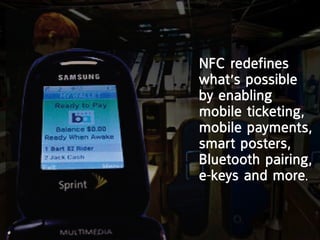

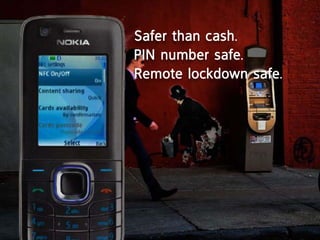

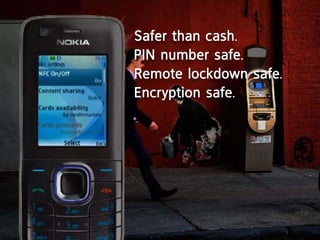

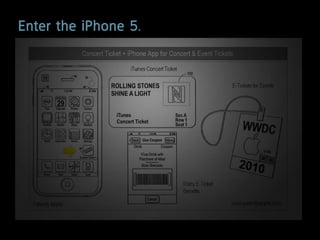

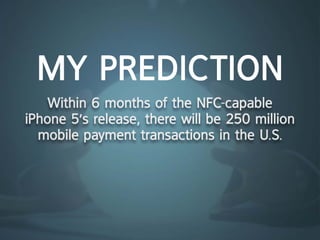

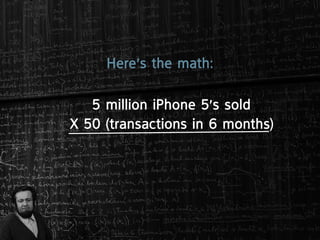

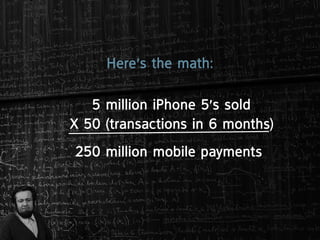

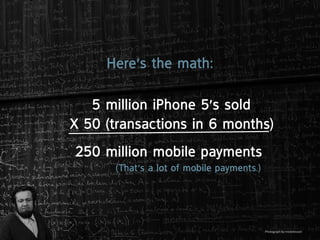

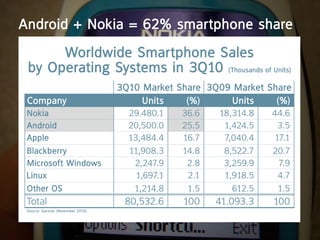

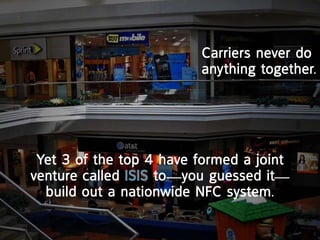

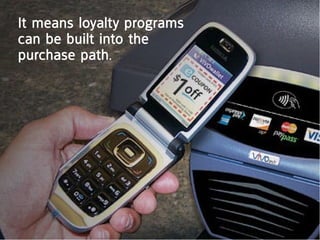

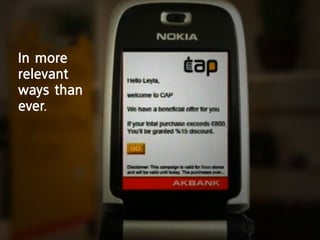

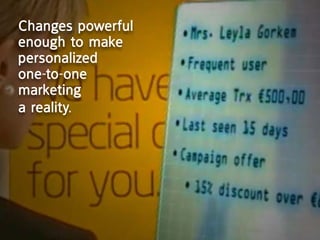

The document discusses how mobile payments using near field communication (NFC) technology will revolutionize commerce. It argues that as more smartphones and point-of-sale systems become NFC-enabled, the number of mobile payment transactions in the US will surge. Within 6 months of the rumored NFC-capable iPhone 5 release, the author predicts there will be 250 million mobile payment transactions. This mobile payment movement will change how consumers buy things and require marketers to adapt their strategies to take advantage of new opportunities for location-based offers, mobile coupons, and loyalty programs.