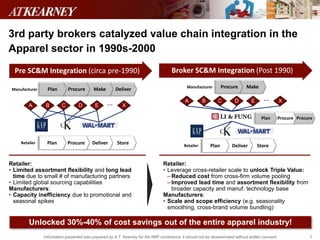

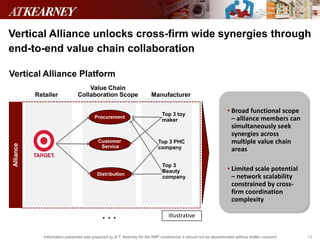

The document discusses disruptive trends in the consumer retail industry and the need for supply chain integration. It outlines four major trends driving changes: commodity scarcity, global competition, post-recession consciousness, and changing demographics. To address these challenges, the document argues that manufacturers and retailers must move beyond local optimization to integrated value chain collaboration. Two models for integration are proposed: an open broker model and a vertical alliance model. The document concludes by providing guidance on assessing opportunities and developing a roadmap for integration.