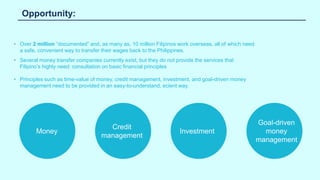

The document outlines a business proposition for 'Bagong Bayani Financial', aimed at creating a Filipino-centric online platform for money remittance, bill payments, savings, and financial consulting, targeting the over 2 million Filipinos working overseas. It addresses the financial management challenges faced by Overseas Filipino Workers (OFWs), offering educational tools and a secure means for money transfers, thereby promoting better savings and credit building. The business seeks $6 million in Series A funding to launch its operations and aims to pilot in six months, led by experienced professionals in finance and business management.