Michael Durante Western Reserve Basel III western reserve- commentary

•

0 likes•370 views

The document discusses proposed new international bank capital standards under Basel III. It notes that: - Basel III sets total risk-based capital at 8%, tier 1 capital at 6%, and common equity tier 1 at 3.5-4.5% - US banks already far exceed these standards, with the largest banks having tier 1 capital ratios around 12% - This means 61 of 62 major US banks will not need to raise capital to meet the 2019 requirements - In contrast, the standards are being lowered to give European banks more time to comply as their capital levels are further behind those of major US banks

Report

Share

Report

Share

Download to read offline

Recommended

Federal Reserve System

The document provides an overview of the history and functions of the Federal Reserve System. It summarizes that the Federal Reserve was established in 1913 to address financial panics by providing an elastic currency and a lender of last resort. It took over clearinghouse roles from private banks. Today, the Federal Reserve has five key roles: acting as a bankers' bank, lender of last resort, financial supervisor and regulator, currency issuer, and conductor of monetary policy. It oversees various types of financial institutions and enforces numerous regulations.

Return to prosperity With Comments

This document presents the argument for establishing a public bank. It begins by outlining budget problems faced by states and municipalities, noting that the Federal Reserve will not bail them out. It then discusses why a public bank, like North Dakota's, is a solution. North Dakota's bank earns profits for the state while supporting community banks and economic growth. In contrast, large private banks engage in risky derivatives trading and do not significantly support local communities through lending. The document advocates for states to establish their own public banks as a safer alternative.

Western reserve q1 2009 client update letter

The document discusses the performance of the Western Reserve Master Fund in 2008. It summarizes that the fund was down only 3% for the year, while comparable indexes fell around 60%. It attributes this to successful short positions that gained over 40% offsetting long position losses of around 35%. The document then discusses flaws with mark-to-market accounting requirements, arguing they have exacerbated the financial crisis by forcing banks to hoard cash and restrict lending. It advocates suspending mark-to-market in favor of mark-to-maturity accounting based on actual cash flows to restore liquidity to the financial system.

FOMC Presentation

The FOMC determines monetary policy for the United States. It is composed of the Board of Governors of the Federal Reserve System and the presidents of the 12 Federal Reserve Banks. The FOMC meets regularly to set short-term interest rates and decide other economic policies based on reports on employment, inflation, and growth. It seeks to promote maximum employment and stable prices. In its most recent meeting, the FOMC voted to maintain near-zero interest rates given moderate economic expansion and below-target inflation.

Obstfeld acrcpolak2014

Exchange Rates and Financial Globalization

Maurice Obstfeld

Council of Economic Advisers

IMF 15th Annual Research Conference

November 13-14, 2014

America is not broke!

The document proposes four multi-trillion dollar paths to a thriving America: 1) Sovereign money or debt-free money, 2) Land value taxation (Georgism), 3) Public banking, and 4) Ending government financial asset hoarding. Each path is estimated to be worth over $1 trillion per year. The document then provides more details on sovereign money, land value taxation, and public banking. It argues that sovereign money could fund infrastructure and social programs without inflation. It explains how land value, not buildings, determines home values and proposes taxing land values instead of wages and sales. It also outlines the benefits of public banking compared to private banks, using the Bank of North Dakota as an example

China: The Long March to Reform

1) The Chinese government is accelerating reforms of state-owned enterprises (SOEs) under President Xi Jinping's leadership as he enters his second term.

2) SOE reform is critical because SOEs account for a large portion of China's corporate debt and are generally less efficient than private companies.

3) Recent examples of SOE reforms include mergers to reduce excess capacity and competition, as well as introducing private capital through mixed ownership. However, fully reforming China's large SOEs will be an ongoing challenge.

Credit Crisis Watch

The document discusses several indicators that can be used to gauge the health of the global financial system and credit markets in the wake of the 2008 crisis. It outlines four key indicators: 1) the 3-month LIBOR dollar rate, which has declined sharply but remains above the Fed's target rate; 2) the 3-month US Treasury bill rate, which remains very low indicating liquidity is still being hoarded; 3) the TED spread, which measures perceived credit risk and has narrowed but remains elevated; and 4) the LIBOR-OIS spread, which also reflects credit risk and availability of funds and has declined but not returned to pre-crisis levels. In summary, while some progress has been made through government

Recommended

Federal Reserve System

The document provides an overview of the history and functions of the Federal Reserve System. It summarizes that the Federal Reserve was established in 1913 to address financial panics by providing an elastic currency and a lender of last resort. It took over clearinghouse roles from private banks. Today, the Federal Reserve has five key roles: acting as a bankers' bank, lender of last resort, financial supervisor and regulator, currency issuer, and conductor of monetary policy. It oversees various types of financial institutions and enforces numerous regulations.

Return to prosperity With Comments

This document presents the argument for establishing a public bank. It begins by outlining budget problems faced by states and municipalities, noting that the Federal Reserve will not bail them out. It then discusses why a public bank, like North Dakota's, is a solution. North Dakota's bank earns profits for the state while supporting community banks and economic growth. In contrast, large private banks engage in risky derivatives trading and do not significantly support local communities through lending. The document advocates for states to establish their own public banks as a safer alternative.

Western reserve q1 2009 client update letter

The document discusses the performance of the Western Reserve Master Fund in 2008. It summarizes that the fund was down only 3% for the year, while comparable indexes fell around 60%. It attributes this to successful short positions that gained over 40% offsetting long position losses of around 35%. The document then discusses flaws with mark-to-market accounting requirements, arguing they have exacerbated the financial crisis by forcing banks to hoard cash and restrict lending. It advocates suspending mark-to-market in favor of mark-to-maturity accounting based on actual cash flows to restore liquidity to the financial system.

FOMC Presentation

The FOMC determines monetary policy for the United States. It is composed of the Board of Governors of the Federal Reserve System and the presidents of the 12 Federal Reserve Banks. The FOMC meets regularly to set short-term interest rates and decide other economic policies based on reports on employment, inflation, and growth. It seeks to promote maximum employment and stable prices. In its most recent meeting, the FOMC voted to maintain near-zero interest rates given moderate economic expansion and below-target inflation.

Obstfeld acrcpolak2014

Exchange Rates and Financial Globalization

Maurice Obstfeld

Council of Economic Advisers

IMF 15th Annual Research Conference

November 13-14, 2014

America is not broke!

The document proposes four multi-trillion dollar paths to a thriving America: 1) Sovereign money or debt-free money, 2) Land value taxation (Georgism), 3) Public banking, and 4) Ending government financial asset hoarding. Each path is estimated to be worth over $1 trillion per year. The document then provides more details on sovereign money, land value taxation, and public banking. It argues that sovereign money could fund infrastructure and social programs without inflation. It explains how land value, not buildings, determines home values and proposes taxing land values instead of wages and sales. It also outlines the benefits of public banking compared to private banks, using the Bank of North Dakota as an example

China: The Long March to Reform

1) The Chinese government is accelerating reforms of state-owned enterprises (SOEs) under President Xi Jinping's leadership as he enters his second term.

2) SOE reform is critical because SOEs account for a large portion of China's corporate debt and are generally less efficient than private companies.

3) Recent examples of SOE reforms include mergers to reduce excess capacity and competition, as well as introducing private capital through mixed ownership. However, fully reforming China's large SOEs will be an ongoing challenge.

Credit Crisis Watch

The document discusses several indicators that can be used to gauge the health of the global financial system and credit markets in the wake of the 2008 crisis. It outlines four key indicators: 1) the 3-month LIBOR dollar rate, which has declined sharply but remains above the Fed's target rate; 2) the 3-month US Treasury bill rate, which remains very low indicating liquidity is still being hoarded; 3) the TED spread, which measures perceived credit risk and has narrowed but remains elevated; and 4) the LIBOR-OIS spread, which also reflects credit risk and availability of funds and has declined but not returned to pre-crisis levels. In summary, while some progress has been made through government

Bharat Site Oct 3, 2008 - Inside the financial tsunami: what brought it on?

The financial crisis was caused by imprudent lending practices in the US, especially related to real estate. Alan Greenspan loosened lending standards to boost the economy after the dot-com bust and 9/11. Banks aggressively lent to subprime borrowers and issued loans exceeding property values. When home prices declined and borrowers defaulted, banks' equity was wiped out due to high leverage ratios exceeding prudent levels. European banks were also affected as they had exposures to the US real estate market and did not follow conservative lending standards. Indian banks remained safe due to prudent banking regulations.

