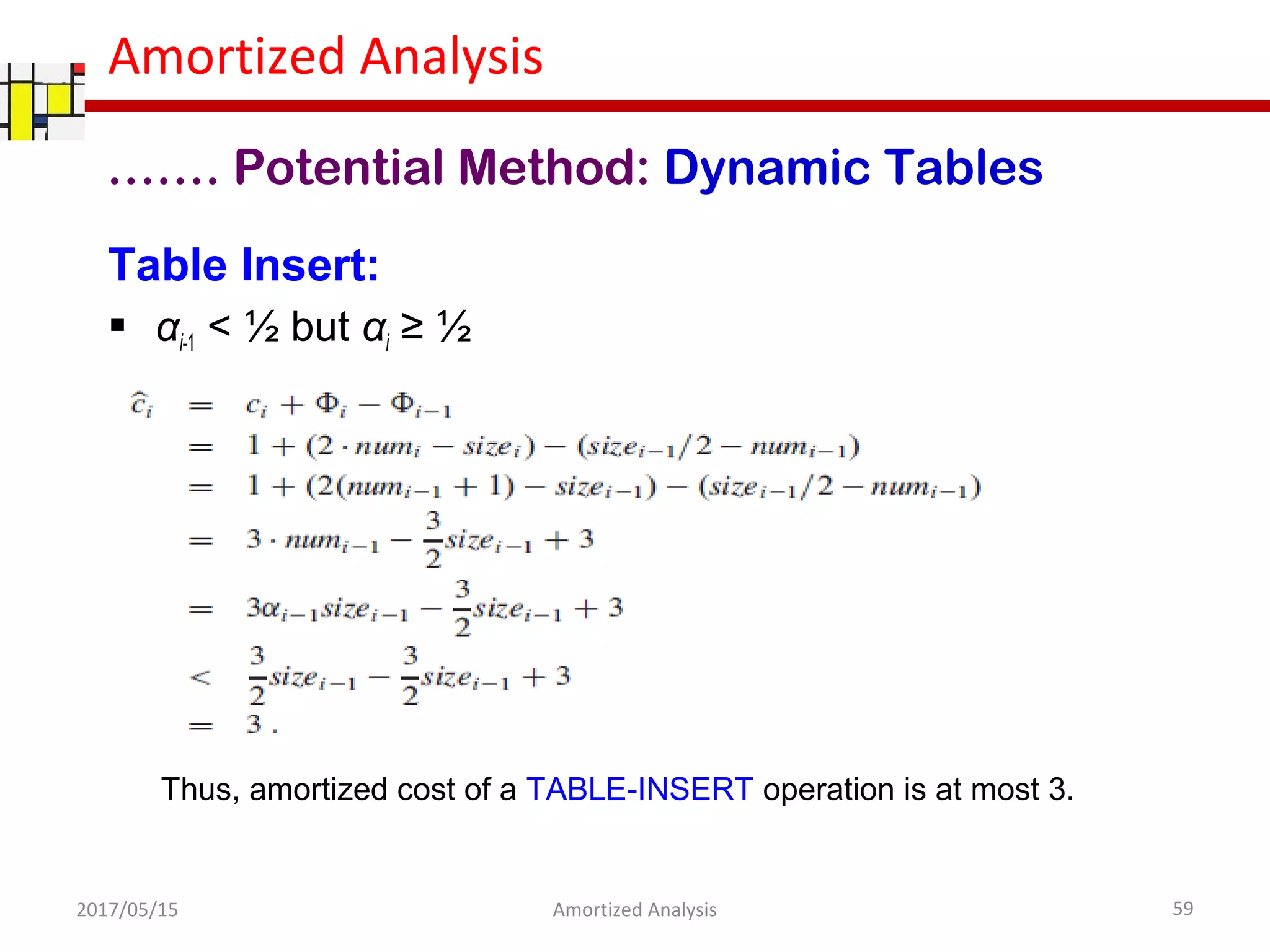

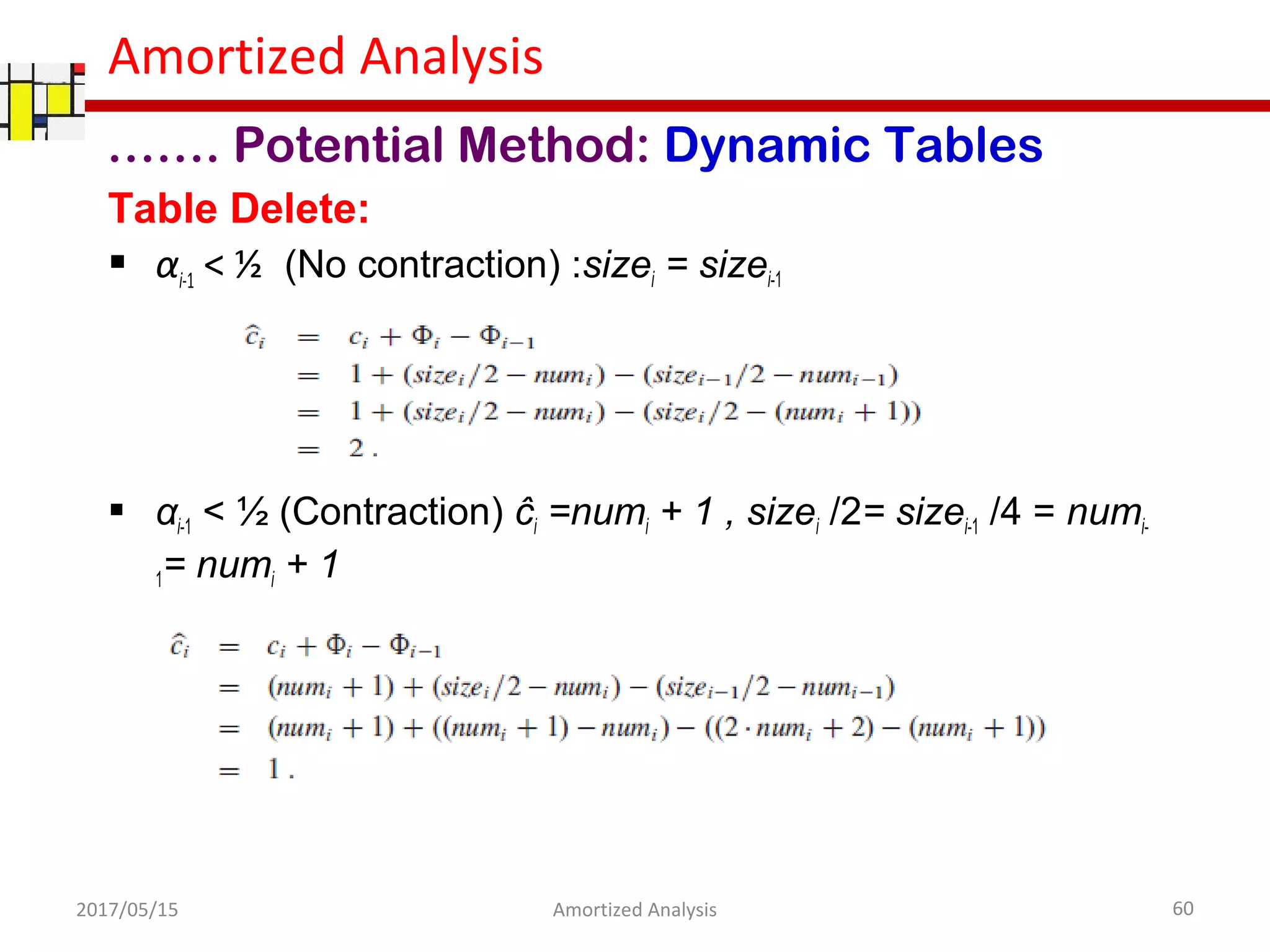

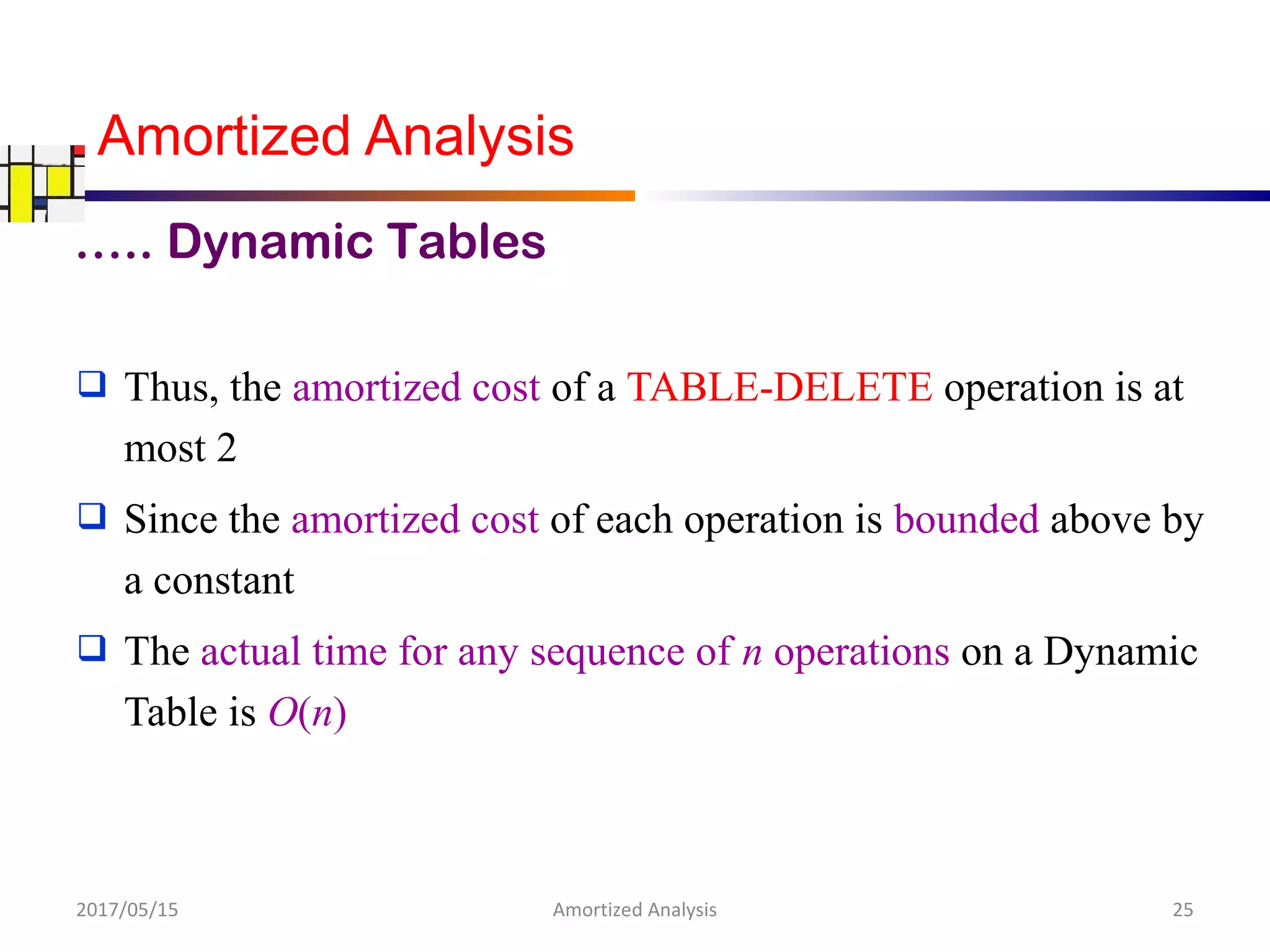

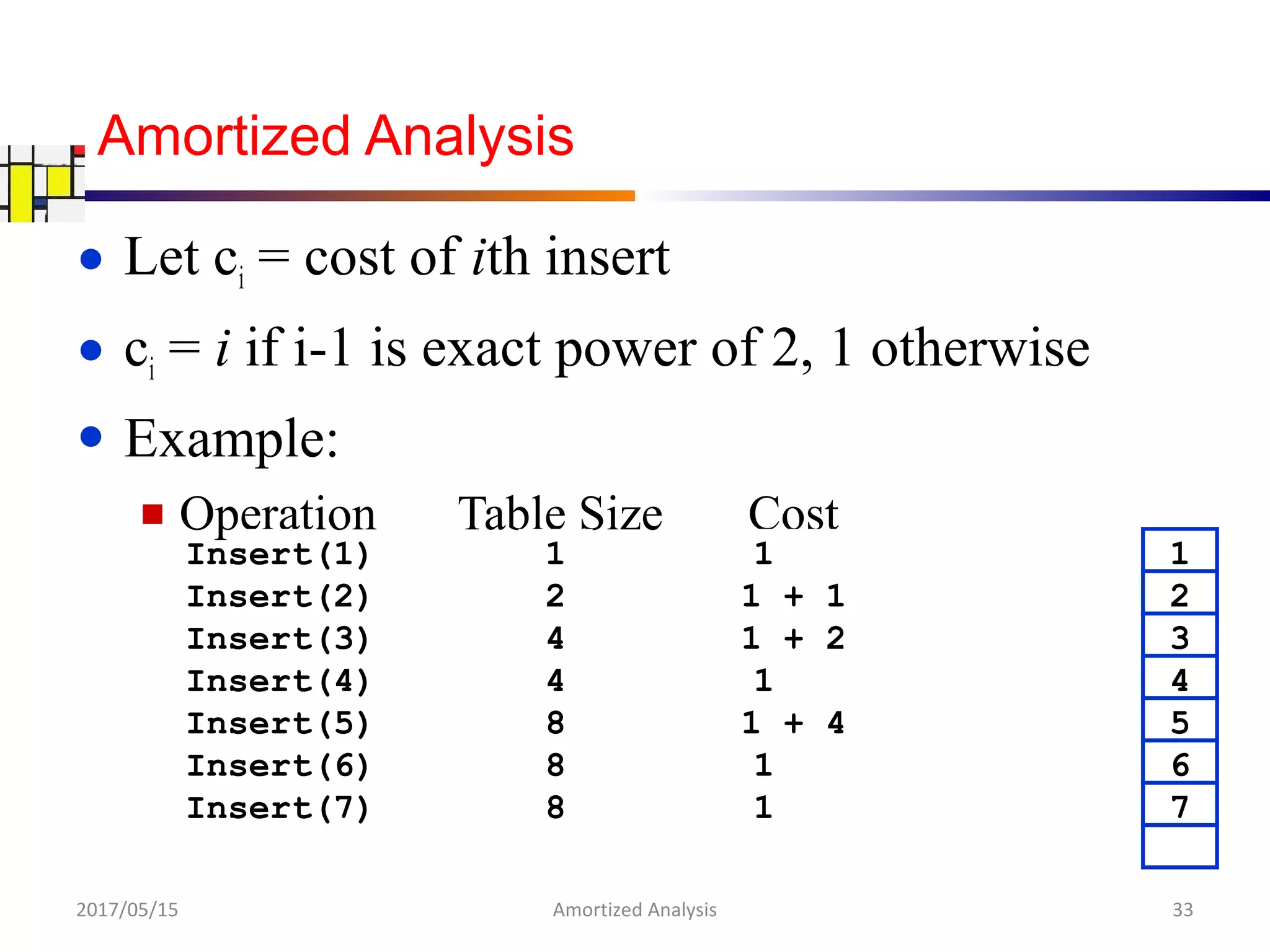

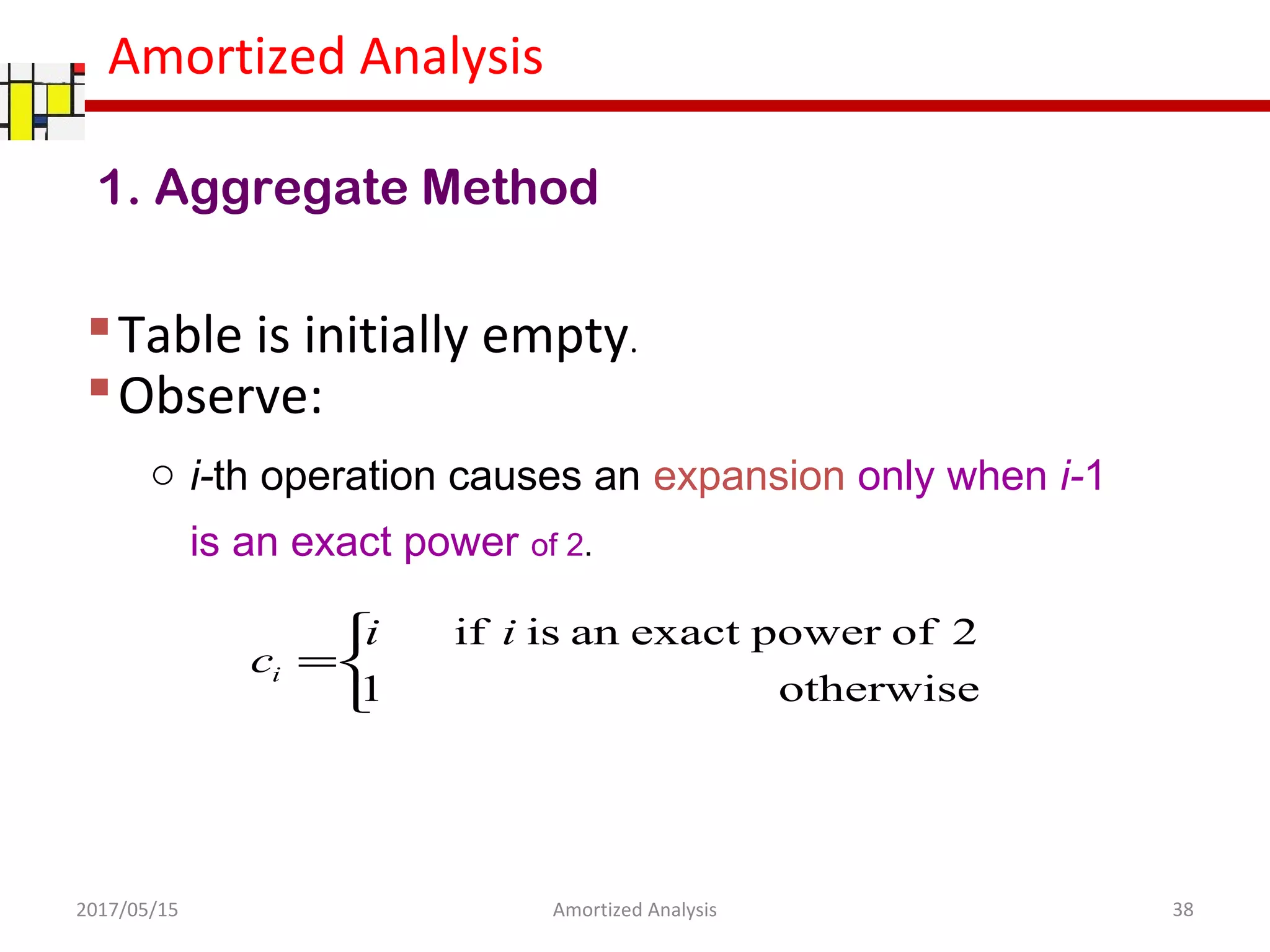

