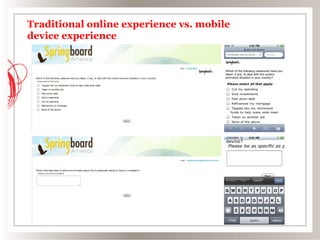

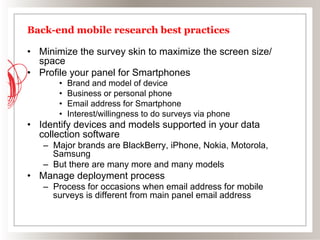

Mobile data collection is growing as more respondents receive and complete surveys on their mobile devices. However, questionnaires need to be optimized for mobile to collect accurate data. There is a wide variety of smartphones with different capabilities. Mobile surveys should be short, concise with simple questions to accommodate different devices and data constraints. Back-end practices like profiling panels and front-end design practices can help optimize mobile surveys.