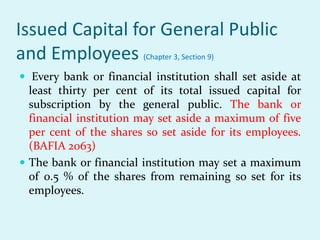

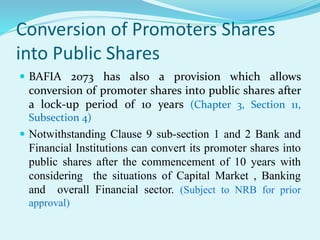

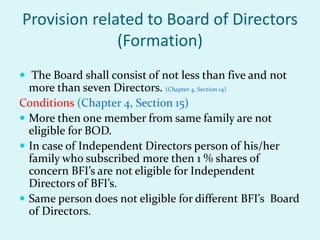

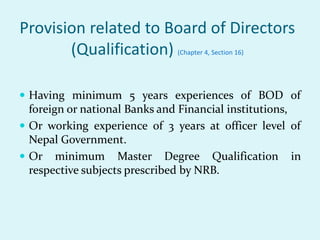

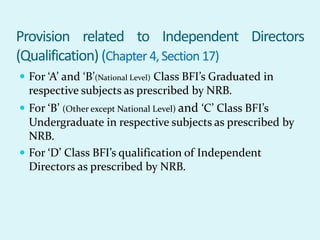

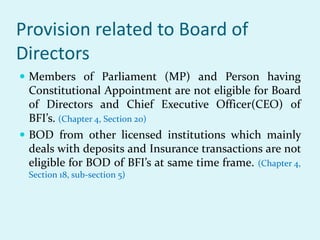

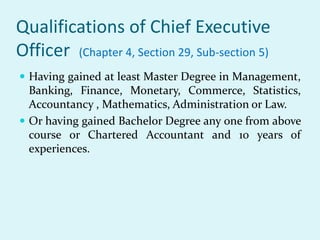

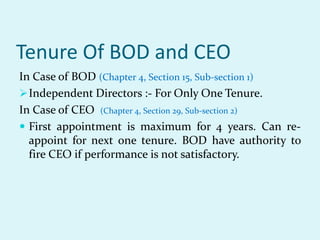

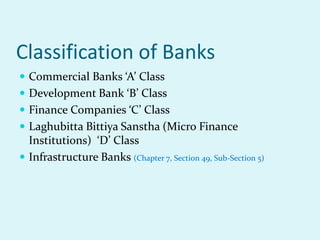

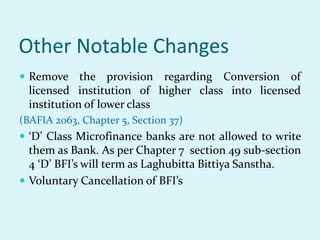

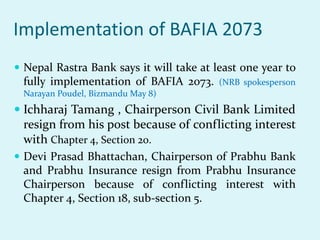

This document summarizes key aspects of the Bank and Financial Institution Act (BAFIA) 2073 passed in Nepal. It outlines the historical context of banking acts in Nepal. It then discusses disputes around BAFIA 2073 and why it was formulated. Some of the key changes introduced in BAFIA 2073 include provisions around board of directors qualifications and tenure, CEO qualifications, classification of banks, and restrictions on certain individuals serving on boards. Full implementation of BAFIA 2073 is expected to take around one year. Some issues around adapting banking regulations to federalism in Nepal and balancing CEO and board powers still need to be addressed.