Embed presentation

Download to read offline

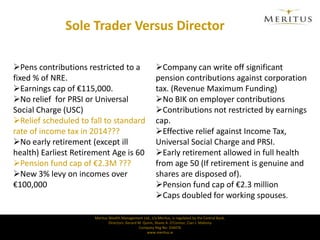

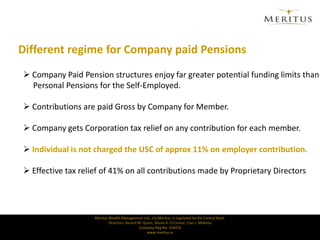

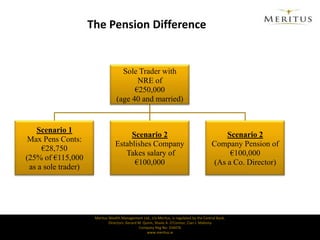

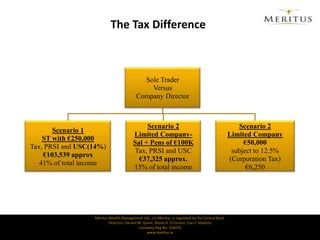

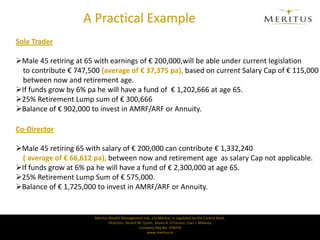

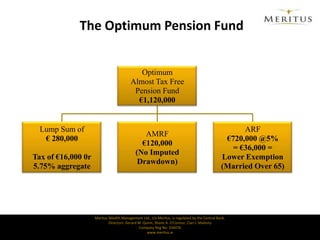

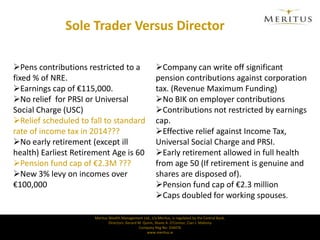

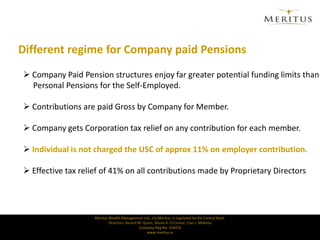

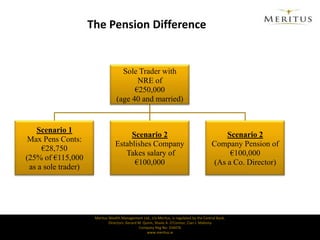

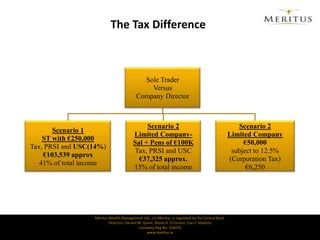

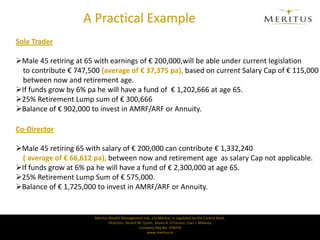

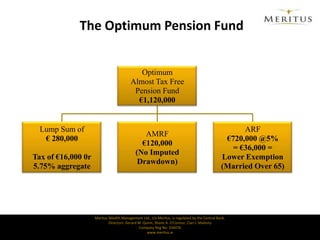

There are key differences between personal pensions for sole traders and company pensions for directors. Personal pensions for sole traders have earnings caps and relief that is restricted to a percentage of earnings. Company pensions for directors allow for greater potential funding as companies can claim tax relief on contributions and directors are not subject to earnings caps. Company pensions also provide more favorable tax treatment as individuals do not pay USC tax on employer contributions and receive effective tax relief of 41% on contributions.