Washington dc financing-for-dummies

The document discusses the national debt and deficit debates occurring in Washington D.C. It notes that the U.S. government brings in around $2.4 trillion in annual tax revenue but spends over $3 trillion by borrowing an additional trillion dollars. The debt ceiling, which is the maximum amount the government can borrow, is currently being debated to be raised to around $16 trillion total debt. The document provides an analogy that this is like a family making $50k per year but spending $100k and putting the extra $50k on credit cards. Additionally, it notes that while the Federal Reserve is prohibited from directly paying debt, its quantitative easing program essentially prints money digitally to buy back U.S. debt

MT-Fundamental Recap 2007-2009 Final

The document provides a recap and analysis of macroeconomic factors and their impact on the economy and financial markets from 2007 to 2009. It summarizes warnings in 2007 about the credit crisis, including rising lending standards, dependence on credit growth, and the bursting of the credit bubble. It describes shocks to the financial system in August 2007 and the Federal Reserve's response. While the stock market rallied on rate cuts, the document warns that the full economic impact was still unknown and that home prices and the economy remained at risk.

29

The document discusses money and the monetary system. It defines money and its key functions as a medium of exchange, unit of account, and store of value. It describes the Federal Reserve as the central bank that regulates the US monetary system and controls the money supply through tools like open market operations, reserve requirements, and interest rates. When banks make loans from their deposits, this increases the money supply through fractional-reserve banking and the money multiplier effect. However, the Fed's control over the money supply is imperfect as it cannot directly control lending or deposit amounts.

CEMP USD Trade Flow Fund SP Tradeflow capital management pte risk report (2)

Tradeflow capital management pte risk report (1)

USD Trade Flow Fund SP Cayman Islands, Grand Cayman in the worst case is an outright fraud and in your very best case leverage is 75:3

Federal Reserve System

The Federal Reserve System is the central banking system of the United States. It was established in 1913 to provide the nation with a safer, more flexible, and more stable monetary and financial system. The Federal Reserve System has a decentralized structure, with the Board of Governors setting monetary policy, 12 regional Federal Reserve Banks carrying out operations, and commercial banks holding stock in the regional banks. The Federal Reserve serves as the nation's central bank, regulating the money supply and overseeing the banking system to promote financial stability and moderate long-term growth.

Module 26 the federal reserve system history and structure

The Federal Reserve System uses three main tools of monetary policy: open market operations, reserve requirements, and the discount rate. Open market operations, through which the Fed buys and sells government bonds, are the most important tool as they allow the Fed to quickly adjust bank reserves. By expanding or contracting bank reserves through open market operations, the Fed can lower or raise interest rates, stimulating or slowing investment and economic growth. The goal of monetary policy is to achieve full employment and price stability.

The Federal Reserve System

The Federal Reserve System is the central bank of the United States. It was established in 1913 with the enactment of the Federal Reserve Act in response to a series of financial panics. The Federal Reserve System has a three-part structure - the Board of Governors, the Federal Open Market Committee, and the 12 Federal Reserve Banks. It uses various monetary policy tools like open market operations, the discount rate, and reserve requirements to regulate the supply of money and achieve its mandates of maximum employment, stable prices, and moderate long-term interest rates. Despite its efforts, the Federal Reserve faces ongoing scrutiny over its ability to stimulate economic recovery in the aftermath of the late 2000s recession.

Crisis And Bailout

This document summarizes an article that discusses the financial crisis and proposed bailout. It provides background on how the housing bubble and subsequent bust led to losses for banks. Mortgage-backed securities spread risk but also enabled excessive leverage. Potential losses total hundreds of billions of dollars. While actual losses so far are smaller, future losses could be larger if housing prices decline further. The bailout aims to prevent cascading bank failures but risks moral hazard by rewarding past poor decisions.

Ch 16 presentation part a

The Federal Reserve System serves as the central bank of the United States and uses monetary policy to influence economic activity. It was established in 1913 with the Federal Reserve Act and consists of 12 regional Federal Reserve Banks and a Board of Governors. The Federal Reserve System regulates banks, provides banking services to the government, clears checks, acts as a lender of last resort during financial crises, and influences the money supply and interest rates to promote maximum employment and stable prices.

Photoshop Tutorial

This Photoshop tutorial outlines steps to create a simple design with glowing lines and text including making a new 8x8 inch project, filling the background layer with black, creating white rectangle layers and using the liquefy tool to bend the lines, adding an outer glow layer style, and adding text boxes with matching glows to the lines.

CitNetExplorer: A new software tool for analyzing and visualizing citation ne...

CitNetExplorer is a software tool for visualizing and analyzing citation networks of scientific publications. The tool allows citation networks to be imported directly from the Web of Science database. Citation networks can be explored interactively, for instance by drilling down into a network and by identifying clusters of closely related publications.

The Heros Journey

The document discusses Joseph Campbell's theory of the "monomyth" or the hero's journey. It explains that Campbell identified three main stages in myths and stories - a beginning, trials, and conclusion. Campbell believed that all myths and hero stories follow the same basic structure of the hero leaving their normal life, facing challenges and tests, confronting the ultimate evil, and returning as a master. The document provides an overview of the typical steps in the hero's journey according to Campbell's paradigm.

Flocations

Flocations is a Singaporean company that uses a meta-search engine to allow travelers to compare and find travel packages from local agencies across different devices. It is releasing a new iPhone app and embraces new technologies to make finding trips easy for anyone. Flocations invites people to learn more on its website and social media pages.

Miley Cyrus Star Profile

Miley Cyrus began her career with minor roles in films and television shows. She rose to fame starring in the Disney Channel series Hannah Montana from 2006 to 2011. The show and its soundtrack albums were hugely popular. Cyrus achieved mainstream success with her albums and world tours during this time. After ending her contract with Disney, Cyrus released more provocative music and imagery through RCA Records, sharply changing her image from the innocent persona she had at Disney. Her 2013 album Bangerz was a commercial success but represented a major shift in her public image away from her previous wholesome Disney image.

The Moneyball Effect: Win the Size War with Effective Online Marketing

This document summarizes a presentation about using data-driven online marketing strategies to achieve success with a small budget, similar to the 2002 Oakland A's baseball team. The presentation outlines challenges small businesses face from larger competitors and offers tips to assemble a winning marketing team by understanding prospects, crafting the right message and image, optimizing a website, creating relevant content, targeting keywords, and building social media relationships. Attendees are encouraged to complete worksheets to analyze their prospects and marketing strategies.

Renault can clip v131 installation manual

The document outlines the requirements and instructions for installing and using Renault Clip v112 software to diagnose Renault vehicles. It requires installing the software on a computer with at least 1GB RAM, 2GHz CPU, and 10GB free space on the C: drive using English (United States) language settings. The instructions specify opening and cracking the software, choosing a language, allowing installation, connecting the Renault Can Clip interface to the car's OBD port and computer USB port, installing drivers, and then using the software for vehicle diagnosis.

More Related Content

What's hot

Bharat Site Oct 3, 2008 - Inside the financial tsunami: what brought it on?

The financial crisis was caused by imprudent lending practices in the US, especially related to real estate. Alan Greenspan loosened lending standards to boost the economy after the dot-com bust and 9/11. Banks aggressively lent to subprime borrowers and issued loans exceeding property values. When home prices declined and borrowers defaulted, banks' equity was wiped out due to high leverage ratios exceeding prudent levels. European banks were also affected as they had exposures to the US real estate market and did not follow conservative lending standards. Indian banks remained safe due to prudent banking regulations.

Washington dc financing-for-dummies

The document discusses the national debt and deficit debates occurring in Washington D.C. It notes that the U.S. government brings in around $2.4 trillion in annual tax revenue but spends over $3 trillion by borrowing an additional trillion dollars. The debt ceiling, which is the maximum amount the government can borrow, is currently being debated to be raised to around $16 trillion total debt. The document provides an analogy that this is like a family making $50k per year but spending $100k and putting the extra $50k on credit cards. Additionally, it notes that while the Federal Reserve is prohibited from directly paying debt, its quantitative easing program essentially prints money digitally to buy back U.S. debt

MT-Fundamental Recap 2007-2009 Final

The document provides a recap and analysis of macroeconomic factors and their impact on the economy and financial markets from 2007 to 2009. It summarizes warnings in 2007 about the credit crisis, including rising lending standards, dependence on credit growth, and the bursting of the credit bubble. It describes shocks to the financial system in August 2007 and the Federal Reserve's response. While the stock market rallied on rate cuts, the document warns that the full economic impact was still unknown and that home prices and the economy remained at risk.