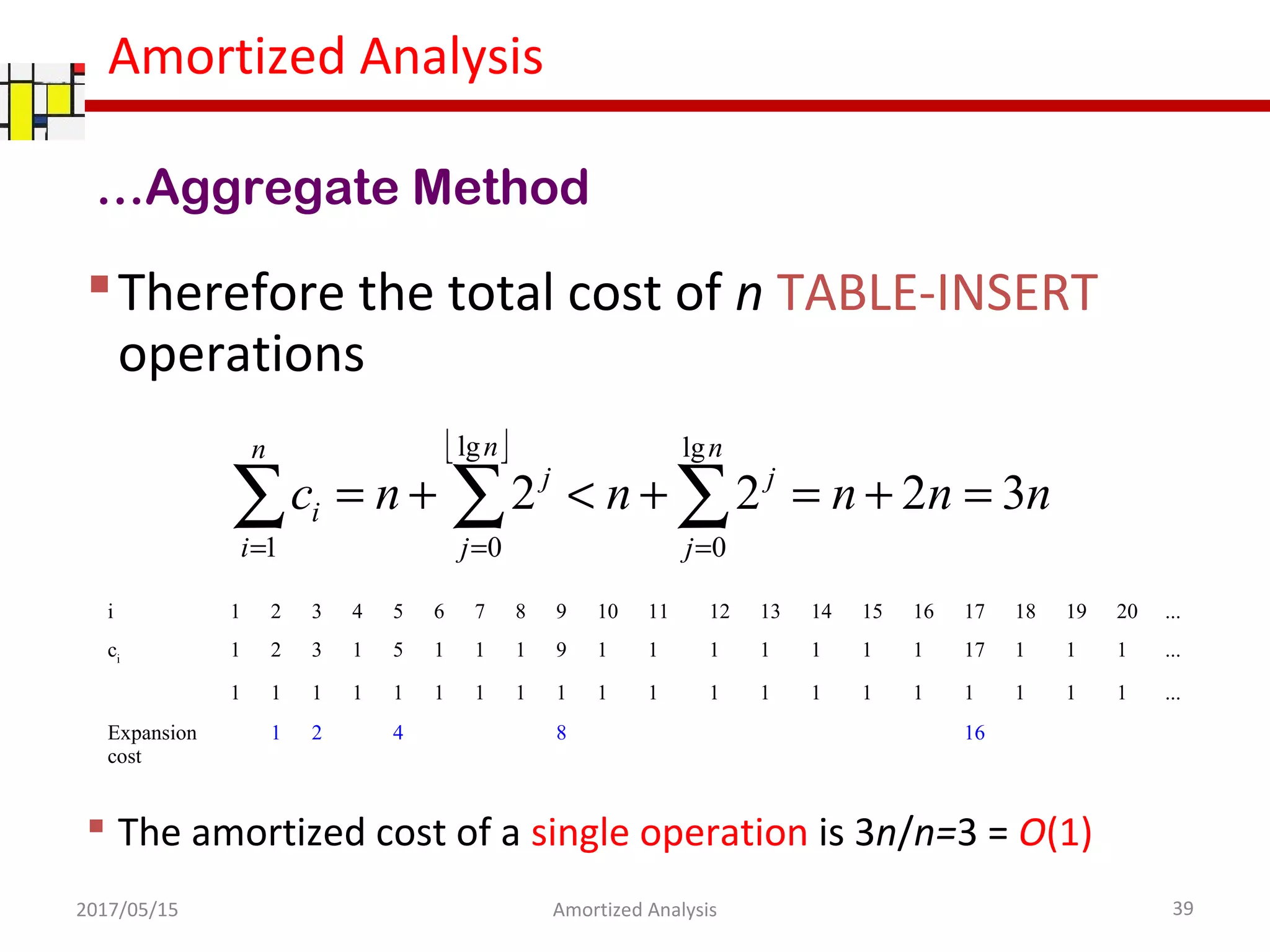

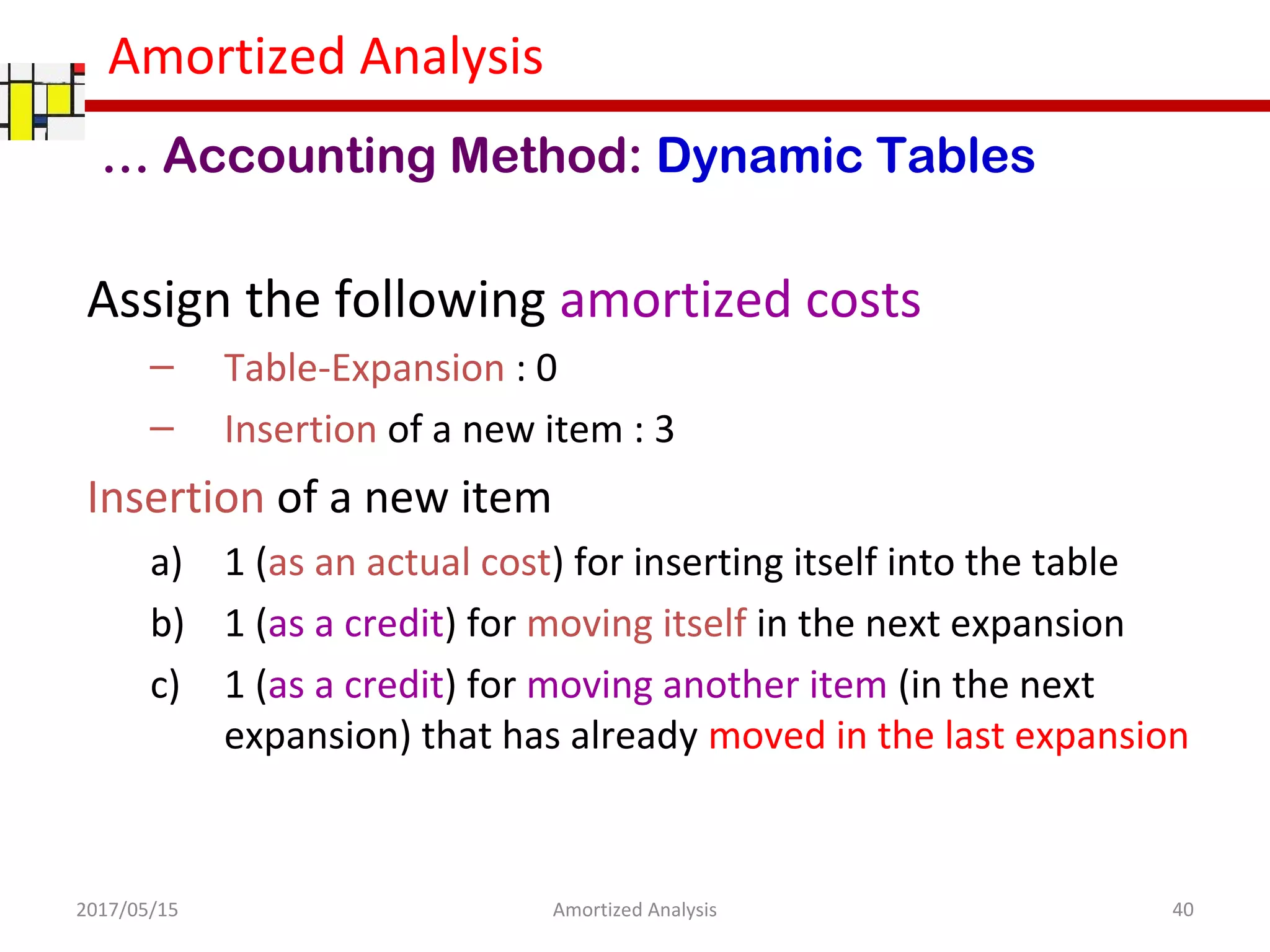

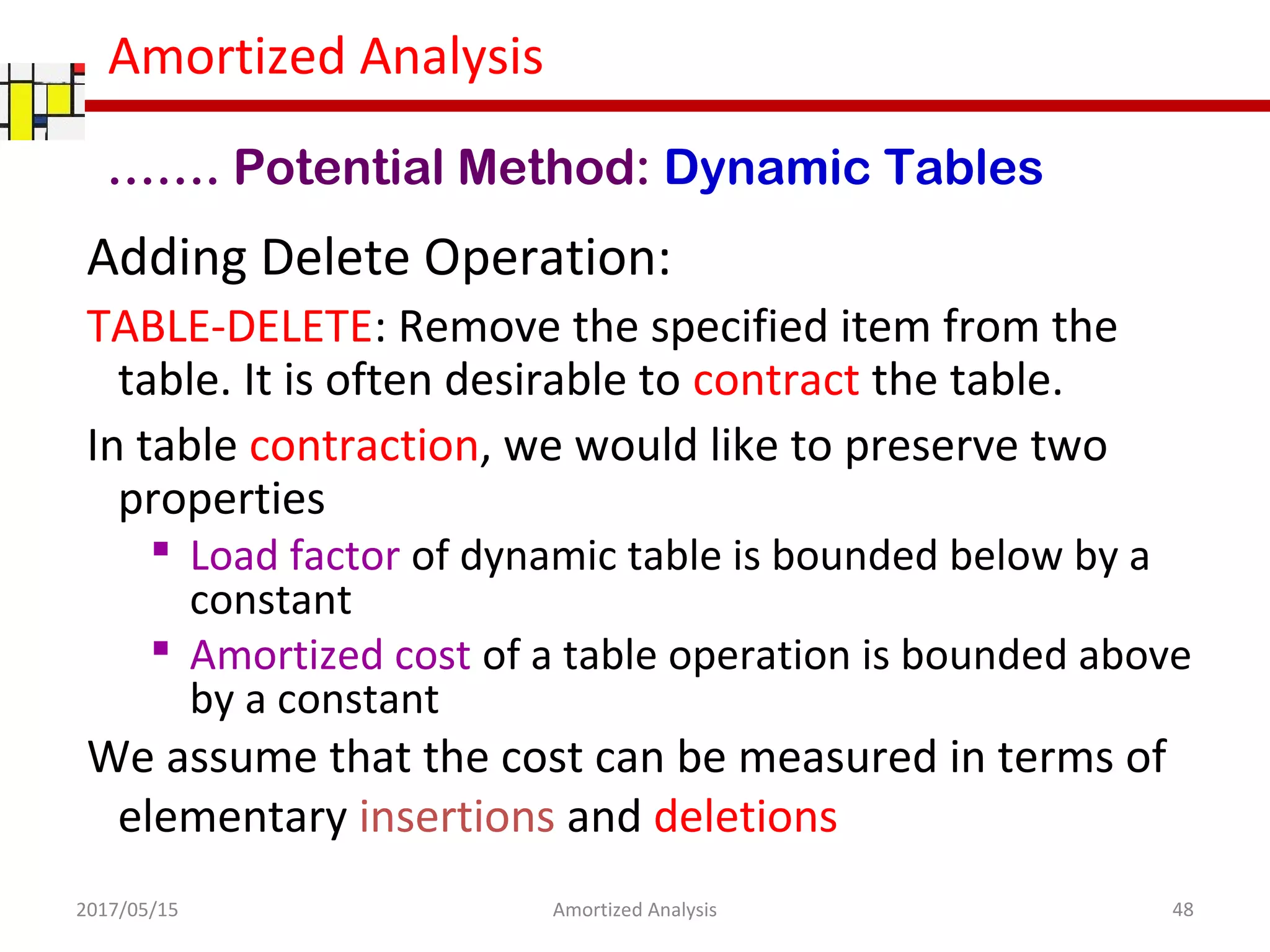

The document discusses amortized analysis, which averages the time required to perform a sequence of operations over all operations. It describes three methods of amortized analysis: aggregate analysis, accounting analysis, and potential analysis. As an example, it analyzes the amortized cost of operations on a dynamic table using these three methods and shows that the amortized cost of insertion and deletion is O(1), even though some operations may have higher actual costs when triggering expansions or contractions of the table.

