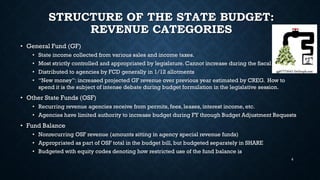

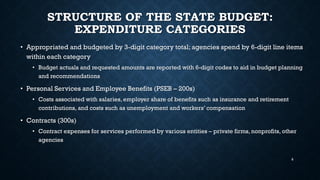

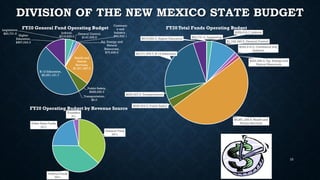

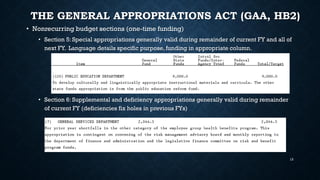

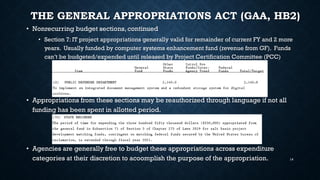

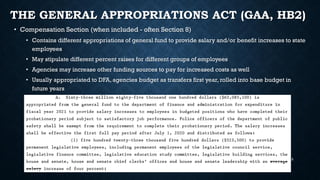

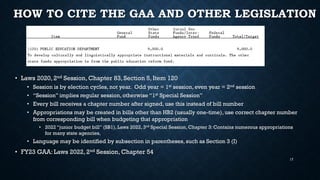

This document provides an overview of New Mexico's state budget process. It discusses the roles of the State Budget Division and other actors involved in developing, passing, and implementing the state budget. Key parts of the budget include the revenue sources (general fund, federal funds, other state funds), expenditure categories (personal services, contracts, other costs), and the structure of the General Appropriations Act that is passed each year.