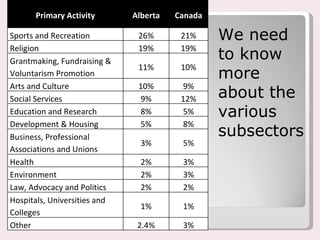

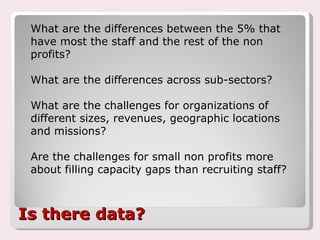

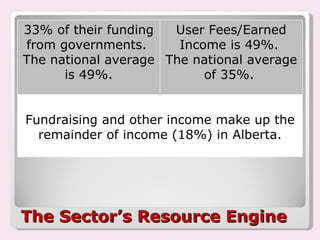

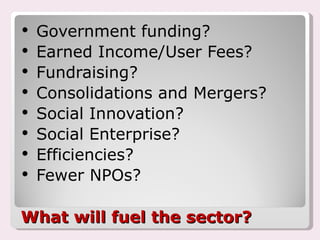

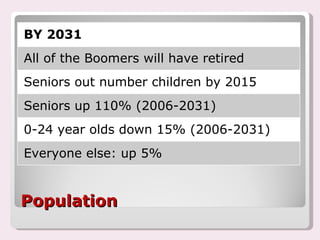

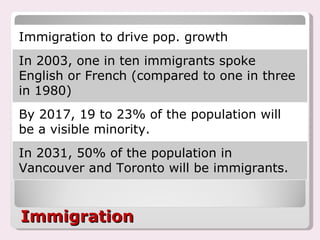

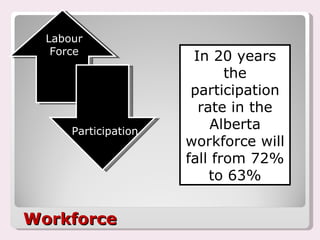

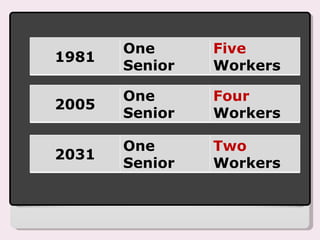

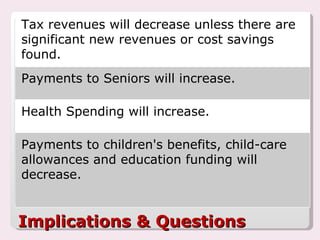

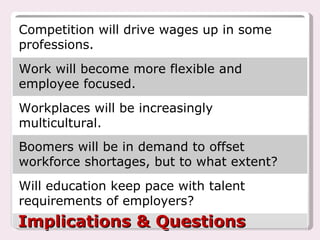

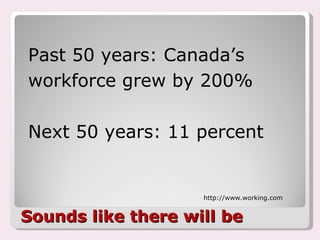

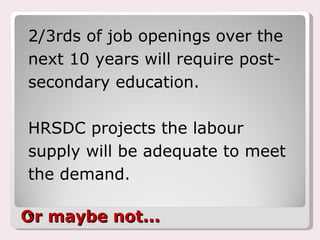

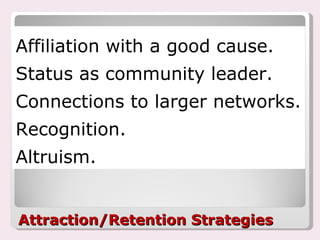

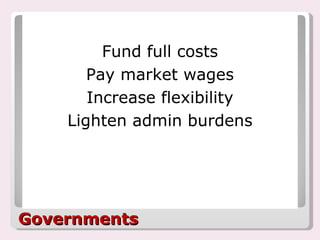

The document discusses the future of the nonprofit sector in Alberta, Canada, focusing on revenue sources, trends, workforce demographics, and potential challenges. It highlights the sector's significant role in the economy, the need for more information on staffing disparities among nonprofits, and implications of an aging population on workforce supply and organization funding. Key questions include the impact of government funding and social innovation on the sector's sustainability.