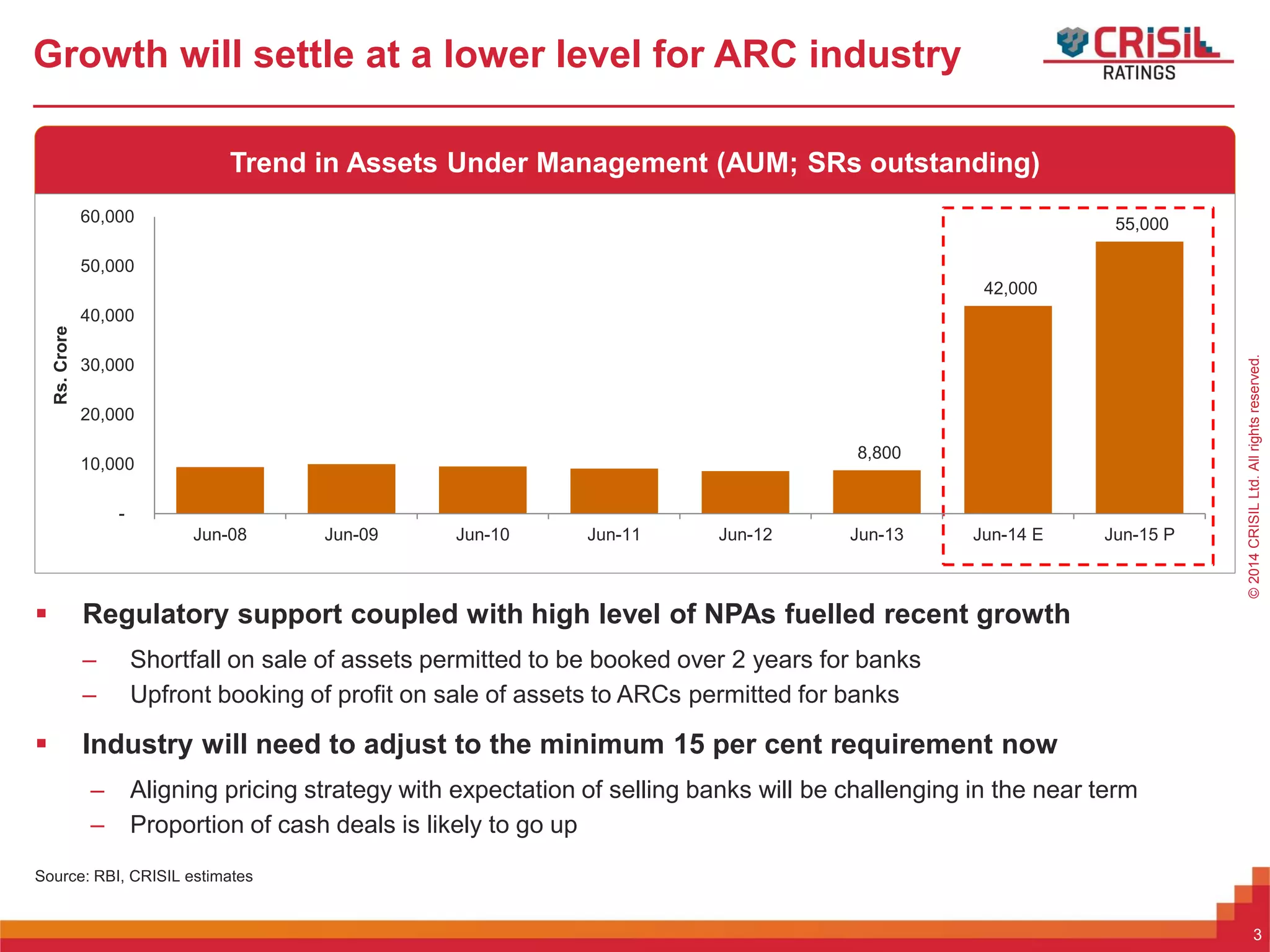

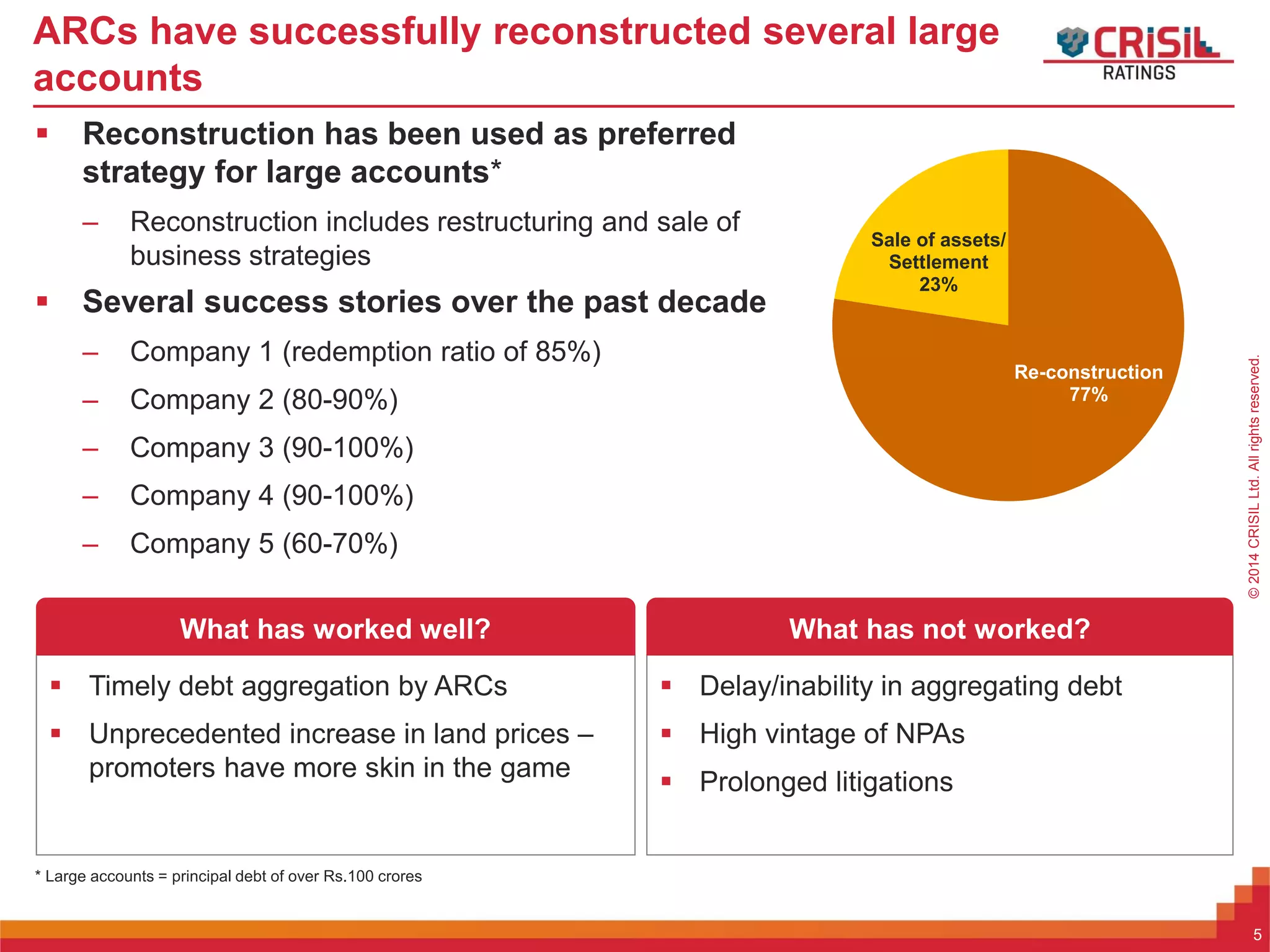

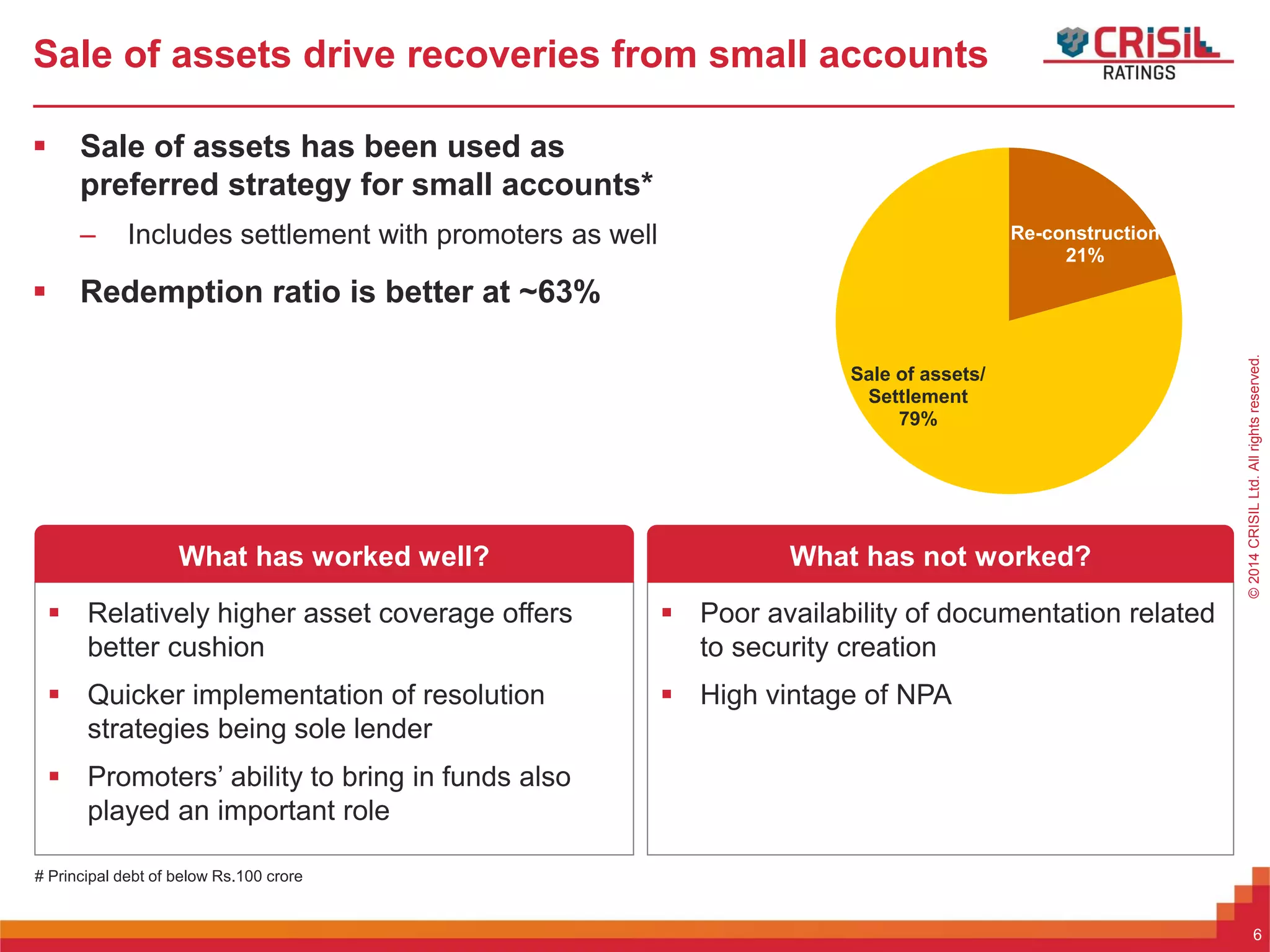

