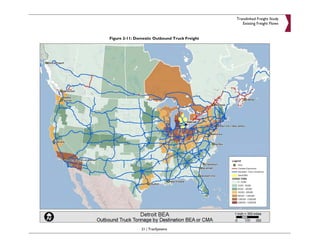

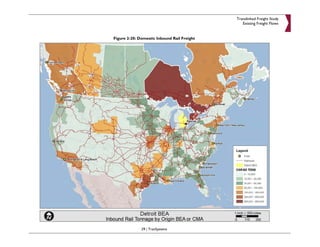

This executive summary discusses the Translinked initiative, which aims to create an industry cluster focused on transportation, distribution, and logistics across southeast Michigan, northwest Ohio, and southwest Ontario. The goal is to establish an efficient multimodal hub for freight by mobilizing public and private resources. Key recommendations include attracting more freight flows, developing value-added services, and improving infrastructure like rail. An analysis of 2009 freight data found that trucking dominates regional cargo flows, which are concentrated among a few major commodity groups.