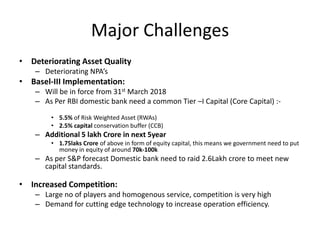

The document analyzes the banking sector in India and identifies several major challenges: (1) deteriorating asset quality and rising non-performing assets, (2) the need for banks to raise an additional 5 lakh crore in the next 5 years to meet new capital standards under Basel III, and (3) increased competition from many players offering similar services. However, the document also notes some positive factors for the sector including an uptick in credit and deposit growth, the financial inclusion program expanding banking access, and growing mobile banking services.