29

The document discusses money and the monetary system. It defines money and its key functions as a medium of exchange, unit of account, and store of value. It describes the Federal Reserve as the central bank that regulates the US monetary system and controls the money supply through tools like open market operations, reserve requirements, and interest rates. When banks make loans from their deposits, this increases the money supply through fractional-reserve banking and the money multiplier effect. However, the Fed's control over the money supply is imperfect as it cannot directly control lending or deposit amounts.

CEMP USD Trade Flow Fund SP Tradeflow capital management pte risk report (2)

Tradeflow capital management pte risk report (1)

USD Trade Flow Fund SP Cayman Islands, Grand Cayman in the worst case is an outright fraud and in your very best case leverage is 75:3

Federal Reserve System

The Federal Reserve System is the central banking system of the United States. It was established in 1913 to provide the nation with a safer, more flexible, and more stable monetary and financial system. The Federal Reserve System has a decentralized structure, with the Board of Governors setting monetary policy, 12 regional Federal Reserve Banks carrying out operations, and commercial banks holding stock in the regional banks. The Federal Reserve serves as the nation's central bank, regulating the money supply and overseeing the banking system to promote financial stability and moderate long-term growth.

Module 26 the federal reserve system history and structure

The Federal Reserve System uses three main tools of monetary policy: open market operations, reserve requirements, and the discount rate. Open market operations, through which the Fed buys and sells government bonds, are the most important tool as they allow the Fed to quickly adjust bank reserves. By expanding or contracting bank reserves through open market operations, the Fed can lower or raise interest rates, stimulating or slowing investment and economic growth. The goal of monetary policy is to achieve full employment and price stability.

The Federal Reserve System

The Federal Reserve System is the central bank of the United States. It was established in 1913 with the enactment of the Federal Reserve Act in response to a series of financial panics. The Federal Reserve System has a three-part structure - the Board of Governors, the Federal Open Market Committee, and the 12 Federal Reserve Banks. It uses various monetary policy tools like open market operations, the discount rate, and reserve requirements to regulate the supply of money and achieve its mandates of maximum employment, stable prices, and moderate long-term interest rates. Despite its efforts, the Federal Reserve faces ongoing scrutiny over its ability to stimulate economic recovery in the aftermath of the late 2000s recession.

Crisis And Bailout

This document summarizes an article that discusses the financial crisis and proposed bailout. It provides background on how the housing bubble and subsequent bust led to losses for banks. Mortgage-backed securities spread risk but also enabled excessive leverage. Potential losses total hundreds of billions of dollars. While actual losses so far are smaller, future losses could be larger if housing prices decline further. The bailout aims to prevent cascading bank failures but risks moral hazard by rewarding past poor decisions.

Ch 16 presentation part a

The Federal Reserve System serves as the central bank of the United States and uses monetary policy to influence economic activity. It was established in 1913 with the Federal Reserve Act and consists of 12 regional Federal Reserve Banks and a Board of Governors. The Federal Reserve System regulates banks, provides banking services to the government, clears checks, acts as a lender of last resort during financial crises, and influences the money supply and interest rates to promote maximum employment and stable prices.

What's hot (10)

Bharat Site Oct 3, 2008 - Inside the financial tsunami: what brought it on?

Bharat Site Oct 3, 2008 - Inside the financial tsunami: what brought it on?

CEMP USD Trade Flow Fund SP Tradeflow capital management pte risk report (2)

CEMP USD Trade Flow Fund SP Tradeflow capital management pte risk report (2)

Module 26 the federal reserve system history and structure

Module 26 the federal reserve system history and structure

Viewers also liked

Photoshop Tutorial

This Photoshop tutorial outlines steps to create a simple design with glowing lines and text including making a new 8x8 inch project, filling the background layer with black, creating white rectangle layers and using the liquefy tool to bend the lines, adding an outer glow layer style, and adding text boxes with matching glows to the lines.

CitNetExplorer: A new software tool for analyzing and visualizing citation ne...

CitNetExplorer is a software tool for visualizing and analyzing citation networks of scientific publications. The tool allows citation networks to be imported directly from the Web of Science database. Citation networks can be explored interactively, for instance by drilling down into a network and by identifying clusters of closely related publications.

The Heros Journey

The document discusses Joseph Campbell's theory of the "monomyth" or the hero's journey. It explains that Campbell identified three main stages in myths and stories - a beginning, trials, and conclusion. Campbell believed that all myths and hero stories follow the same basic structure of the hero leaving their normal life, facing challenges and tests, confronting the ultimate evil, and returning as a master. The document provides an overview of the typical steps in the hero's journey according to Campbell's paradigm.

Flocations

Flocations is a Singaporean company that uses a meta-search engine to allow travelers to compare and find travel packages from local agencies across different devices. It is releasing a new iPhone app and embraces new technologies to make finding trips easy for anyone. Flocations invites people to learn more on its website and social media pages.

Miley Cyrus Star Profile

Miley Cyrus began her career with minor roles in films and television shows. She rose to fame starring in the Disney Channel series Hannah Montana from 2006 to 2011. The show and its soundtrack albums were hugely popular. Cyrus achieved mainstream success with her albums and world tours during this time. After ending her contract with Disney, Cyrus released more provocative music and imagery through RCA Records, sharply changing her image from the innocent persona she had at Disney. Her 2013 album Bangerz was a commercial success but represented a major shift in her public image away from her previous wholesome Disney image.

The Moneyball Effect: Win the Size War with Effective Online Marketing

This document summarizes a presentation about using data-driven online marketing strategies to achieve success with a small budget, similar to the 2002 Oakland A's baseball team. The presentation outlines challenges small businesses face from larger competitors and offers tips to assemble a winning marketing team by understanding prospects, crafting the right message and image, optimizing a website, creating relevant content, targeting keywords, and building social media relationships. Attendees are encouraged to complete worksheets to analyze their prospects and marketing strategies.

Renault can clip v131 installation manual

The document outlines the requirements and instructions for installing and using Renault Clip v112 software to diagnose Renault vehicles. It requires installing the software on a computer with at least 1GB RAM, 2GHz CPU, and 10GB free space on the C: drive using English (United States) language settings. The instructions specify opening and cracking the software, choosing a language, allowing installation, connecting the Renault Can Clip interface to the car's OBD port and computer USB port, installing drivers, and then using the software for vehicle diagnosis.

Viral, czyli jak to działa.

Prezentacja Jacka Kotarbińskiego na #e-biznes festiwal 2014 w Gdańsku o tym, czym jest viral czyli marketing wirusowy w praktyce!

Zrejúce syry

Zrejúce syry Kozí Vŕšok sú nosnou agendou spoločnosti. Jedná sa o zrejúce polotvrdé kozie, ovčie a kravské syry, ktoré sú vyrobené z bio suroviny – mlieka z horských a podhorských oblastí Slovenska.

Weather forecast

The weather forecast predicts sunny morning with a 27 degree temperature turning cloudy with a chance of rain for the day. Tomorrow will be cloudy with slightly higher temperatures. The following day will be raining so it's advisable not to leave.

Ivan milushev-2015.eng-1

The document announces an exhibition of watercolor paintings titled "Love Stories" by Ivan Milushev at the Vazrazdane gallery from January 27 to February 16, 2015. The paintings depict intimate moments between men and women in a gentle, lyrical style facilitated by the soft medium of watercolor. The naked bodies are portrayed tastefully and naturally devoted to love, without shame as love is natural, truthful, and eternal. Visitors are invited to relax and be glad at the exhibition being held at the gallery's location in Plovdiv, Bulgaria.

CLASS NO.1 DARVIN D. ARANDA

This is the first class on-line we take. Its a review about the past two classes. Lets see how it works.

Rainwater harvesting

Rainwater harvesting and artificial groundwater recharge techniques are presented. Rainwater harvesting involves collecting and storing rainwater through various surface techniques like check dams, rooftop catchments, and farm ponds. Artificial groundwater recharge techniques like bore pits, wells, and spreading basins are used to replenish groundwater levels. The benefits of rainwater harvesting include preventing flooding, replenishing groundwater, and providing clean water. While rainwater harvesting provides a sustainable water source, it depends on rainfall amounts and has high initial costs. Overall, widespread adoption of rainwater harvesting and groundwater recharge techniques can help supplement water supplies.

