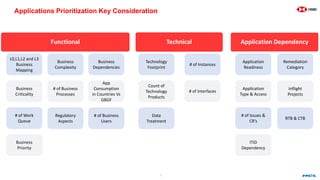

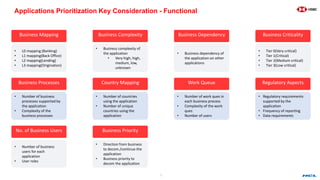

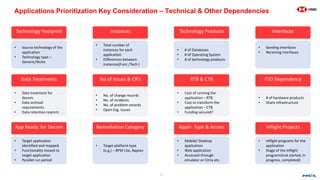

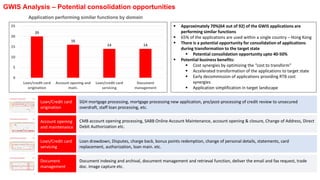

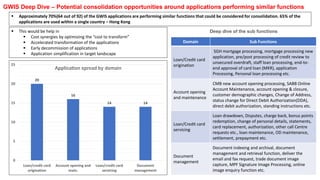

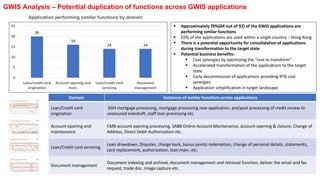

The document outlines a framework for prioritizing and planning the decommissioning of applications based on various criteria, including functional and technical dependencies, business criticality, and cost efficiency. It identifies different move groups and wave planning strategies to transition applications based on their complexity and interdependencies, aiming to optimize the transformation process. Additionally, the analysis highlights potential opportunities for application consolidation to achieve cost synergies and simplified management within the target landscape.