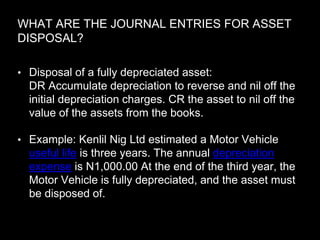

This document discusses asset disposal and the related accounting entries. It begins by defining an asset disposal as removing an asset from accounting books, usually because it is fully depreciated, sold, or no longer useful. Reasons for disposal include being fully depreciated, sold, or to avoid theft. Journal entries for disposal include reversing accumulated depreciation and removing the asset value. Disposals may result in gains or losses depending on sale price. On the cash flow statement, sale proceeds are recorded as investing cash flows while gains or losses are recorded as operating cash flows. An example cash flow statement transaction is provided.