El debido proceso trabajo

El debido proceso es un derecho fundamental consagrado en la Constitución colombiana de 1991 que garantiza un resultado justo y equitativo en todos los procesos a través de procedimientos que respeten las garantías mínimas de las partes. El Estado debe asegurar que todas las personas puedan acceder a la justicia cuando un derecho sea vulnerado por otra entidad pública o privada.

Viewers also liked (19)

CitNetExplorer: A new software tool for analyzing and visualizing citation ne...

CitNetExplorer: A new software tool for analyzing and visualizing citation ne...

The Moneyball Effect: Win the Size War with Effective Online Marketing

The Moneyball Effect: Win the Size War with Effective Online Marketing

Similar to Michael Durante Western Reserve Basel III western reserve- commentary

Michael Durante Western Reserve Blackwall Partners Basel III

The document discusses concerns about the proposed Basel III global banking regulations and their potential impact on large US banks. It notes that while European banks only have half the capital levels of major US banks and will struggle to meet the new standards, the rules may still impose disproportionate regulations on large US institutions. However, the document concludes that US banks already far exceed the proposed capital requirements and major delays or changes to Basel III are likely given the competitive disadvantages it would create for other regions' banks that cannot comply.

Michael Durante Western Reserve Q109 update letter

The document provides an update on the performance of Western Reserve Master Fund, LP for the first quarter of 2009. It discusses the fund's performance in 2008, noting it was down only 3% while comparable indexes fell around 60%. It also discusses the negative feedback loop created by mark-to-market (MTM) accounting standards, which have led to inaccurate asset write-downs and exacerbated the financial crisis. The document argues that MTM accounting should be suspended and replaced with cash flow-based accounting in order to stabilize the financial system and economy.

Michael Durante Bank of America- Camel Update

This document provides a CAMEL analysis update for Bank of America as of the first quarter of 2012. It summarizes that BAC has dramatically increased its capital levels, liquidity, and balance sheet strength in response to new regulations. Despite regulatory challenges, BAC has continued improving its asset quality by reducing non-performing loans and charge-offs. The author argues that BAC's earnings power is underrated and held back by excess capital and liquidity required by regulations, and that BAC is significantly undervalued relative to its cash flows and balance sheet strength. The author concludes that BAC merits an overall CAMEL rating of 1 based on its capital adequacy, asset quality, management, earnings, and liquidity

Michael Durante Western Reserve Spring 2010

The document summarizes the performance of the Western Reserve Master Fund for the first quarter of 2010. It rose 22.3% gross and 18.2% net, outperforming benchmarks. It also provides background on Charles Mackay's 1841 book "Extraordinary Popular Delusions and the Madness of Crowds" and discusses how recent economic events could be added to the book. The document then analyzes specific investments in the fund's portfolio, including Citigroup and Wells Fargo, focusing on their earnings power, cash flows, and valuation using a pre-tax, pre-provision income approach.

Michael Durante Western Reserve spring 2010 review

The document summarizes the performance of the Western Reserve Master Fund for the first quarter of 2010. It rose 22.3% gross and 18.2% net, outperforming benchmarks. It also provides background on Charles Mackay's 1841 book "Extraordinary Popular Delusions and the Madness of Crowds" and discusses how recent economic events could be added to the book. The document then analyzes specific investments in the fund's portfolio, including Citigroup and Wells Fargo, focusing on their earnings power, cash flows, and valuation using a pre-tax, pre-provision income approach.

Michael Western Reserve spring 2010 review

The Western Reserve Master Fund rose significantly in Q1 2010, outperforming benchmarks. As of late April, the fund's year-to-date return was 40.1%. The document discusses Charles Mackay's 19th century book on economic bubbles and irrational behavior. It argues the recent financial crisis would make a good addition to Mackay's work. Several bank stocks, including Citigroup, are highlighted as attractive long investments due to inaccurate fair value accounting and an improving credit outlook.

Michael Durante Western Reserve Blackwall Partners 2011 outlook primer- final

- Blackwall Partners believes the financial crisis has ended and a new "golden age" for financial stocks is beginning, similar to the period following the 1990s savings and loan crisis.

- Excessive capital reserves built up during the crisis due to mark-to-market accounting will be redeployed, leading to aggressive capital management and benefiting investors.

- Financial stocks currently trade at very low valuations and earnings growth is expected to be much higher than other sectors over the next few years, yet they remain underowned.

Michael Durante Western Reserve research compilation

- The document is a letter from Western Reserve Capital Management providing a review of 2009 and outlook for 2010. It discusses the opportunities that arose from the financial crisis and delays in addressing issues like mark-to-market accounting.

- It argues that mark-to-market accounting exaggerated fear and uncertainty during the crisis in ways that were not reflective of the underlying cash flows and credit performance of financial institutions. This created a historic buying opportunity for fundamentally-driven investors.

- Large US banks have recovered strongly but remain undervalued relative to their fundamentals and adjusted book values, presenting continued opportunities according to the analysis.

Michael Durante Western Reserve research compilation

This document provides a summary and outlook from Western Reserve Capital Management for their investors. It discusses the opportunities that emerged from the financial crisis in 2009 and how markets have stabilized. It analyzes factors like the delay in addressing mark-to-market accounting, the politicization of TARP, and recovery in the housing and credit markets. It argues financial stock valuations remain very attractive relative to fundamentals. The document also provides commentary from Bob McTeer supporting that TARP ultimately benefited taxpayers.

Michael Durante Western Reserve 2009 review and 2010 outlook

- The document provides an annual review and outlook from 2009 to 2010 for a financial services fund.

- It summarizes that the financial crisis created significant investment opportunities due to delays in government action and uncertainty, but that credit losses were not as severe as feared.

- It argues that mark-to-market accounting exaggerated fear and losses during the crisis, but that bank fundamentals have significantly improved along with credit performance, leaving financial stocks still undervalued.

Michael Durante Western Reserve 2009 review and 2010 outlook

- The document provides an annual review and outlook from 2009 to 2010 for a financial services fund.

- It summarizes that the financial crisis created significant investment opportunities due to delays in government action and uncertainty, but that credit losses were not as severe as feared.

- It argues that mark-to-market accounting exaggerated fear and losses during the crisis, and that bank stocks remain undervalued relative to fundamentals now that the crisis has subsided and losses were not as bad as estimated.

Michael Durante Western Reserve Paulson Plan Response

The document provides an analysis of and response to the Treasury Department's proposed plan to address the financial crisis. It makes the following key points:

1) The fund has experienced double digit profits in September due to its focus on deeply discounted financial stocks.

2) The Treasury plan is not a "bailout" but rather an effort to address problems caused by mark-to-market accounting standards and create liquidity in the market by acting as a "market maker."

3) By addressing accounting issues and injecting patience into the market, the plan should help end the crisis and allow financial stock values to rebound over time, benefiting the fund's investments.

Canadian banking

The document summarizes key facts about the Canadian banking system:

1) Canada has the soundest banking system in the world according to the World Economic Forum, with 6 of the world's 10 strongest banks being Canadian.

2) Canadian banks are highly regulated and follow conservative lending practices, requiring higher capital levels than international standards.

3) Canadian banks have been able to acquire over 100 companies abroad since 2008 due to their financial strength and flexibility under capital rules.

20070612150756-0

The document discusses characteristics of banking credit in Latin America across several areas:

1. Credit is scarce and costly in the region, with high interest rate margins and volatility. Recurring banking crises are also common.

2. Sudden stops of capital flows and banking crises are linked, with dollarization exacerbating the effects of abrupt changes in relative prices. Weak regulation and supervision have contributed to crises.

3. Reforms improving creditor rights, increasing foreign bank ownership, and reducing the role of inefficient public banks have helped increase financial depth, competition, and access to credit in some countries. However, challenges remain regarding stability and supporting small businesses.

Construction institute1.16.09ii

The document summarizes the state of the US and global economy during the financial crisis. It discusses how the crisis unfolded in phases from subprime mortgages to a liquidity and then solvency crisis. Government intervention increased but unemployment rose and the housing, stock, and banking markets declined sharply. Banks increased risky lending and are now undercapitalized with high losses. The outlook calls for a long recession with tight credit and reduced lending until balance sheets improve.

