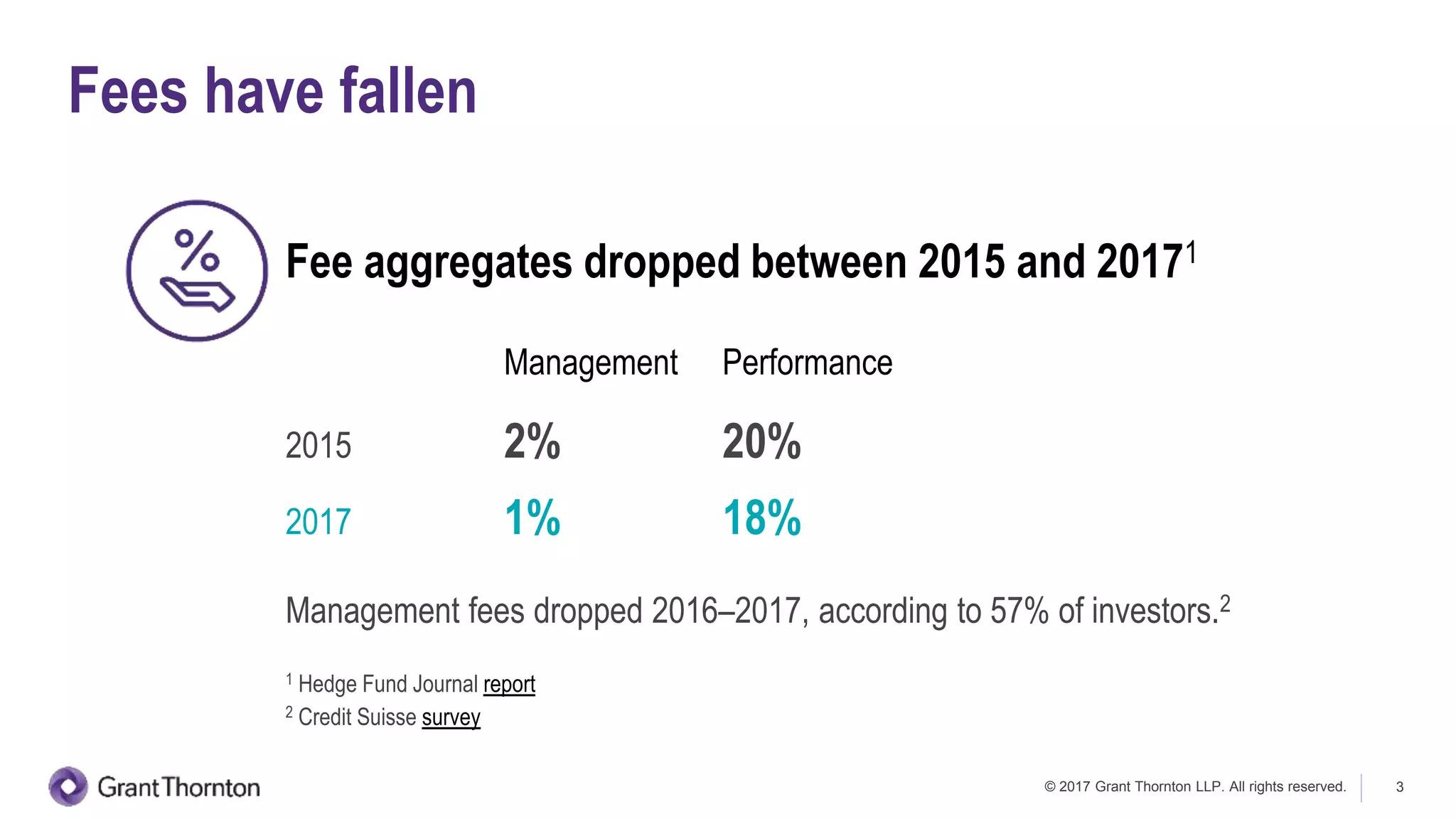

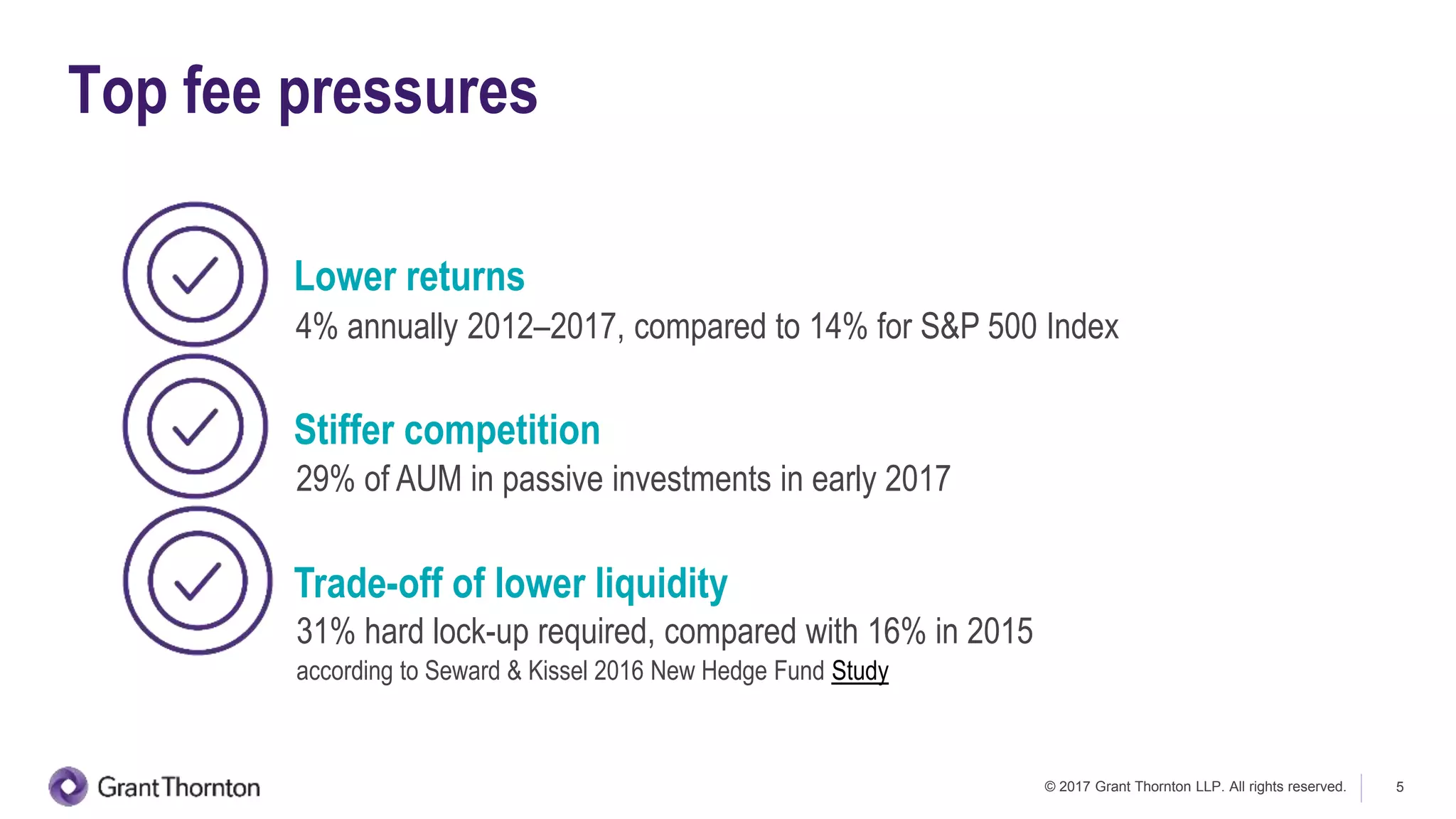

The asset management industry faces significant challenges with declining hedge fund fees and increased competition, necessitating strategies such as expansion and operational restructuring. Key recommendations include exploring new fee structures linked to performance, embracing technology for efficiency, and refocusing on compliance. Additionally, firms are encouraged to consider acquisitions and partnerships to adapt to a global market and diversify their offerings.