![Amortized Analysis

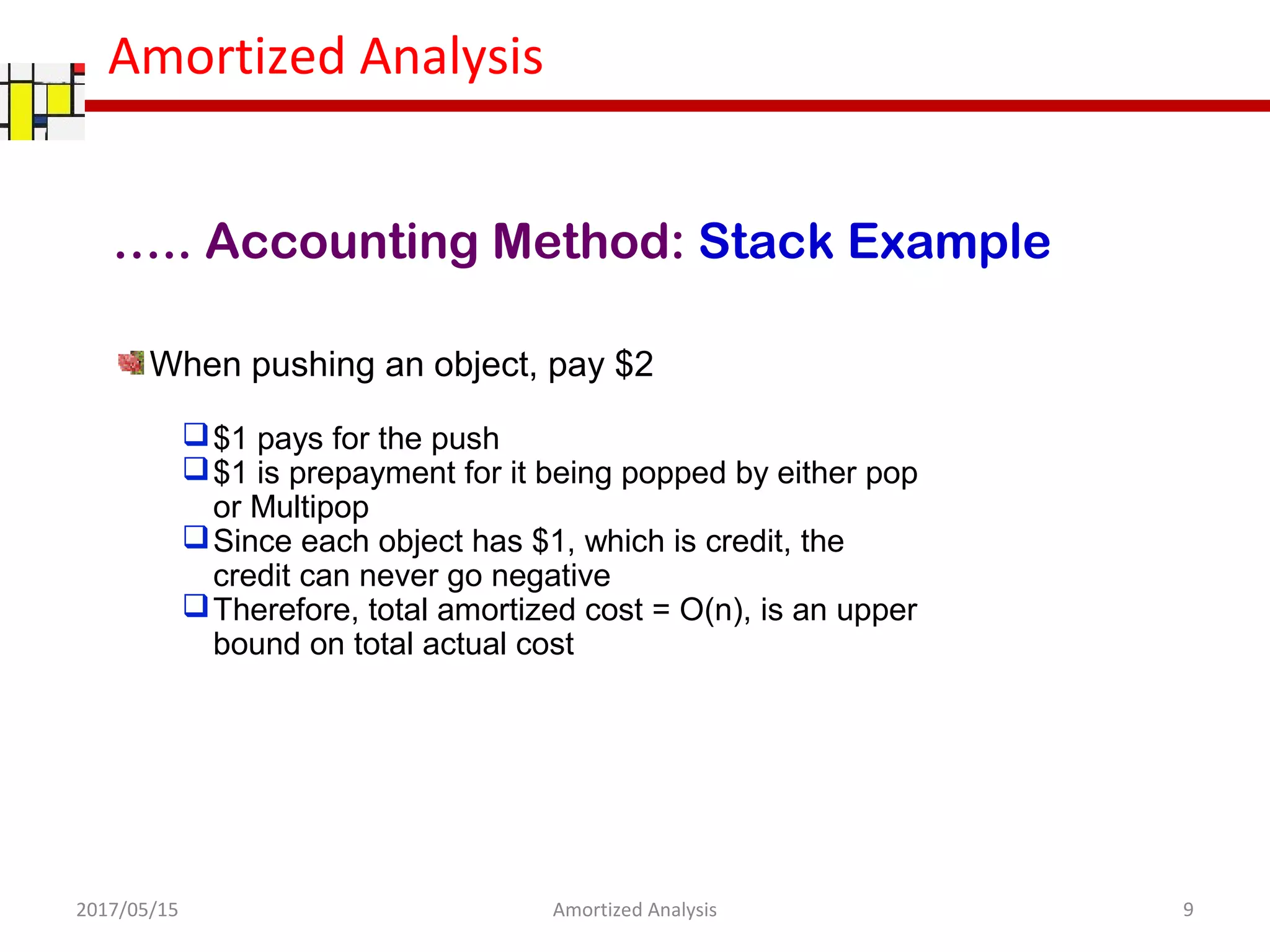

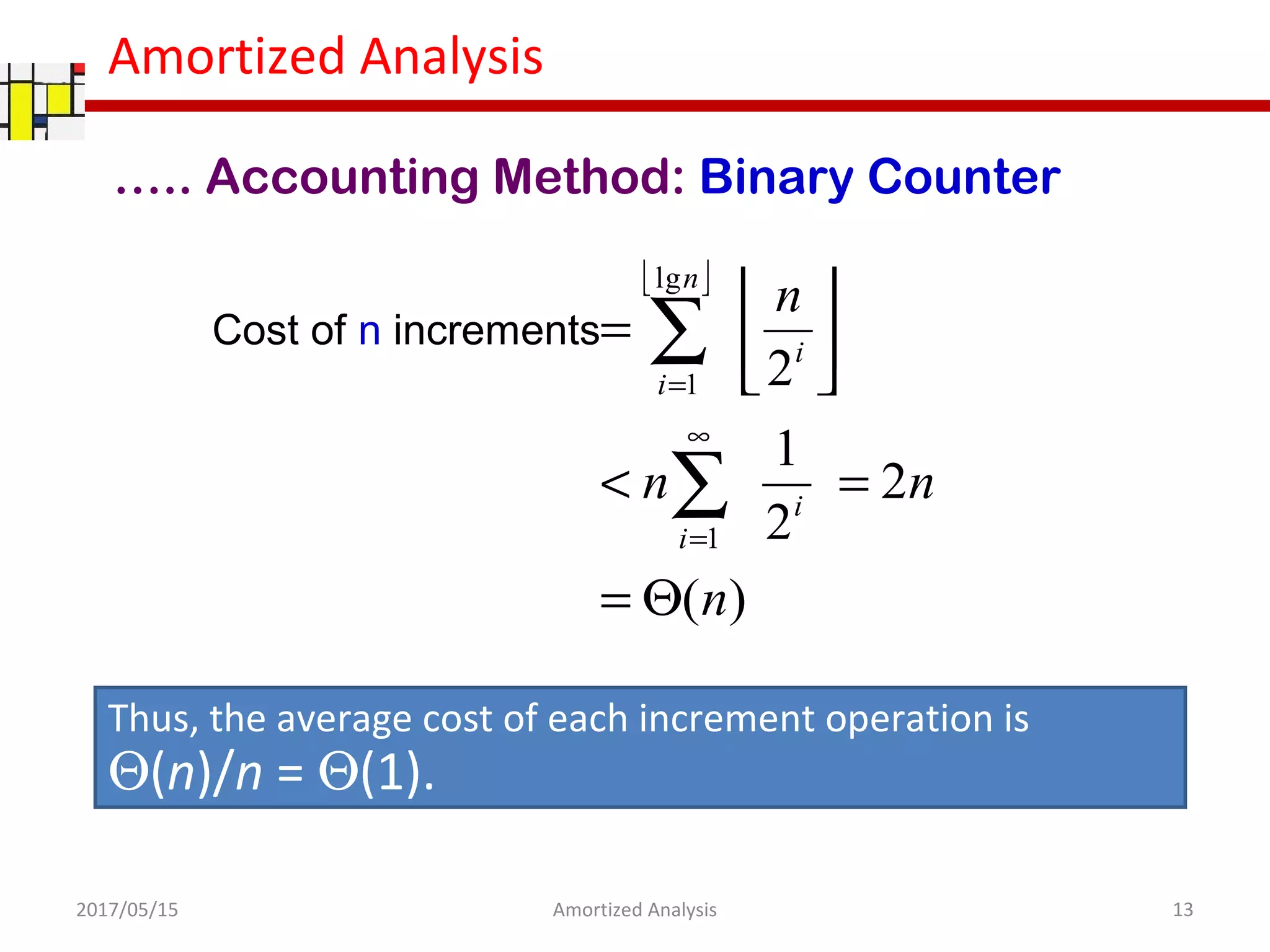

….. Accounting Method: Binary Counter

k-bit Binary Counter: A[0..k−1]

INCREMENT(A)

1. i ← 0

2. while i < length[A] and A[i] = 1

3. do A[i] ← 0 ⊳ reset a bit

4. i ← i + 1

5. if i < length[A]

6. then A[i] ← 1 ⊳ set a bit

∑ ⋅= −

=

1

0 2][k

i

i

iAx

Introduction

2017/05/15 10Amortized Analysis](https://image.slidesharecdn.com/aoaamortizedanalysis-170604074340/75/Aoa-amortized-analysis-10-2048.jpg)

![Amortized Analysis

Ctr A[4] A[3] A[2] A[1] A[0] Cost

0 0 0 0 0 0 0

1 0 0 0 0 1 1

2 0 0 0 1 0 3

3 0 0 0 1 1 4

4 0 0 1 0 0 7

5 0 0 1 0 1 8

6 0 0 1 1 0 10

7 0 0 1 1 1 11

8 0 1 0 0 0 15

9 0 1 0 0 1 16

10 0 1 0 1 0 18

11 0 1 0 1 1 19

A[0] flipped every op n

A[1] flipped every 2 ops n/2

A[2] flipped every 4 ops n/22

A[3] flipped every 8 ops n/23

… … … … …

A[i] flipped every 2i

ops n/2i

Total cost of n operations

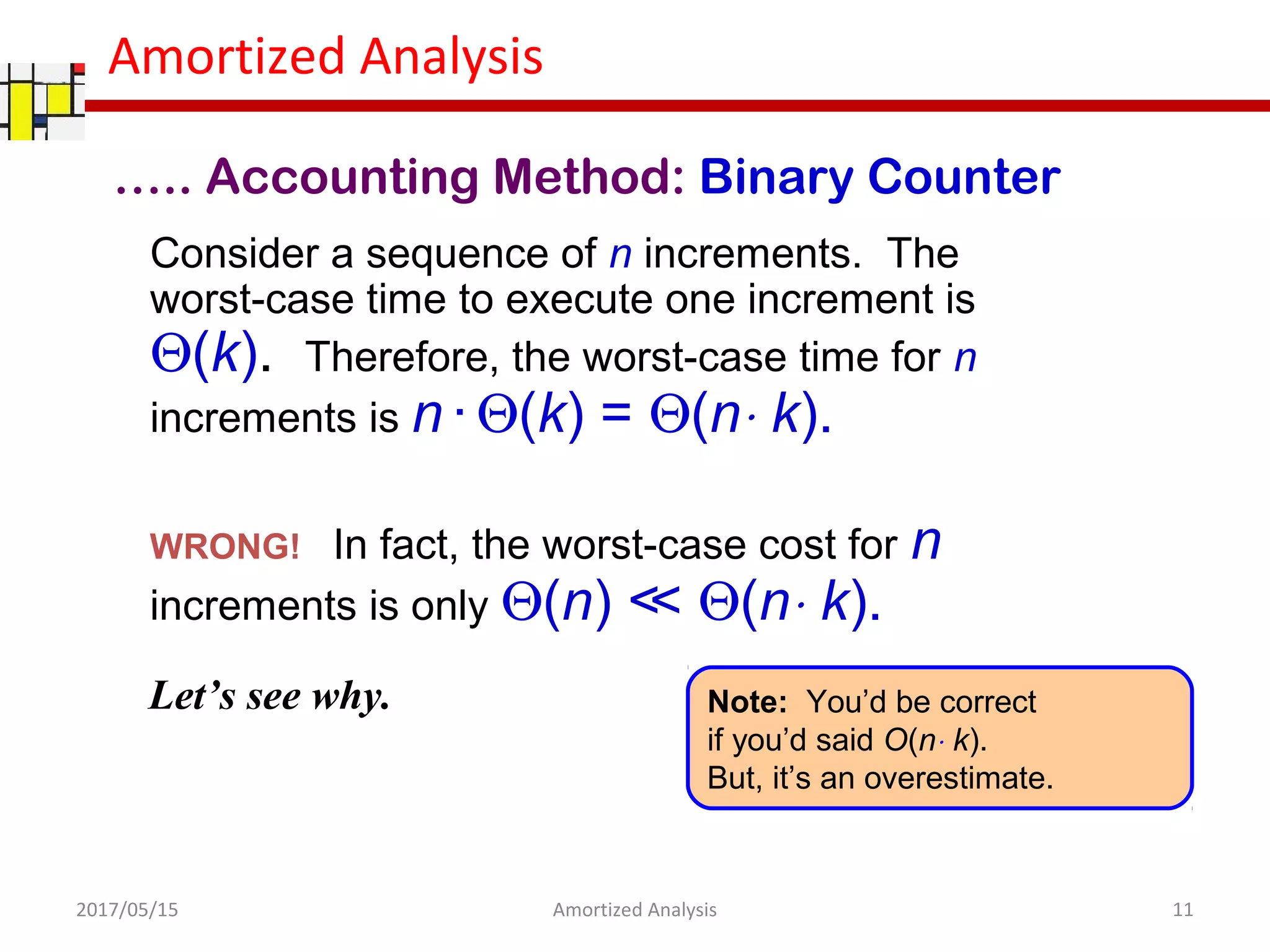

….. Accounting Method: Binary Counter

2017/05/15 12Amortized Analysis](https://image.slidesharecdn.com/aoaamortizedanalysis-170604074340/75/Aoa-amortized-analysis-12-2048.jpg)