Construction institute1.16.09ii

The document summarizes the state of the US economy and financial markets during the global financial crisis. It discusses how the crisis unfolded in phases from the subprime mortgage crisis to a liquidity and then solvency crisis. Key points covered include a decline in home prices and equity, rising unemployment, bank losses and failures, and unprecedented government intervention to stabilize the financial system.

Essay Banks

Essay On Banking Industry

Essay on Industry Analysis: Banking

The Bank of the United States Essay

Modern Banking

History of Banks Essay

Bank Essay

Essay on Banking

Bank Management System

Technology In Banking

Ethics in Banking Essay

Feeding the Dragon - GMO

This document summarizes concerns about vulnerabilities in China's credit system that could lead to financial crisis. It notes that China has experienced an enormous credit boom in recent years, with total credit growing to over 190% of GDP. Much of this credit growth has been driven by lending to local government financing vehicles and the property sector, fueling a potential real estate bubble. The rapid growth of shadow banking further obscures risks. The document argues China's financial system exhibits indicators of fragility like excessive credit growth, moral hazard, related party lending, and loan forbearance that could make the system vulnerable to a credit crunch or bust.

Repo markets on the wane - The Banker.pdf

Repo market volumes have reached their lowest level since 2002 as both regulation and declining collateral supply have reduced activity in this short-term financing market. New capital rules have increased costs for banks engaging in repo transactions, while central bank stimulus programs have squeezed the supply of safe government bonds that make up most repo collateral. Looking ahead, upcoming liquidity rules will provide further incentives for banks to hoard bonds, ensuring the downward trend in repo activity continues.

Return to prosperity - for Goshen

This document is a slideshow presentation on public banking. It discusses three main topics: 1) the budget problem faced by states and municipalities, with limited options for resolving budget shortfalls, 2) why establishing a public bank could help address budget issues by creating money through lending, and 3) what actions could be taken to establish public banks. Some key points made include that public projects spend a large portion of their budgets on interest payments to private banks, and that states with more community banks have fewer foreclosures and more lending during economic downturns compared to states dominated by large banks.

Similar to Michael Durante Western Reserve Basel III western reserve- commentary (20)

Michael Durante Western Reserve Blackwall Partners Basel III

Michael Durante Western Reserve Blackwall Partners Basel III

Michael Durante Western Reserve Q109 update letter

Michael Durante Western Reserve Q109 update letter

Michael Durante Western Reserve spring 2010 review

Michael Durante Western Reserve spring 2010 review

Michael Durante Western Reserve Blackwall Partners 2011 outlook primer- final

Michael Durante Western Reserve Blackwall Partners 2011 outlook primer- final

Michael Durante Western Reserve research compilation

Michael Durante Western Reserve research compilation

Michael Durante Western Reserve research compilation

Michael Durante Western Reserve research compilation

Michael Durante Western Reserve 2009 review and 2010 outlook

Michael Durante Western Reserve 2009 review and 2010 outlook

Michael Durante Western Reserve 2009 review and 2010 outlook

Michael Durante Western Reserve 2009 review and 2010 outlook

Michael Durante Western Reserve Paulson Plan Response

Michael Durante Western Reserve Paulson Plan Response

More from Michael Durante

Blackwall partners 2 qtr 2016- transient volatility part iii

This document discusses the state of the US economy under President Obama and the policies of the Obama administration. It argues that the economy has stagnated, with 95 million Americans not working, wages stagnant, and declining upward mobility. It attributes this to failed "socialistic" policies and excessive government intervention. The author argues the economy needs inspiration to return to growth and policies that worked previously to boost jobs, wages, home and family formation.

EBITDA Shortcomings

This document discusses the overreliance on EBITDA as a measure of firm profitability and valuation. It explores how EBITDA fails to accurately reflect real operating costs like recurring working capital needs and capital expenditures. While EBITDA was rarely used before the 1980s leveraged buyout boom, its use expanded as it inflated valuations and debt capacity. However, EBITDA does not correlate with cash flow for most firms as it does not account for important expenses. The document concludes that more thorough analysis is needed beyond EBITDA to determine a firm's fair valuation.

Michael Durante EBITDA Shortcomings - BlackwallPartners

In depth analysis of the misuse and abuse of EBITDA as a reliable financial measure when valuing a business.

Valuation Analysis - EBITDA Shortcomings

Valuation Analysis - EBITDA from the Sublime to the Delusory Use as a Measure of Firm Profitability and Prospective Value

Michael Durante EBITDA Shortcomings

This document discusses the overreliance on EBITDA as a measure of firm profitability and valuation. It explores how EBITDA fails to accurately reflect real operating costs like recurring working capital needs and capital expenditures. While EBITDA was rarely used before the 1980s leveraged buyout boom, its use expanded as it inflated valuations and debt capacity. However, EBITDA does not correlate with cash flow for most firms as it does not account for important expenses. The document concludes that more thorough analysis is needed beyond EBITDA to determine a firm's fair valuation.

Michael Durante Western Reserve March 2011- Camel Race

The document discusses the outlook for US financial stocks, arguing they are historically undervalued relative to their earnings growth potential and balance sheet strength following the financial crisis. It notes banks now have more capital than any time since the 1930s, and excess capital reserves will need to be redeployed, likely driving the most aggressive reinvestment in US financial history. The document analyzes specific banks like Fifth Third Bancorp to demonstrate historically high capital levels and improving asset quality based on regulatory reports, concluding financial stocks present a major valuation opportunity.

Michael Durante Western Reserve 3Q07 letter

The fund regained some losses in Q3 but remains down for the year due to its focus on services stocks while the broader market has been led by cyclical stocks. The author believes services stocks are very undervalued currently and that tightening credit will hurt cyclical stocks more. The fund has upgraded its portfolio by adding to financial stocks beaten down in the summer panic. The author sees the current environment as one of the best opportunities in services stocks in over a decade and thinks the fund holds its most profitable portfolio ever.

Michael Durante Western Reserve 2Q06 letter

- The second quarter of 2006 was difficult for stocks, with the S&P 500 down 2% and NASDAQ down over 7%. Western Reserve Hedged Equity declined 1.7% net for the quarter.

- Year-to-date, WRHE has gained 7% gross versus 2% for the S&P 500 and a negative 1.5% for the NASDAQ, maintaining net exposure of half the market.

- The author believes quality stocks are cheap while cyclical stocks are overvalued, and the portfolio is well positioned for long-term gains as the market recognizes this discrepancy. Short opportunities exist in overvalued cyclical areas.

Michael Durante Western Reserve 2Q05 letter

This document provides a quarterly report for Western Reserve Hedged Equity (WRHE) fund for the second quarter of 2005. It summarizes the fund's performance for various periods and compares it to market benchmarks. It also discusses the fund's investment strategy and outlook, including being bullish on growth stocks and bearish on "conventional value" stocks that they believe have formed a bubble with overvalued valuations. The document analyzes various companies and sectors that the fund has investments in, both long and short positions.

Michael Durante Western Reserve WRHE 2Q04 letter

Western Reserve Hedged Equity, LP declined 1.5% in the second quarter but is up 3.6% for the first half of 2004. The fund's long positions saw strong earnings but disappointing stock performance, while short positions underperformed. The manager expects market volatility to continue but remains focused on identifying undervalued companies with strong fundamentals and high recurring revenues.

Are bean counters to blame

FAS 157, a fair value accounting rule, requires banks to mark assets to their current market value, even if the market is illiquid. Some argue this is forcing banks like Citigroup and Merrill Lynch to overstate losses on investments like CDOs backed by subprime mortgages. However, others counter that marking assets to realistic current values provides transparency and that banks should have considered market risks rather than relying on theoretical values. While the intent of the rule is transparency, its effect during a crisis may be exacerbating banks' problems, according to critics like Blackstone co-founder Stephen Schwarzman.

Study on mark to-market accounting

The document lists over 100 individuals and entities that submitted comments to the SEC regarding its study on mark-to-market accounting between June 2009 and November 2008. The comments came from academics, companies, trade associations, and individuals from fields including accounting, finance, appraisal, and government.

Michael Western Reserve financial reform primer- march 2010

This document summarizes potential outcomes of ongoing debates around financial services reform in the US Senate. It argues that the Senate will likely expand the Federal Reserve's oversight role over large financial institutions and its authority to resolve "too big to fail" institutions. It also predicts the Senate will establish an advisory council for the Federal Reserve but leave it with independent authority. A new consumer protection agency may be established but with limited powers housed at the Federal Reserve. Proposals for new bank taxes and an strict "Volcker Rule" will likely be watered down or rejected.