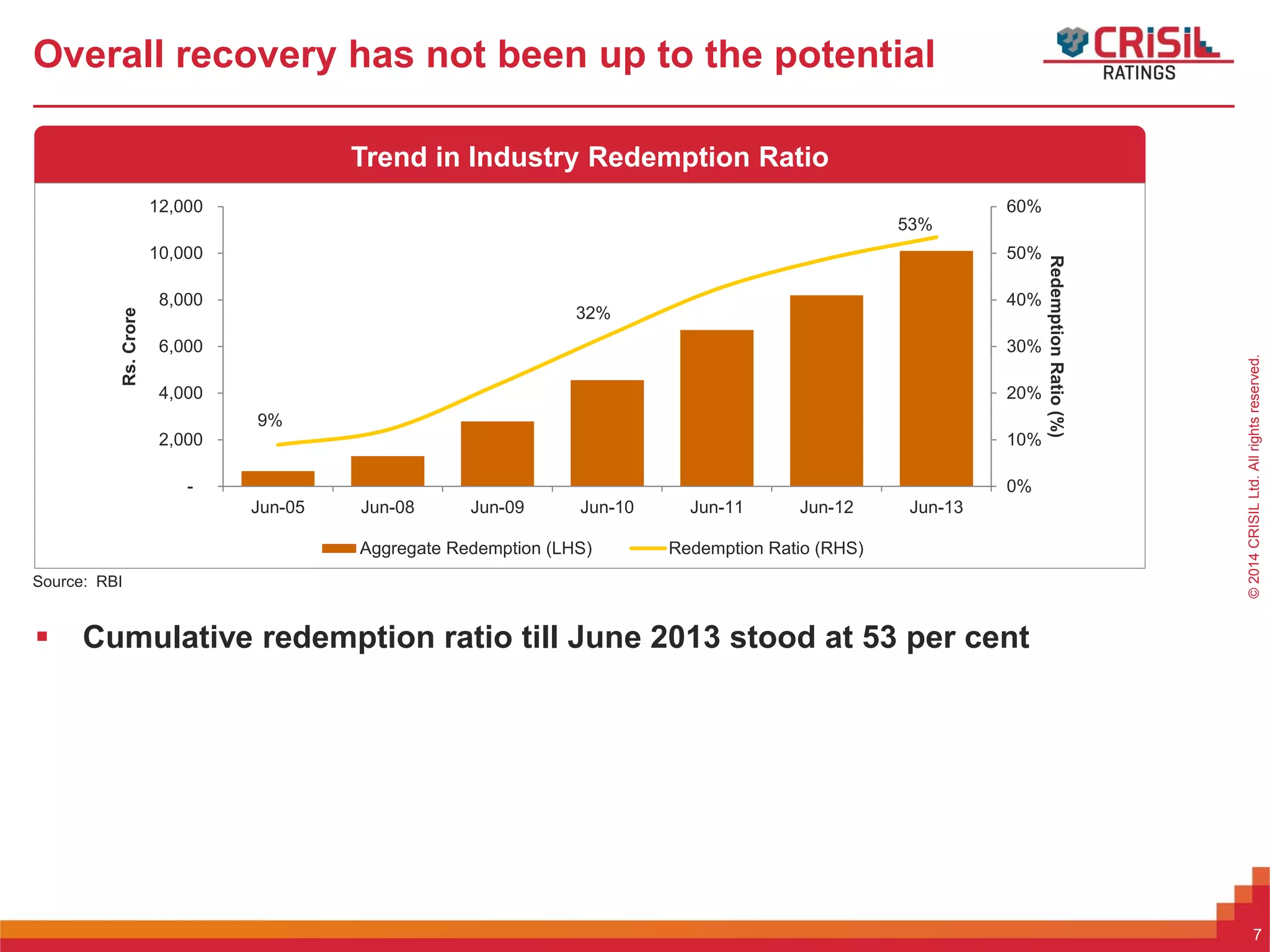

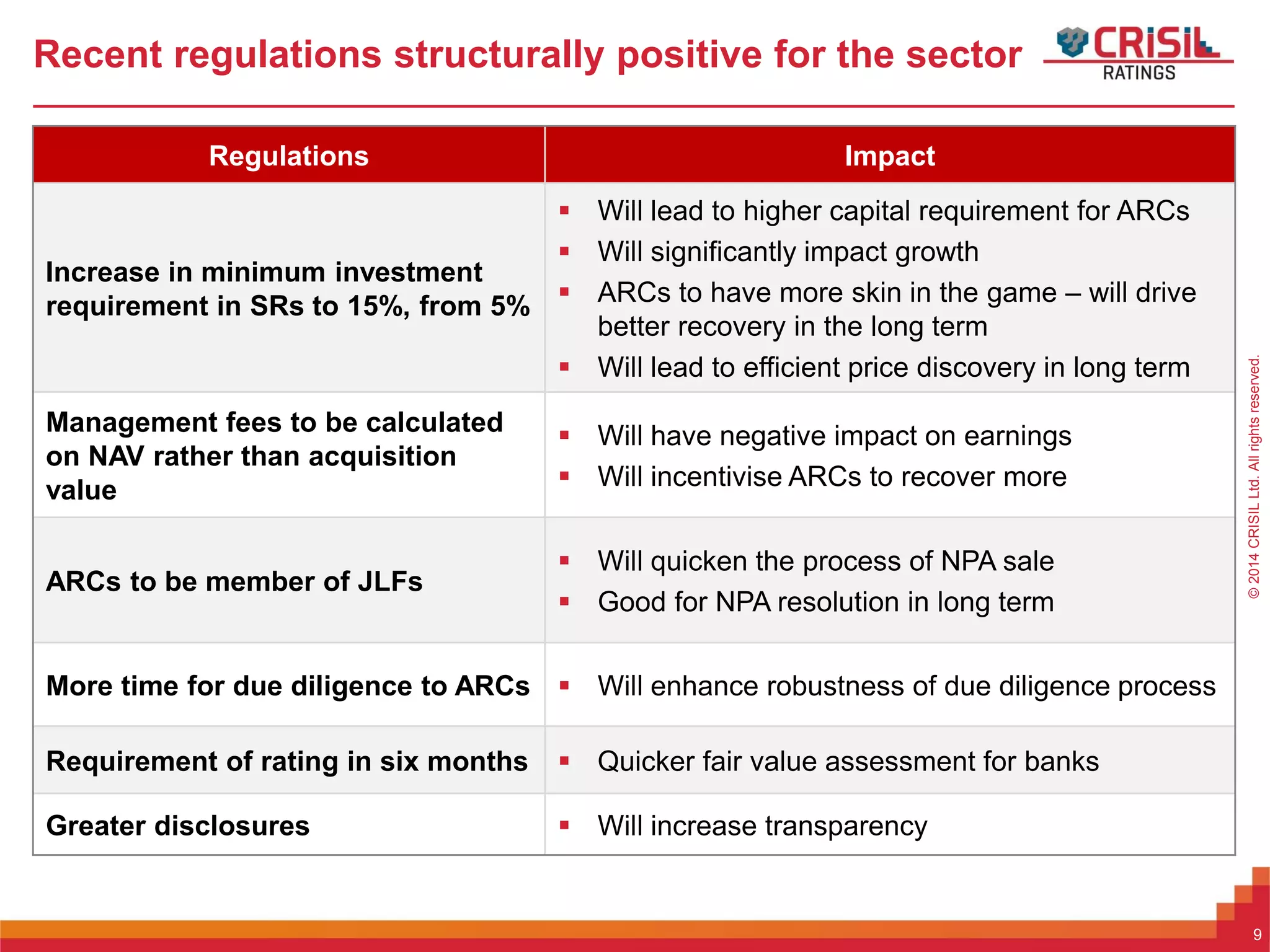

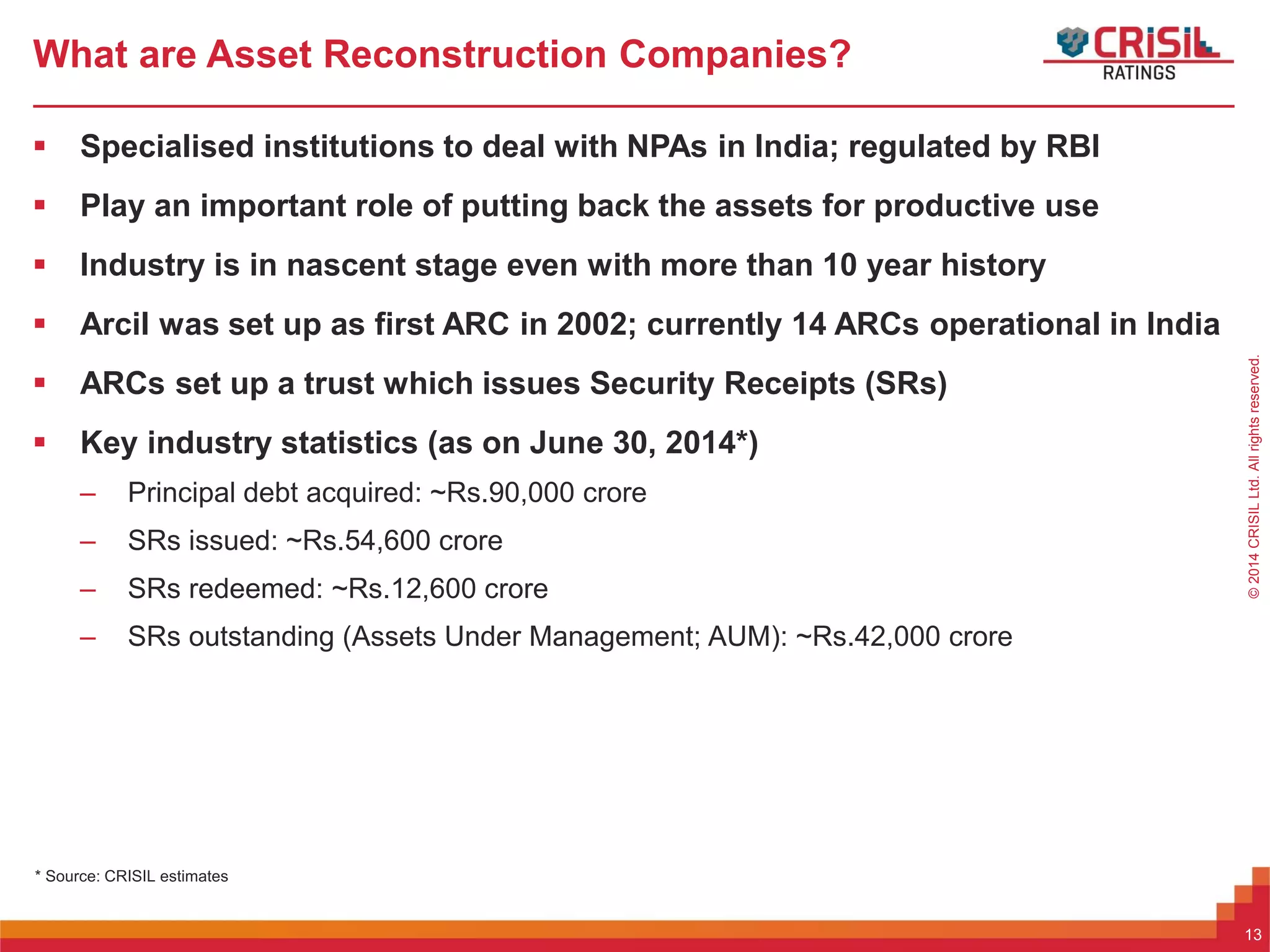

The document analyzes the asset reconstruction companies (ARCs) industry in India, noting a projected moderation in growth due to new regulations while emphasizing improved price discovery and recovery prospects. Key challenges include increased capital requirements and pressure on earnings, alongside a critical need for effective asset resolution strategies. Recent regulatory changes are viewed as structurally beneficial for the sector, aiming for better recovery outcomes and more efficient processes in handling non-performing assets.