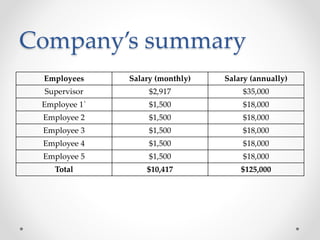

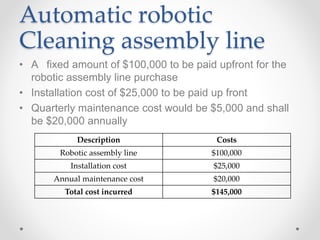

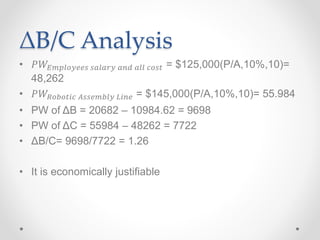

The document outlines a proposal for a hand car wash service in San Francisco to replace its employees with a robotic assembly line, which aims to reduce labor costs and increase profitability. An economic analysis indicates that, despite significant upfront costs of $145,000 for the robotic system and its installation, the potential annual net profit could rise to $300,000, making the investment justified. The recommendation concludes that transitioning to automation would eliminate employee salaries and enhance the business's profitability.