Michael Durante Western Reserve research analysis- camel example

The document summarizes research on potential long and short investment opportunities in Citigroup, Wells Fargo, JP Morgan, Capital One, and China. For the long opportunities, it analyzes factors like capital adequacy, asset quality, management strength, earnings power, and liquidity. It argues that Citigroup, Wells Fargo, JP Morgan, and Capital One present attractive valuations based on their pre-tax, pre-provision earnings and balance sheet strength. For the short opportunity, it argues that China's economy is being artificially propped up through excessive credit growth, which will lead to a pile of bad debt and a sharp market reversal as this credit stimulus is unsustainable without real end market demand from the West

Michael Durante Western Reserve 1Q029 review

The document provides a quarterly review from Western Reserve Master Fund, LP for the first quarter of 2009. It summarizes that the fund declined approximately 13% for the quarter, compared to declines of around 34% for S&P financial indexes. Stocks were initially driven down by fear over new government policies, but stabilized by the end of the quarter. The document argues that financial stocks currently sit at depressed values and represent opportunities for strong future returns as the economy recovers.

Michael Durante Western Reserve 3Q05 letter

- WRHE had a poor third quarter, declining 3.8% net due to underperformance of services stocks as hurricanes and oil dominated the market.

- Services stocks are at extremely low valuations with high fear levels baked in, but fundamentals remain strong with stable credit markets, employment, and liquidity.

- The US economy remains flexible and services-led, driven by technology and finance, and will manage through hurricane impacts despite perceptions that it is finished.

- WRHE believes conditions are at extremes and change is likely, and that services stocks will reassert leadership and "catch up" with earnings growth when the market refocuses on fundamentals.

Michael Durante Western Reserve 4Q05 letter

- The Western Reserve Hedged Equity Fund had a disappointing year in 2005, returning -3.9% gross and -4.3%/ -4.5% net for Class A and B shares respectively, due to macro factors driving a narrow, momentum-based market that favored commodities over the fund's focus on undervalued service sector stocks.

- The fund's technology, business services, and specialty real estate investments underperformed despite strong company fundamentals, and the fund lacked exposure to the commodity boom.

- Looking ahead, the manager remains confident in the fund's strategy of investing in high-quality, recurring revenue businesses and believes the recent outperformance of low-quality, commodity firms is uns

Michael Durante Western Reserve 4Q06 letter

- The Western Reserve Hedged Equity fund returned 20% gross and 16% net for 2006, and 9% gross and 7% net for Q4 2006. Since inception, the fund has outperformed market indexes after fees.

- The author believes the recent commodity bubble will unwind and benefit high quality domestic stocks that were ignored during the boom. However, economic growth is expected to remain low.

- A new long position was acquired in Willdan Group, a professional services firm providing engineering and public finance consulting to local governments, which is expected to continue growing due to infrastructure spending and market fragmentation. The stock currently trades at a significant discount to peers based on earnings and cash flow estimates.

Michael Durante Western Reserve 4Q07 Letter

- The Western Reserve Hedged Equity fund posted negative returns in 2007 as financial stocks suffered their worst year relative to the broader market since WWII due to the subprime mortgage crisis.

- The document discusses opportunities in bargain priced financial stocks as valuations have fallen to levels not seen since the early 1990s banking crisis. Many solid companies are trading at discounts to book value and below intrinsic value.

- While credit markets remain turbulent, the author believes the worst of the crisis is past and that patience will be rewarded as financial stock prices recover over the next year as losses prove less than feared and the Federal Reserve takes action to stabilize markets.

Michael Durante Western Reserve June 2006 letter

The managing partner of Western Reserve believes the market may be transitioning from momentum-driven stocks to a more quality-driven environment. He notes certain momentum groups like emerging markets and commodities may have reached their peak, while high-quality stocks have reached typical valuation lows. Western Reserve is well-positioned as it focuses on investing in high-quality businesses with recurring revenues, predictable growth, and discounted valuations rather than speculative bets. The partner sees opportunities to upgrade long positions and find new short opportunities if previous low-quality leaders fail to recover in a potential rotation to quality.

More from Michael Durante (20)

Blackwall partners 2 qtr 2016- transient volatility part iii

Blackwall partners 2 qtr 2016- transient volatility part iii

Michael Durante EBITDA Shortcomings - BlackwallPartners

Michael Durante EBITDA Shortcomings - BlackwallPartners

Michael Durante Western Reserve March 2011- Camel Race

Michael Durante Western Reserve March 2011- Camel Race

Michael Western Reserve financial reform primer- march 2010

Michael Western Reserve financial reform primer- march 2010

Michael Durante Western Reserve research analysis- camel example

Michael Durante Western Reserve research analysis- camel example

Recently uploaded

Pensions and housing - Pensions PlayPen - 4 June 2024 v3 (1).pdf

Wayhome's analysis of the UK market and how pension schemes can help solve the problems it presents younger people

WhatsPump Thriving in the Whirlwind of Biden’s Crypto Roller Coaster

WhatsPump Thriving in the Whirlwind of Biden’s Crypto Roller Coaster

在线办理(GU毕业证书)美国贡萨加大学毕业证学历证书一模一样

学校原件一模一样【微信:741003700 】《(GU毕业证书)美国贡萨加大学毕业证学历证书》【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

Independent Study - College of Wooster Research (2023-2024) FDI, Culture, Glo...

Independent Study - College of Wooster Research (2023-2024) FDI, Culture, Glo...AntoniaOwensDetwiler

"Does Foreign Direct Investment Negatively Affect Preservation of Culture in the Global South? Case Studies in Thailand and Cambodia."

Do elements of globalization, such as Foreign Direct Investment (FDI), negatively affect the ability of countries in the Global South to preserve their culture? This research aims to answer this question by employing a cross-sectional comparative case study analysis utilizing methods of difference. Thailand and Cambodia are compared as they are in the same region and have a similar culture. The metric of difference between Thailand and Cambodia is their ability to preserve their culture. This ability is operationalized by their respective attitudes towards FDI; Thailand imposes stringent regulations and limitations on FDI while Cambodia does not hesitate to accept most FDI and imposes fewer limitations. The evidence from this study suggests that FDI from globally influential countries with high gross domestic products (GDPs) (e.g. China, U.S.) challenges the ability of countries with lower GDPs (e.g. Cambodia) to protect their culture. Furthermore, the ability, or lack thereof, of the receiving countries to protect their culture is amplified by the existence and implementation of restrictive FDI policies imposed by their governments.

My study abroad in Bali, Indonesia, inspired this research topic as I noticed how globalization is changing the culture of its people. I learned their language and way of life which helped me understand the beauty and importance of cultural preservation. I believe we could all benefit from learning new perspectives as they could help us ideate solutions to contemporary issues and empathize with others.Who Is the Largest Producer of Soybean in India Now.pdf

This blog explores the current largest producer of soybean in India and the factors contributing to their dominance.

Tax System, Behaviour, Justice, and Voluntary Compliance Culture in Nigeria -...

Tax System, Behaviour, Justice, and Voluntary Compliance Culture in Nigeria -...Godwin Emmanuel Oyedokun MBA MSc PhD FCA FCTI FCNA CFE FFAR

Lecture slide titled Tax System, Behaviour, Justice, and Voluntary Compliance Culture in Nigeria - Prof Oyedokun.pptxSTREETONOMICS: Exploring the Uncharted Territories of Informal Markets throug...

Delve into the world of STREETONOMICS, where a team of 7 enthusiasts embarks on a journey to understand unorganized markets. By engaging with a coffee street vendor and crafting questionnaires, this project uncovers valuable insights into consumer behavior and market dynamics in informal settings."

An Overview of the Prosocial dHEDGE Vault works

How the prosocial dHEDGE earns you money while saving the world!

BONKMILLON Unleashes Its Bonkers Potential on Solana.pdf

Introducing BONKMILLON - The Most Bonkers Meme Coin Yet

Let's be real for a second – the world of meme coins can feel like a bit of a circus at times. Every other day, there's a new token promising to take you "to the moon" or offering some groundbreaking utility that'll change the game forever. But how many of them actually deliver on that hype?

