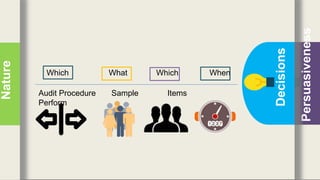

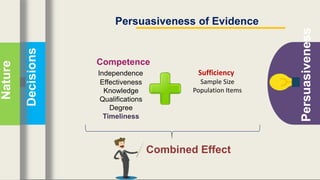

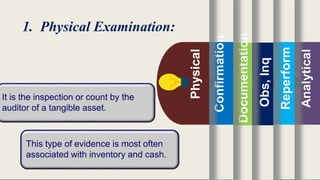

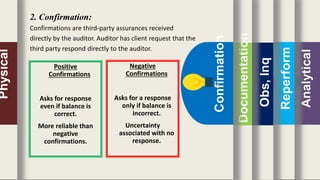

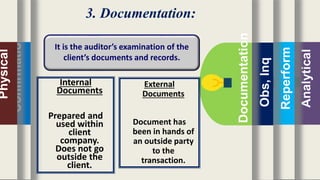

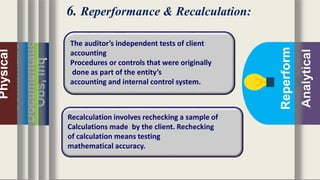

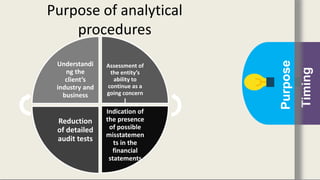

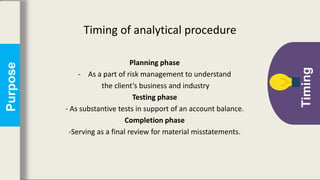

This document is a presentation from Group 13 for an audit and inspection course. It discusses the nature of audit evidence and different types of audit evidence including physical examination, confirmation, documentation, observation and inquiries of clients, reperformance and recalculation, and analytical procedures. It provides details on the purpose and timing of analytical procedures, noting they are used in the planning, testing, and completion phases of an audit to understand the client's business, assess going concern, identify possible misstatements, and reduce detailed testing.