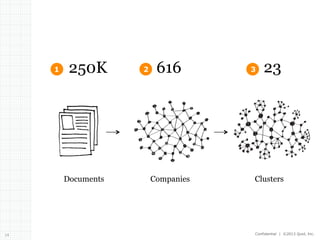

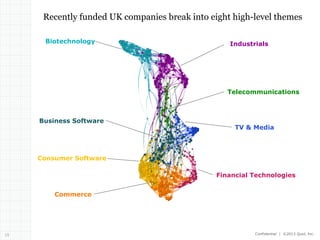

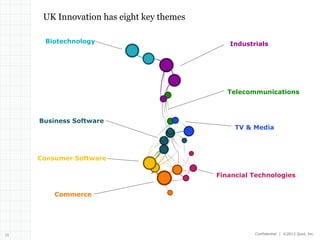

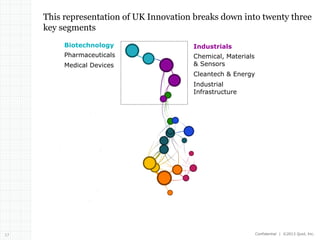

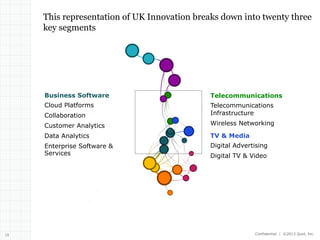

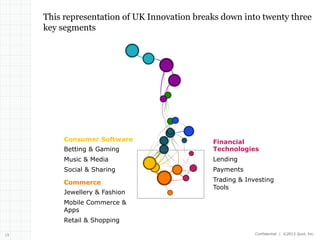

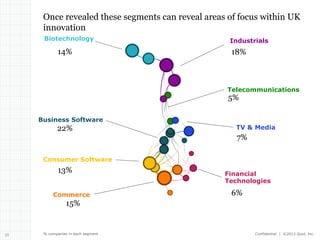

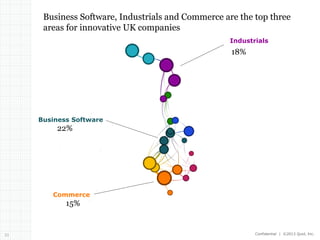

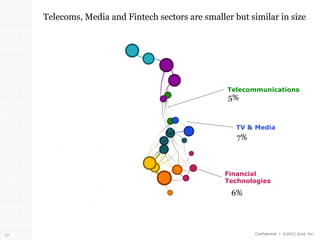

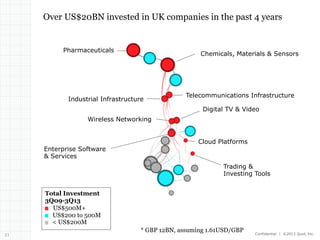

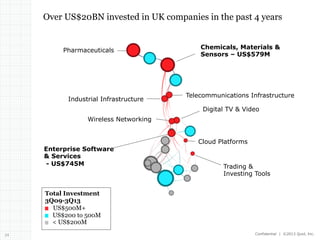

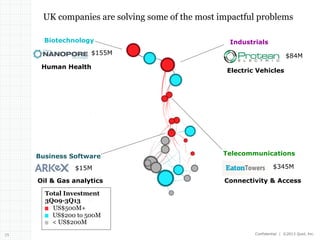

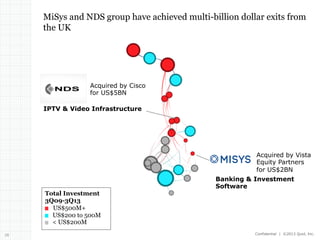

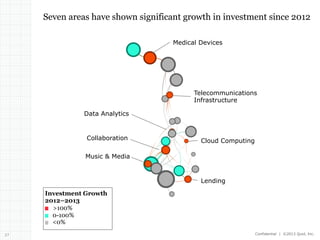

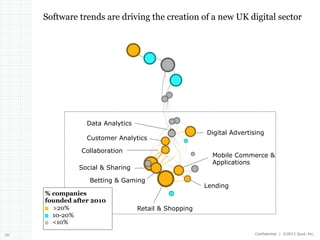

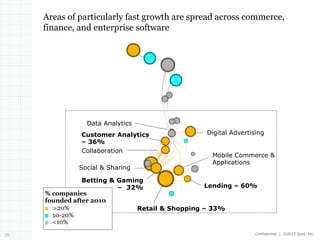

The document discusses mapping UK innovation based on an analysis of over 250,000 documents and 616 companies. It finds that UK innovation breaks down into 23 key segments, with Business Software, Industrials, and Commerce making up the top three areas. Over $20 billion has been invested in UK companies in recent years, with the largest investments going to Pharmaceuticals, Industrial Infrastructure, and Enterprise Software. Several UK companies have seen multi-billion dollar exits, demonstrating the global impact and success of UK innovation.