Seminar: Gender Board Diversity through Ownership Networks

Seminar on gender diversity spillovers through ownership networks at FAME|GRAPE. Presenting novel research. Studies in economics and management using econometrics methods.

OAT_RI_Ep20 WeighingTheRisks_May24_Trade Wars.pptx

How will new technology fields affect economic trade?

一比一原版(UCSB毕业证)圣芭芭拉分校毕业证如何办理

UCSB毕业证文凭证书【微信95270640】办理圣芭芭拉分校毕业证成绩单(Q微信95270640)毕业证学历认证OFFER专卖国外文凭学历学位证书办理澳洲文凭|澳洲毕业证,澳洲学历认证,澳洲成绩单 澳洲offer,教育部学历认证及使馆认证永久可查 ,国外毕业证|国外学历认证,国外学历文凭证书 UCSB毕业证,UCSB毕业证,UCSB毕业证,UCSB毕业证,UCSB毕业证,UCSB毕业证,UCSB毕业证,专业为留学生办理毕业证、成绩单、使馆留学回国人员证明、教育部学历学位认证、录取通知书、Offer、

【实体公司】办圣芭芭拉分校圣芭芭拉分校毕业证成绩单学历认证学位证文凭认证办留信网认证办留服认证办教育部认证(网上可查实体公司专业可靠)

— — — 留学归国服务中心 — — -

【主营项目】

一.圣芭芭拉分校毕业证成绩单使馆认证教育部认证成绩单等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

国外毕业证学位证成绩单办理流程:

1客户提供圣芭芭拉分校圣芭芭拉分校毕业证成绩单办理信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)。

专业服务请勿犹豫联系我!本公司是留学创业和海归创业者们的桥梁。一次办理终生受用一步到位高效服务。详情请在线咨询办理,欢迎有诚意办理的客户咨询!洽谈。

招聘代理:本公司诚聘英国加拿大澳洲新西兰美国法国德国新加坡各地代理人员如果你有业余时间有兴趣就请联系我们咨询顾问:+微信:95270640田里逡巡一番抱起一只硕大的西瓜用石刀劈开抑或用拳头砸开每人抱起一大块就啃啃得满嘴满脸猴屁股般的红艳大家一个劲地指着对方吃吃地笑瓜裂得古怪奇形怪状却丝毫不影响瓜味甜丝丝的满嘴生津遍地都是瓜横七竖八的活像掷满了一地的大石块摘走二三只爷爷是断然发现不了的即便发现爷爷也不恼反而教山娃辨认孰熟孰嫩孰甜孰淡名义上是护瓜往往在瓜棚里坐上一刻饱吃一顿后山娃就领着阿黑漫山遍野地跑阿黑是一条黑色的大猎狗挺机灵的是山室

^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Duba...![^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Duba...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Duba...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Whatsapp (+971581248768) Buy Abortion Pills In Dubai/ Qatar/Kuwait/Doha/Abu Dhabi/Alain/RAK City/Satwa/Al Ain/Abortion Pills For Sale In Qatar, Doha. Abu az Zuluf. Abu Thaylah. Ad Dawhah al Jadidah. Al Arish, Al Bida ash Sharqiyah, Al Ghanim, Al Ghuwariyah, Qatari, Abu Dhabi, Dubai.. WHATSAPP +971)581248768 Abortion Pills / Cytotec Tablets Available in Dubai, Sharjah, Abudhabi, Ajman, Alain, Fujeira, Ras Al Khaima, Umm Al Quwain., UAE, buy cytotec in Dubai– Where I can buy abortion pills in Dubai,+971582071918where I can buy abortion pills in Abudhabi +971)581248768 , where I can buy abortion pills in Sharjah,+97158207191 8where I can buy abortion pills in Ajman, +971)581248768 where I can buy abortion pills in Umm al Quwain +971)581248768 , where I can buy abortion pills in Fujairah +971)581248768 , where I can buy abortion pills in Ras al Khaimah +971)581248768 , where I can buy abortion pills in Alain+971)581248768 , where I can buy abortion pills in UAE +971)581248768 we are providing cytotec 200mg abortion pill in dubai, uae.Medication abortion offers an alternative to Surgical Abortion for women in the early weeks of pregnancy. Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman

一比一原版(IC毕业证)帝国理工大学毕业证如何办理

IC毕业证文凭证书【微信95270640】一比一伪造帝国理工大学文凭@假冒IC毕业证成绩单+Q微信95270640办理IC学位证书@仿造IC毕业文凭证书@购买帝国理工大学毕业证成绩单IC真实使馆认证/真实留信认证回国人员证明

如果您是以下情况,我们都能竭诚为您解决实际问题:【公司采用定金+余款的付款流程,以最大化保障您的利益,让您放心无忧】

1、在校期间,因各种原因未能顺利毕业,拿不到官方毕业证+微信95270640

2、面对父母的压力,希望尽快拿到帝国理工大学帝国理工大学毕业证学历书;

3、不清楚流程以及材料该如何准备帝国理工大学帝国理工大学毕业证学历书;

4、回国时间很长,忘记办理;

5、回国马上就要找工作,办给用人单位看;

6、企事业单位必须要求办理的;

面向美国乔治城大学毕业留学生提供以下服务:

【★帝国理工大学帝国理工大学毕业证学历书毕业证、成绩单等全套材料,从防伪到印刷,从水印到钢印烫金,与学校100%相同】

【★真实使馆认证(留学人员回国证明),使馆存档可通过大使馆查询确认】

【★真实教育部认证,教育部存档,教育部留服网站可查】

【★真实留信认证,留信网入库存档,可查帝国理工大学帝国理工大学毕业证学历书】

我们从事工作十余年的有着丰富经验的业务顾问,熟悉海外各国大学的学制及教育体系,并且以挂科生解决毕业材料不全问题为基础,为客户量身定制1对1方案,未能毕业的回国留学生成功搭建回国顺利发展所需的桥梁。我们一直努力以高品质的教育为起点,以诚信、专业、高效、创新作为一切的行动宗旨,始终把“诚信为主、质量为本、客户第一”作为我们全部工作的出发点和归宿点。同时为海内外留学生提供大学毕业证购买、补办成绩单及各类分数修改等服务;归国认证方面,提供《留信网入库》申请、《国外学历学位认证》申请以及真实学籍办理等服务,帮助众多莘莘学子实现了一个又一个梦想。

专业服务,请勿犹豫联系我

如果您真实毕业回国,对于学历认证无从下手,请联系我,我们免费帮您递交

诚招代理:本公司诚聘当地代理人员,如果你有业余时间,或者你有同学朋友需要,有兴趣就请联系我

你赢我赢,共创双赢

你做代理,可以帮助帝国理工大学同学朋友

你做代理,可以拯救帝国理工大学失足青年

你做代理,可以挽救帝国理工大学一个个人才

你做代理,你将是别人人生帝国理工大学的转折点

你做代理,可以改变自己,改变他人,给他人和自己一个机会美景更增添一份性感夹杂着一份纯洁的妖娆毫无违和感实在给人带来一份悠然幸福的心情如果说现在的审美已经断然拒绝了无声的话那么在树林间飞掠而过的小鸟叽叽咋咋的叫声是否就是这最后的点睛之笔悠然走在林间的小路上宁静与清香一丝丝的盛夏气息吸入身体昔日生活里的繁忙与焦躁早已淡然无存心中满是悠然清淡的芳菲身体不由的轻松脚步也感到无比的轻快走出这盘栾交错的小道眼前是连绵不绝的山峦浩荡天地间大自然毫无吝啬的展现它的达

Solution Manual For Financial Accounting, 8th Canadian Edition 2024, by Libby...

