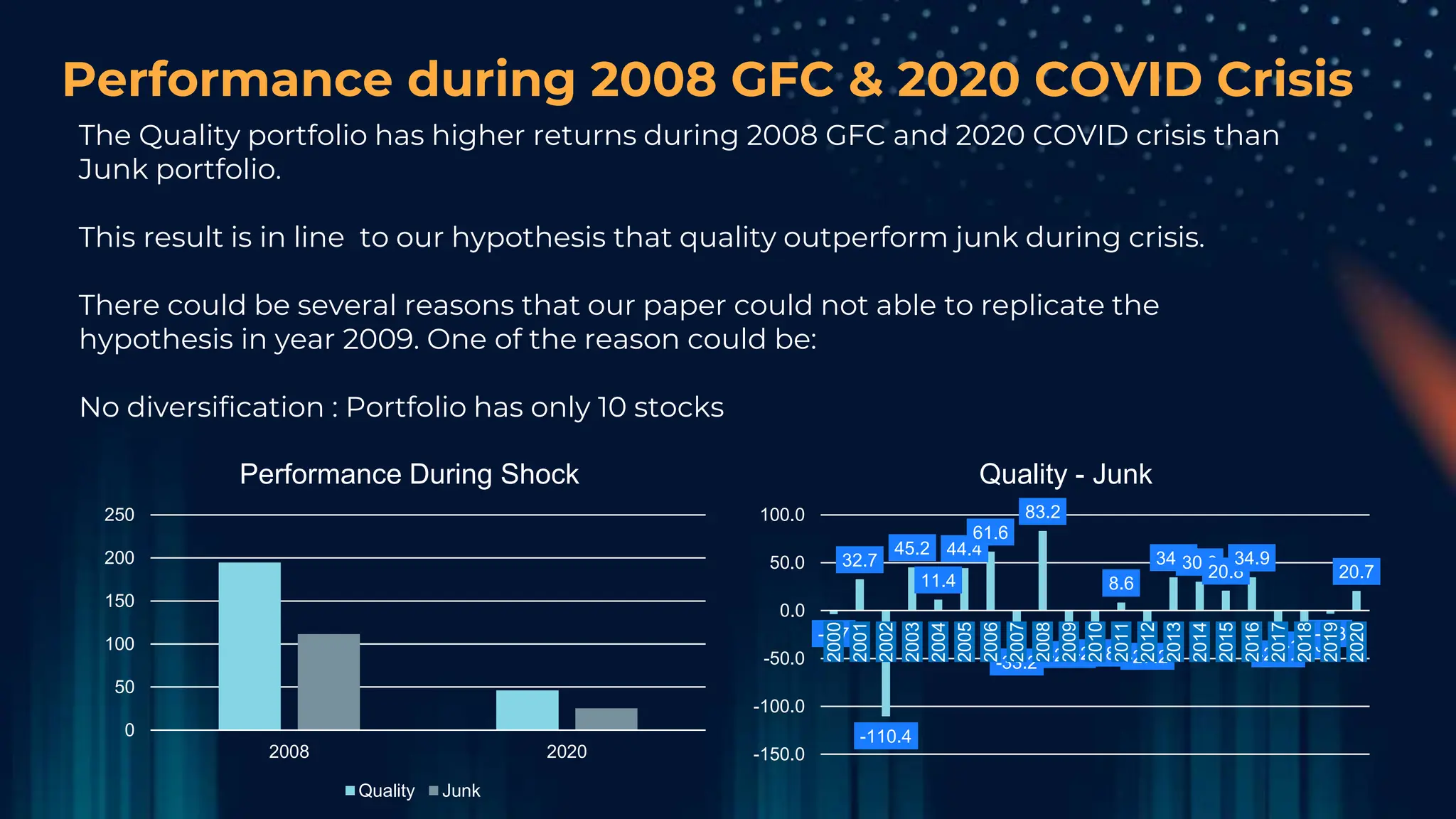

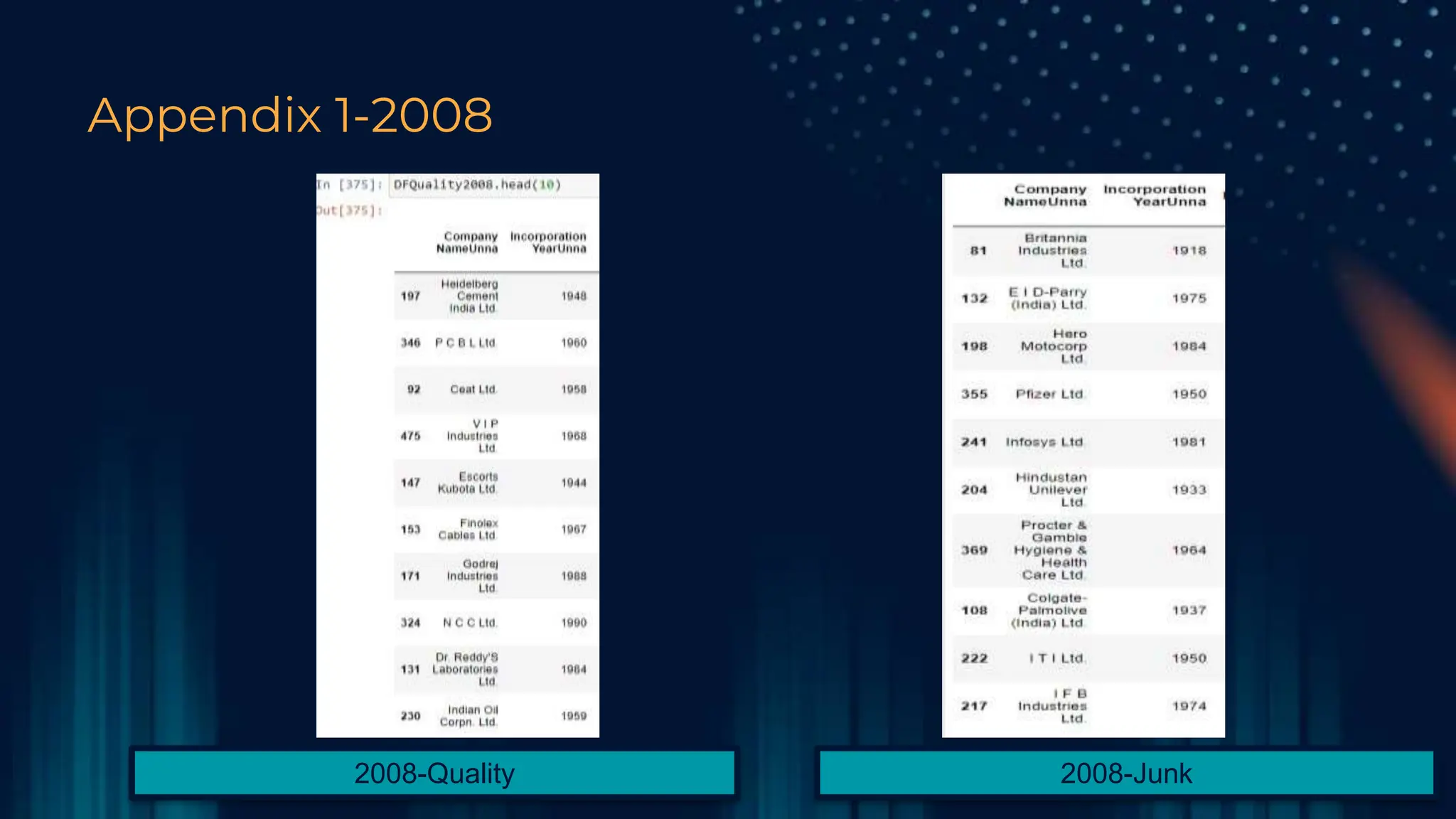

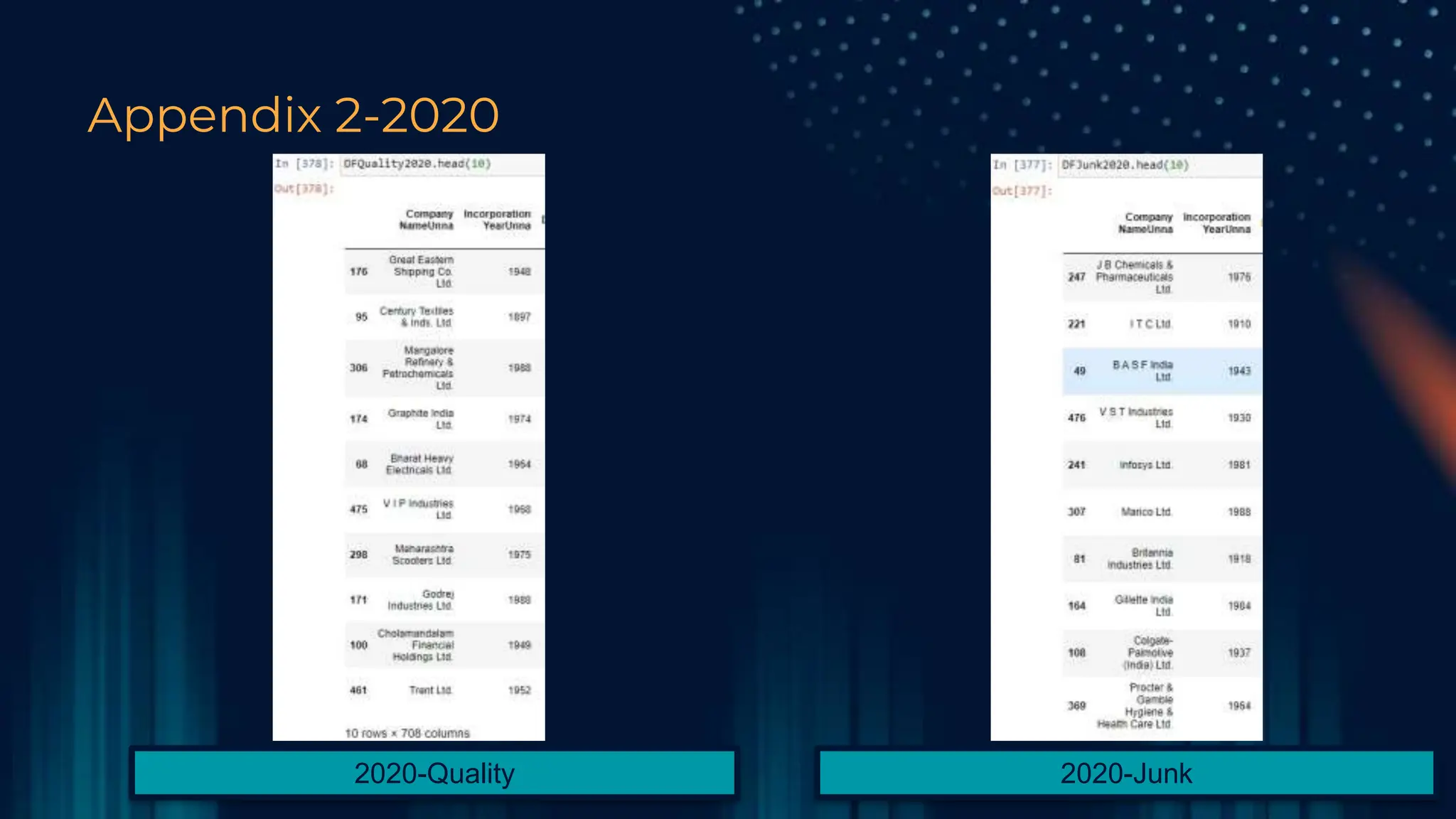

This document explores the concept of behavioral finance, focusing on quality stocks defined by profitability, growth, low risk, and high payouts. The authors find that quality stocks yield higher risk-adjusted returns compared to junk stocks, and analyze the performance of quality portfolios during major economic crises. It also discusses portfolio construction based on quality scores and outlines results and performance metrics over time.