![Amortized Analysis

When Incrementing,

Amortized cost for line 3 = $0

Amortized cost for line 6 = $2

Amortized cost for INCREMENT(A) = $2

Amortized cost for n INCREMENT(A) = $2n =O(n)

INCREMENT(A)

1. i ← 0

2. while i < length[A] and A[i] = 1

3. do A[i] ← 0 ⊳ reset a bit

4. i ← i + 1

5. if i < length[A]

6. then A[i] ← 1 ⊳ set a bit

….. Accounting Method: Binary Counter

2017/05/15 15Amortized Analysis](https://image.slidesharecdn.com/aoaamortizedanalysis-170604074340/75/Aoa-amortized-analysis-15-2048.jpg)

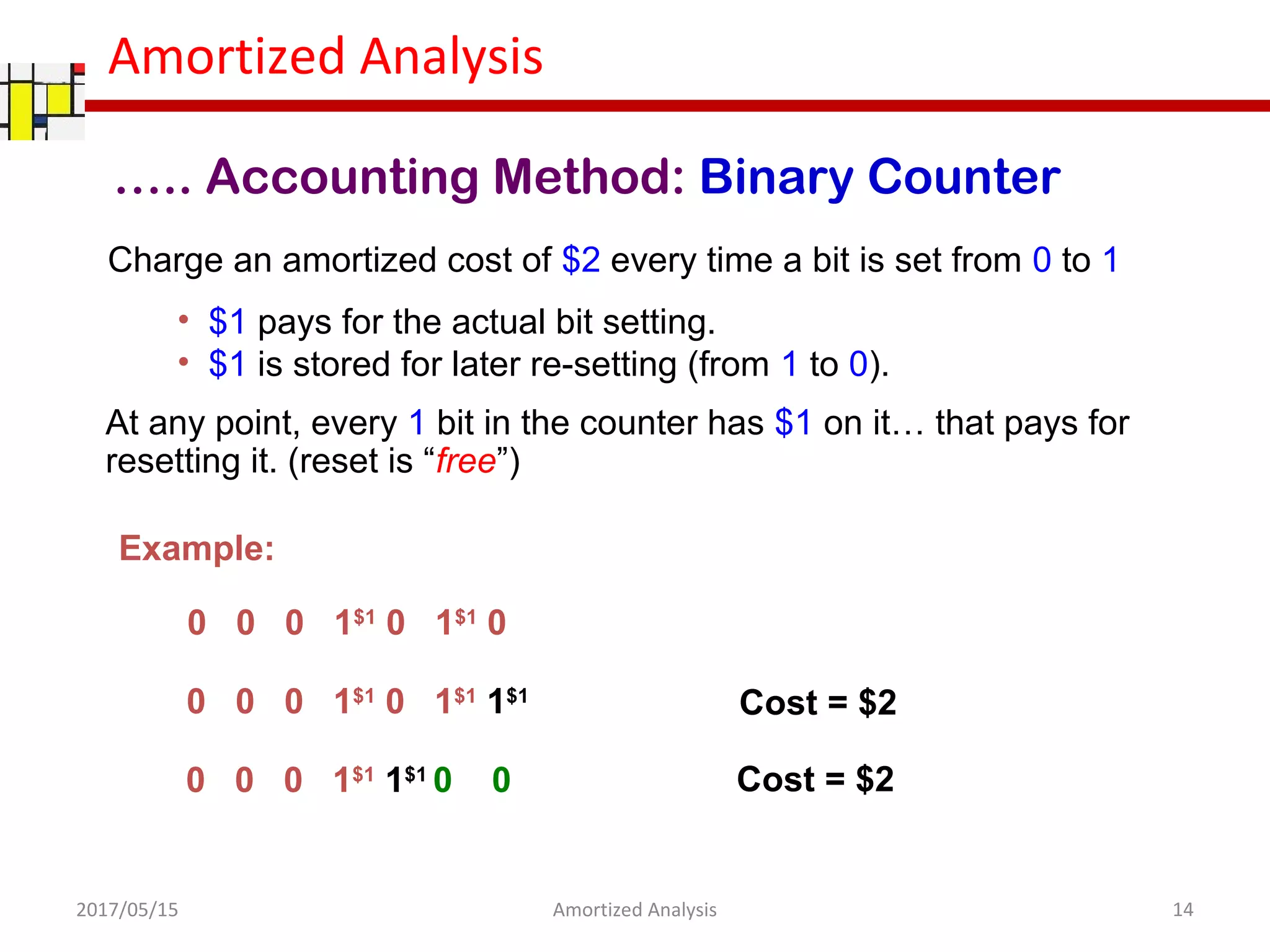

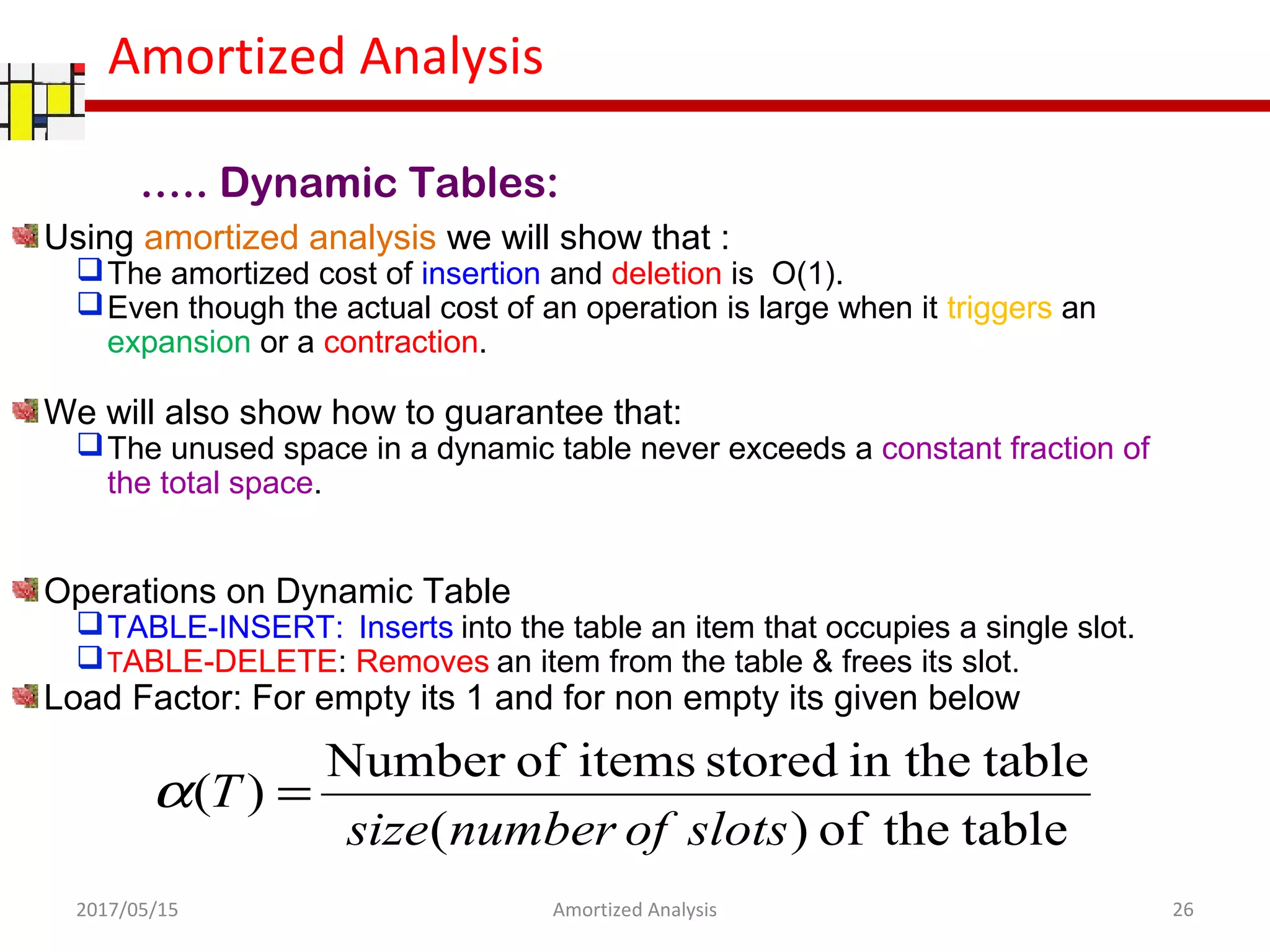

![Amortized Analysis

Table Insert:

….. Insertion-Only Dynamic Tables:

2017/05/15 28Amortized Analysis

1 / 2 ≤ α(T) ≤ 1

TABLE-INSERT (T, x)

1. if size[T] = 0 then

2. allocate table[T] with 1 slot

3. size[T] ← 1

4. if num[T] = size[T] then

5. allocate new-table with 2.size[T] slots

6. copy all items in table[T] into new-table

7. free table[T]

8. table[T] ← new-table[T]

9. size[T] ← 2.size[T]

10. insert x into table[T]

