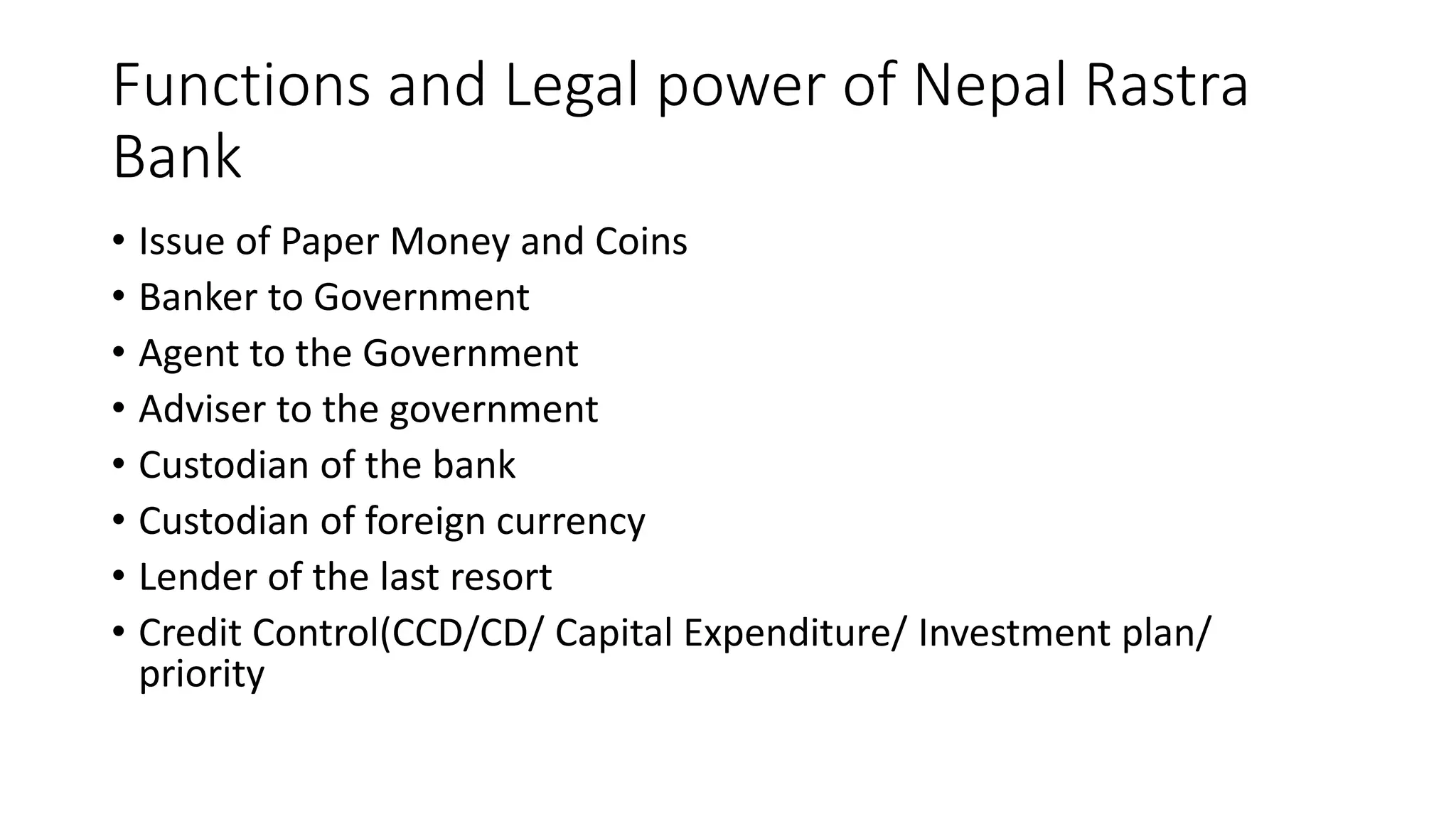

The central bank of Nepal is called Nepal Rastra Bank (NRB). It regulates the country's financial system and monetary policy by supervising banks, managing currency supply, and setting key policy interest rates. As the bank of banks, NRB was established in 2012 and is an autonomous body that serves as the government's chief adviser on financial and economic matters like fiscal policy and foreign exchange rates. Its objectives include maintaining price stability and sustainable economic development.