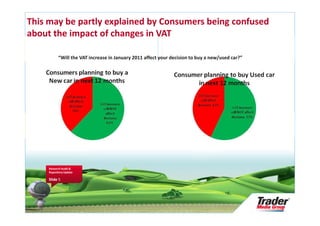

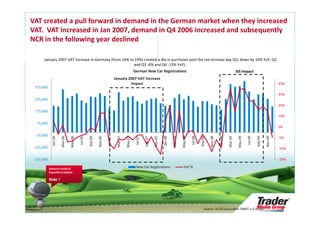

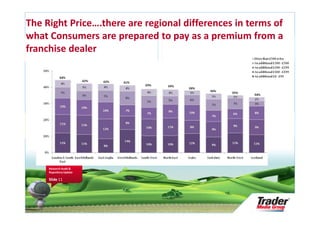

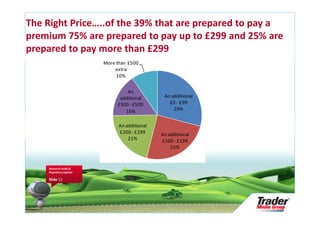

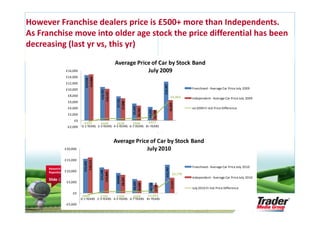

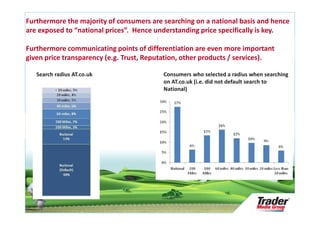

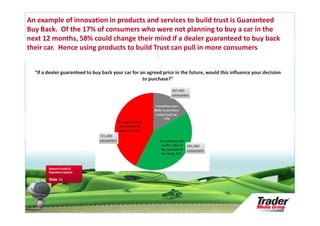

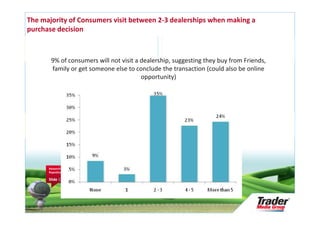

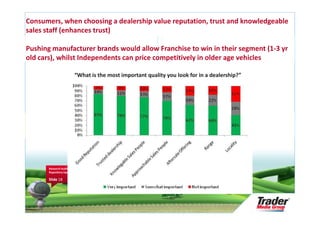

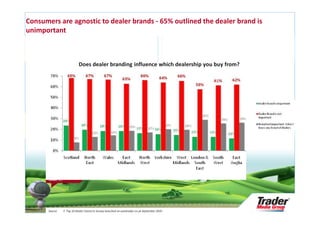

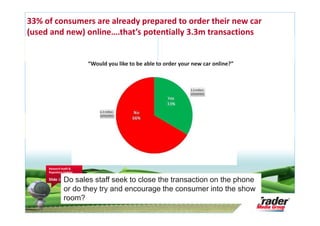

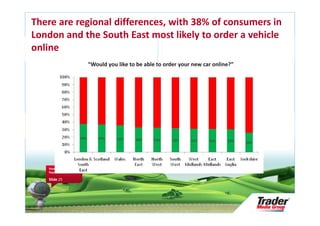

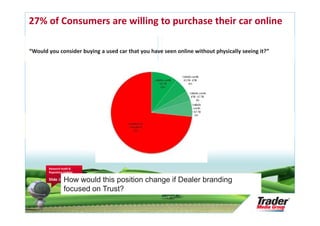

The document summarizes the results of a survey of 5,000 consumers conducted by Auto Trader to understand consumer sentiment and how the car market may change. Key findings include: consumer confidence is stronger than a year ago, but new car registrations are still forecast to decline; many consumers are confused about the upcoming VAT increase; and having the right car at the right price and trusting the dealership are top priorities for consumers. The report provides recommendations to dealers on how to adapt to changes in consumer preferences, such as focusing on trust, reputation, and online presence.