11. num[T] ← num[T] + 1

12. end

table[T] : pointer to block

of table storage

num[T] : number of

items in the table

size[T] : total number of

slots in the table

Initially, table is empty,

so num[T] = size[T] = 0](https://image.slidesharecdn.com/aoaamortizedanalysis-170604074340/75/Aoa-amortized-analysis-28-2048.jpg)

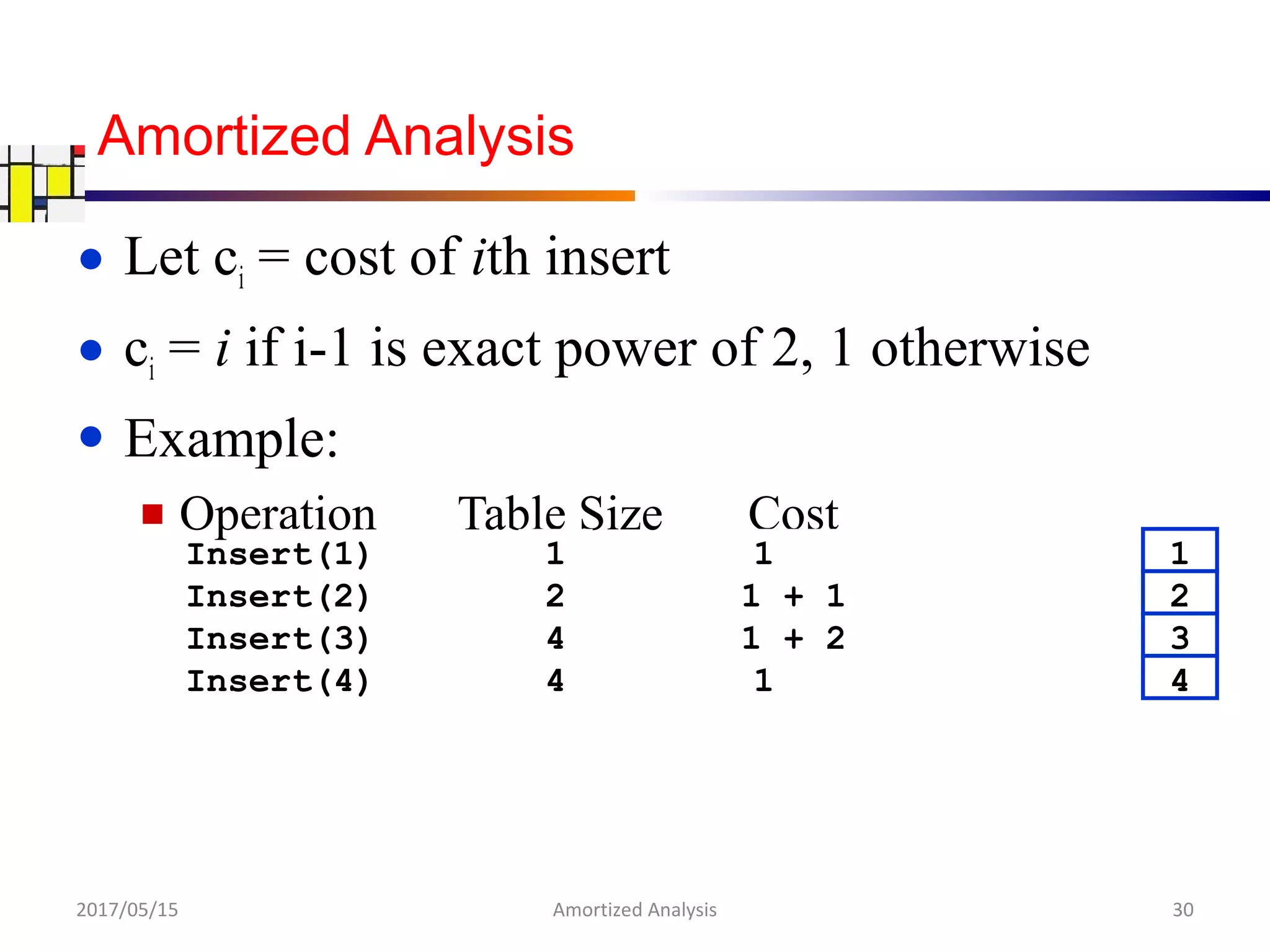

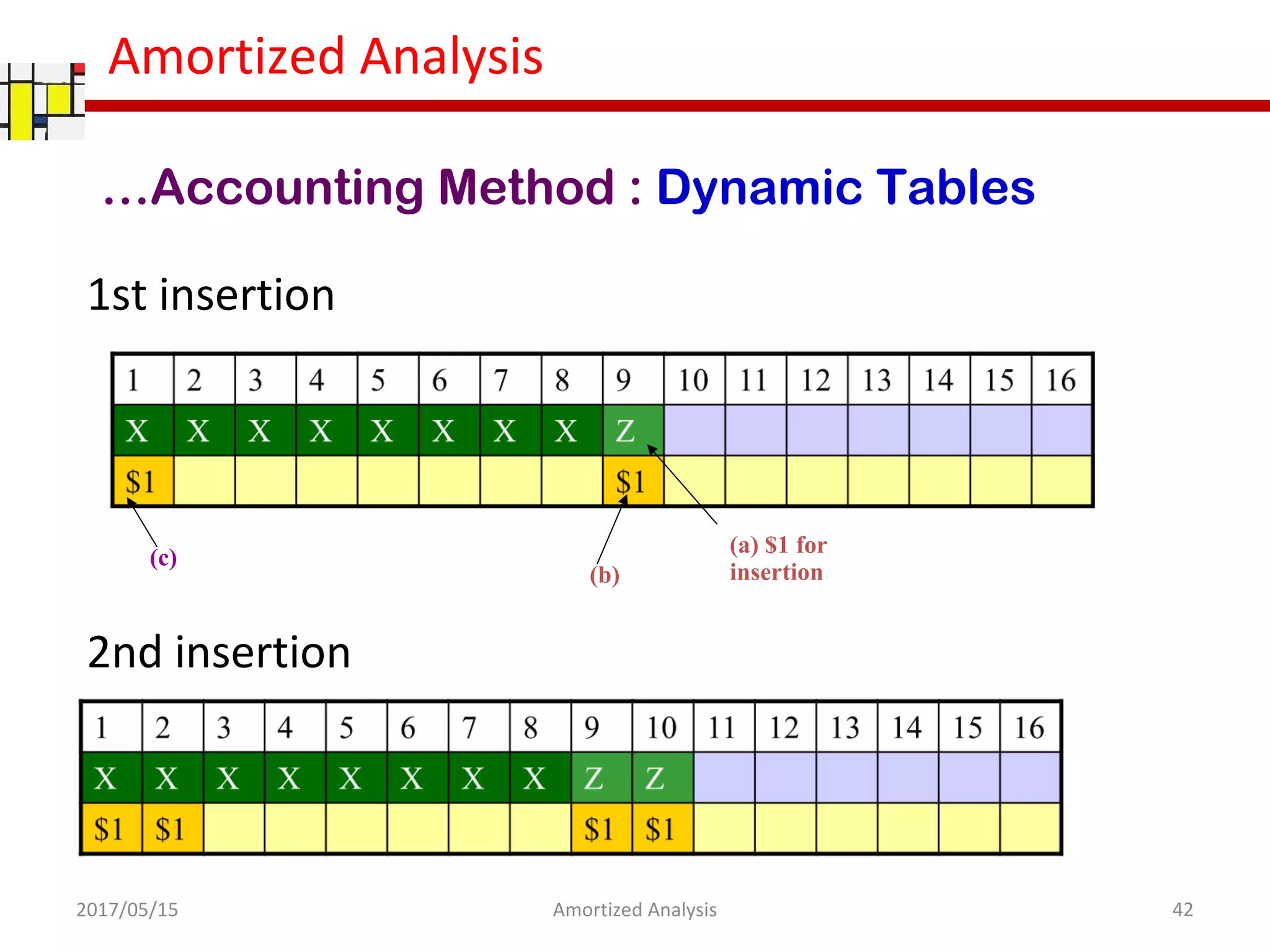

![Amortized Analysis

Size of the table: M

Immediately after an expansion (just before the insertion)

num[T] = M/2 and size[T] = M where M is a power of 2.

Table contains no credits

2017/05/15 41Amortized Analysis

…Accounting Method : Dynamic Tables](https://image.slidesharecdn.com/aoaamortizedanalysis-170604074340/75/Aoa-amortized-analysis-41-2048.jpg)

![Amortized Analysis

Define a potential function Φ that is

– 0 immediately after an expansion

– builds to the table size by the time table becomes full

Next expansion can be paid for by the potential.