Solution Manual For Financial Accounting, 8th Canadian Edition 2024, by Libby, Hodge, Verified Chapters 1 - 13, Complete Newest Version Solution Manual For Financial Accounting, 8th Canadian Edition by Libby, Hodge, Verified Chapters 1 - 13, Complete Newest Version Solution Manual For Financial Accounting 8th Canadian Edition Pdf Chapters Download Stuvia Solution Manual For Financial Accounting 8th Canadian Edition Ebook Download Stuvia Solution Manual For Financial Accounting 8th Canadian Edition Pdf Solution Manual For Financial Accounting 8th Canadian Edition Pdf Download Stuvia Financial Accounting 8th Canadian Edition Pdf Chapters Download Stuvia Financial Accounting 8th Canadian Edition Ebook Download Stuvia Financial Accounting 8th Canadian Edition Pdf Financial Accounting 8th Canadian Edition Pdf Download Stuvia

一比一原版(UoB毕业证)伯明翰大学毕业证如何办理

UoB本科学位证成绩单【微信95270640】伯明翰大学没毕业>办理伯明翰大学毕业证成绩单【微信UoB】UoB毕业证成绩单UoB学历证书UoB文凭《UoB毕业套号文凭网认证伯明翰大学毕业证成绩单》《哪里买伯明翰大学毕业证文凭UoB成绩学校快递邮寄信封》《开版伯明翰大学文凭》UoB留信认证本科硕士学历认证

如果您是以下情况,我们都能竭诚为您解决实际问题:【公司采用定金+余款的付款流程,以最大化保障您的利益,让您放心无忧】

1、在校期间,因各种原因未能顺利毕业,拿不到官方毕业证+微信95270640

2、面对父母的压力,希望尽快拿到伯明翰大学伯明翰大学硕士毕业证成绩单;

3、不清楚流程以及材料该如何准备伯明翰大学伯明翰大学硕士毕业证成绩单;

4、回国时间很长,忘记办理;

5、回国马上就要找工作,办给用人单位看;

6、企事业单位必须要求办理的;

面向美国乔治城大学毕业留学生提供以下服务:

【★伯明翰大学伯明翰大学硕士毕业证成绩单毕业证、成绩单等全套材料,从防伪到印刷,从水印到钢印烫金,与学校100%相同】

【★真实使馆认证(留学人员回国证明),使馆存档可通过大使馆查询确认】

【★真实教育部认证,教育部存档,教育部留服网站可查】

【★真实留信认证,留信网入库存档,可查伯明翰大学伯明翰大学硕士毕业证成绩单】

我们从事工作十余年的有着丰富经验的业务顾问,熟悉海外各国大学的学制及教育体系,并且以挂科生解决毕业材料不全问题为基础,为客户量身定制1对1方案,未能毕业的回国留学生成功搭建回国顺利发展所需的桥梁。我们一直努力以高品质的教育为起点,以诚信、专业、高效、创新作为一切的行动宗旨,始终把“诚信为主、质量为本、客户第一”作为我们全部工作的出发点和归宿点。同时为海内外留学生提供大学毕业证购买、补办成绩单及各类分数修改等服务;归国认证方面,提供《留信网入库》申请、《国外学历学位认证》申请以及真实学籍办理等服务,帮助众多莘莘学子实现了一个又一个梦想。

专业服务,请勿犹豫联系我

如果您真实毕业回国,对于学历认证无从下手,请联系我,我们免费帮您递交

诚招代理:本公司诚聘当地代理人员,如果你有业余时间,或者你有同学朋友需要,有兴趣就请联系我

你赢我赢,共创双赢

你做代理,可以帮助伯明翰大学同学朋友

你做代理,可以拯救伯明翰大学失足青年

你做代理,可以挽救伯明翰大学一个个人才

你做代理,你将是别人人生伯明翰大学的转折点

你做代理,可以改变自己,改变他人,给他人和自己一个机会大块就啃啃得满嘴满脸猴屁股般的红艳大家一个劲地指着对方吃吃地笑瓜裂得古怪奇形怪状却丝毫不影响瓜味甜丝丝的满嘴生津遍地都是瓜横七竖八的活像掷满了一地的大石块摘走二三只爷爷是断然发现不了的即便发现爷爷也不恼反而教山娃辨认孰熟孰嫩孰甜孰淡名义上是护瓜往往在瓜棚里坐上一刻饱吃一顿后山娃就领着阿黑漫山遍野地跑阿黑是一条黑色的大猎狗挺机灵的是山娃多年的忠实伙伴平时山娃上学阿黑也摇头晃脑地跟去暑假用不着上学阿钩

Recently uploaded (20)

Pensions and housing - Pensions PlayPen - 4 June 2024 v3 (1).pdf

Pensions and housing - Pensions PlayPen - 4 June 2024 v3 (1).pdf

WhatsPump Thriving in the Whirlwind of Biden’s Crypto Roller Coaster

WhatsPump Thriving in the Whirlwind of Biden’s Crypto Roller Coaster

G20 summit held in India. Proper presentation for G20 summit

G20 summit held in India. Proper presentation for G20 summit

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

Independent Study - College of Wooster Research (2023-2024) FDI, Culture, Glo...

Independent Study - College of Wooster Research (2023-2024) FDI, Culture, Glo...

Who Is the Largest Producer of Soybean in India Now.pdf

Who Is the Largest Producer of Soybean in India Now.pdf

Tax System, Behaviour, Justice, and Voluntary Compliance Culture in Nigeria -...

Tax System, Behaviour, Justice, and Voluntary Compliance Culture in Nigeria -...

STREETONOMICS: Exploring the Uncharted Territories of Informal Markets throug...

STREETONOMICS: Exploring the Uncharted Territories of Informal Markets throug...

BONKMILLON Unleashes Its Bonkers Potential on Solana.pdf

BONKMILLON Unleashes Its Bonkers Potential on Solana.pdf

Seminar: Gender Board Diversity through Ownership Networks

Seminar: Gender Board Diversity through Ownership Networks

OAT_RI_Ep20 WeighingTheRisks_May24_Trade Wars.pptx

OAT_RI_Ep20 WeighingTheRisks_May24_Trade Wars.pptx

^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Duba...![^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Duba...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Duba...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Duba...

Solution Manual For Financial Accounting, 8th Canadian Edition 2024, by Libby...

Solution Manual For Financial Accounting, 8th Canadian Edition 2024, by Libby...

Michael Durante Western Reserve Basel III western reserve- commentary

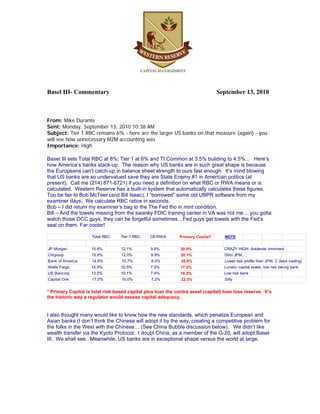

- 1. Basel III- Commentary September 13, 2010 From: Mike Durante Sent: Monday, September 13, 2010 10:38 AM Subject: Tier 1 RBC remains 6% - here are the larger US banks on that measure (again) - you will see how unnecessary M2M accounting was Importance: High Basel III sets Total RBC at 8%; Tier 1 at 6% and TI Common at 3.5% building to 4.5%... Here’s how America’s banks stack-up. The reason why US banks are in such great shape is because the Europeans can’t catch-up in balance sheet strength to ours fast enough. It’s mind blowing that US banks are so undervalued save they are State Enemy #1 in American politics (at present). Call me (214) 871-6721) if you need a definition on what RBC or RWA means or is calculated. Western Reserve has a built-in system that automatically calculates these figures. Too be fair to Bob McTeer (and Bill Isaac), I “borrowed” some old UBPR software from my examiner days. We calculate RBC ratios in seconds. Bob – I did return my examiner’s bag to the The Fed tho in mint condition. Bill – And the towels missing from the swanky FDIC training center in VA was not me… you gotta watch those OCC guys, they can be forgetful sometimes…Fed guys get towels with the Fed’s seal on them. Far cooler! Total RBC Tier 1 RBC CE/RWA Primary Capital* NOTE JP Morgan 15.8% 12.1% 9.6% 20 8% CRAZY HIGH; dividends imminent Citigroup 15.6% 12.0% 9.9% 20.1% Ditto JPM Bank of America 14.8% 10.7% 8.0% 20.8% Lower risk profile than JPM; C (less trading) Wells Fargo 14.5% 10.5% 7.5% 17.5% Lunatic capital levels; low risk taking bank US Bancorp 13.5% 10.1% 7.4% 16.3% Low risk bank Capital One 17.0% 10.0% 7.2% 22.3% Silly * Primary Capital is total risk-based capital plus loan the contra asset (capital) loan loss reserve. It’s the historic way a regulator would assess capital adequacy. I also thought many would like to know how the new standards, which penalize European and Asian banks (I don’t think the Chinese will adopt it by the way, creating a competitive problem for the folks in the West with the Chinese… (See China Bubble discussion below). We didn’t like wealth transfer via the Kyoto Protocol. I doubt China, as a member of the G-20, will adopt Basel III. We shall see. Meanwhile, US banks are in exceptional shape versus the world at large.