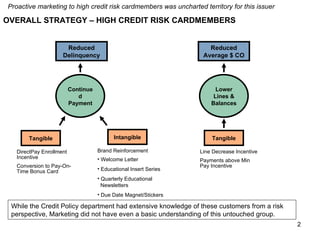

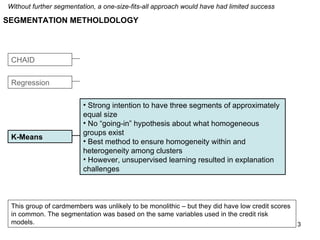

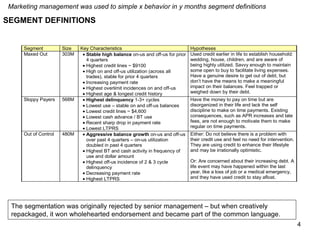

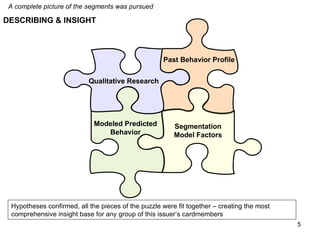

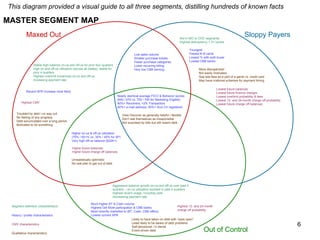

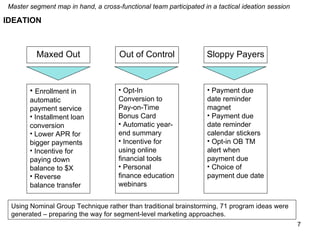

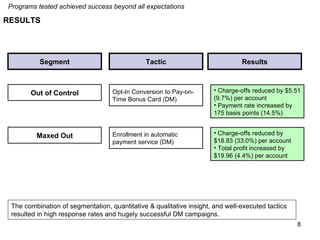

This document describes a case study of behavioral segmentation of high-risk credit card customers. The issuer segmented the customers into three groups - Maxed Out, Sloppy Payers, and Out of Control - based on credit risk models and past payment behavior. Marketing programs were then developed for each segment based on qualitative research. Testing showed that the targeted programs successfully increased payment rates and reduced delinquencies and charge-offs beyond expectations for the different customer segments.