One possible Φ is:

Φ(T) = 2*num[T] –size[T]

Immediately after an expansion

size[T] = 2*num[T] ⇒ Φ(T) = 0

Immediately before an expansion

size[T] = num[T] ⇒ Φ(T) = num[T]

The initial value for the potential is 0

2017/05/15 44Amortized Analysis

……. Potential Method: Dynamic Tables](https://image.slidesharecdn.com/aoaamortizedanalysis-170604074340/75/Aoa-amortized-analysis-44-2048.jpg)

![Amortized Analysis

Definition of Φ:

Since the table is at least half full

(i.e. num[T] ≥ size[T] / 2)

Φ(T) is always nonnegative.

Thus, the sum of the amortized cost of n TABLE-INSERT

operations is an upper bound on the sum of the actual

costs.

2017/05/15 45Amortized Analysis

……. Potential Method: Dynamic Tables](https://image.slidesharecdn.com/aoaamortizedanalysis-170604074340/75/Aoa-amortized-analysis-45-2048.jpg)

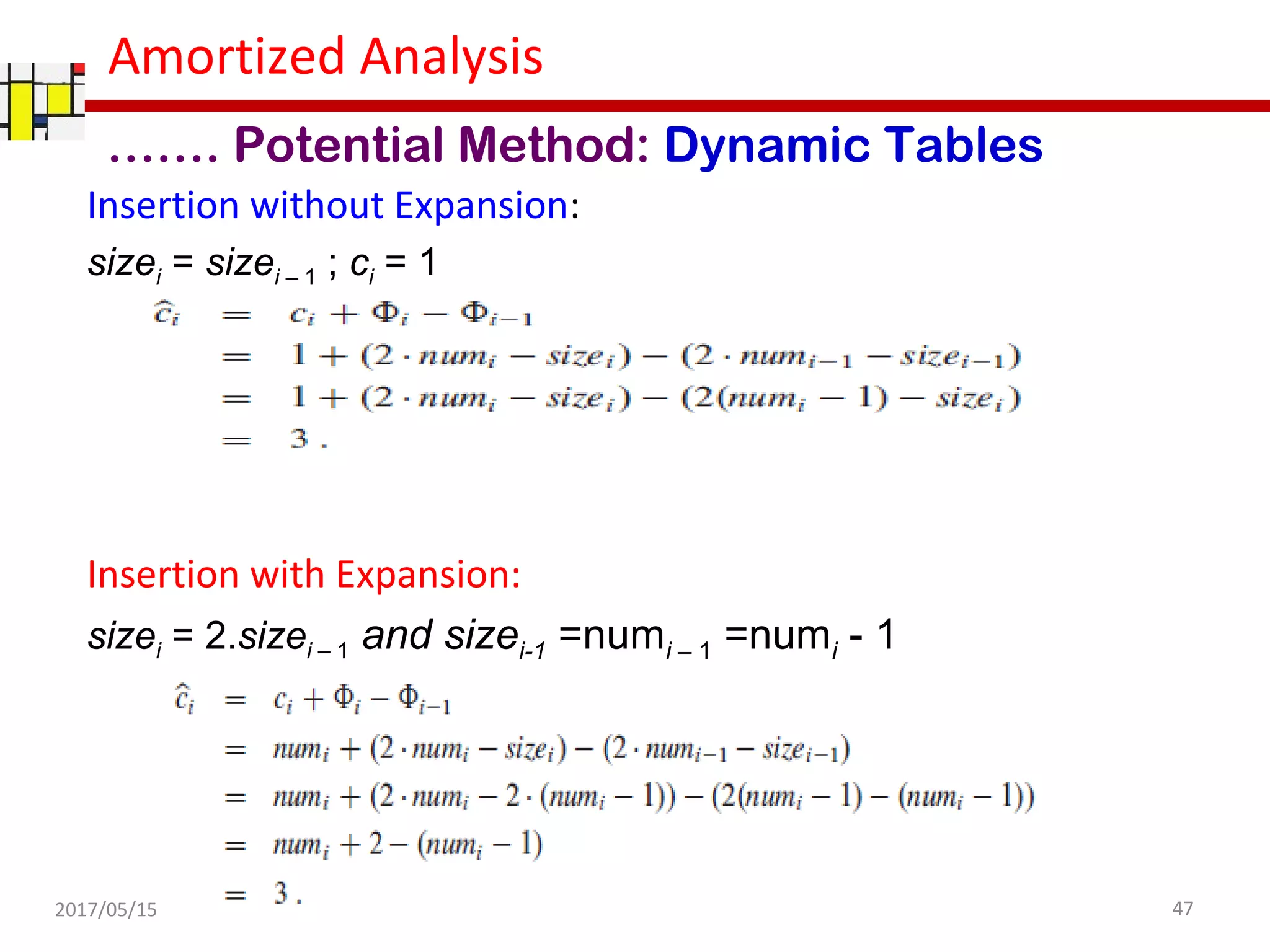

![Amortized Analysis

Analysis of i-th Table Insert:

numi : num[T] after the i-th operation

sizei : size[T] after the i-th operation

Φi : Potential after the i-th operation

Initially we have numi = sizei = Φi = 0

Note that, numi = numi-1 +1 always hold.

2017/05/15 46Amortized Analysis

……. Potential Method: Dynamic Tables](https://image.slidesharecdn.com/aoaamortizedanalysis-170604074340/75/Aoa-amortized-analysis-46-2048.jpg)

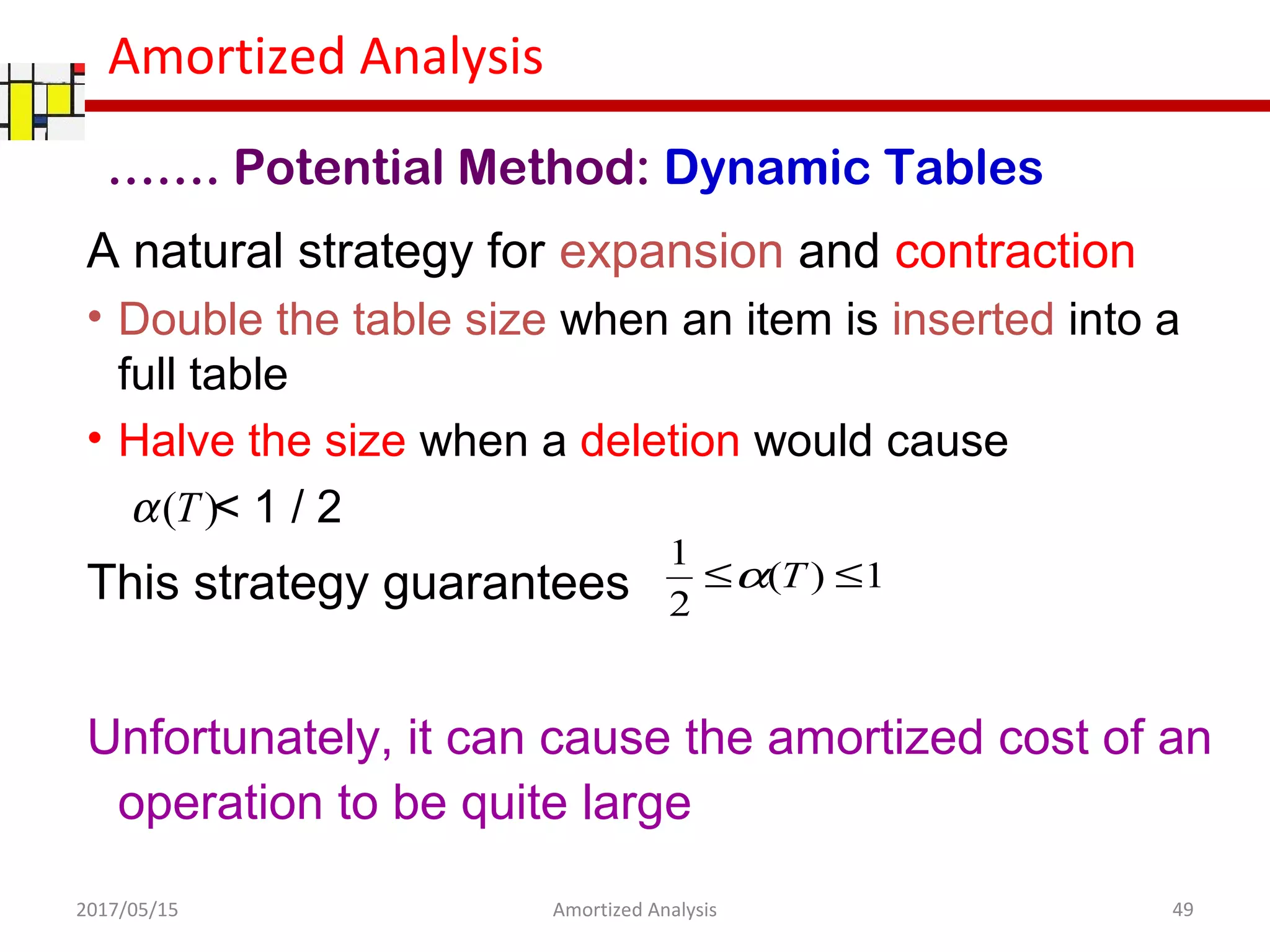

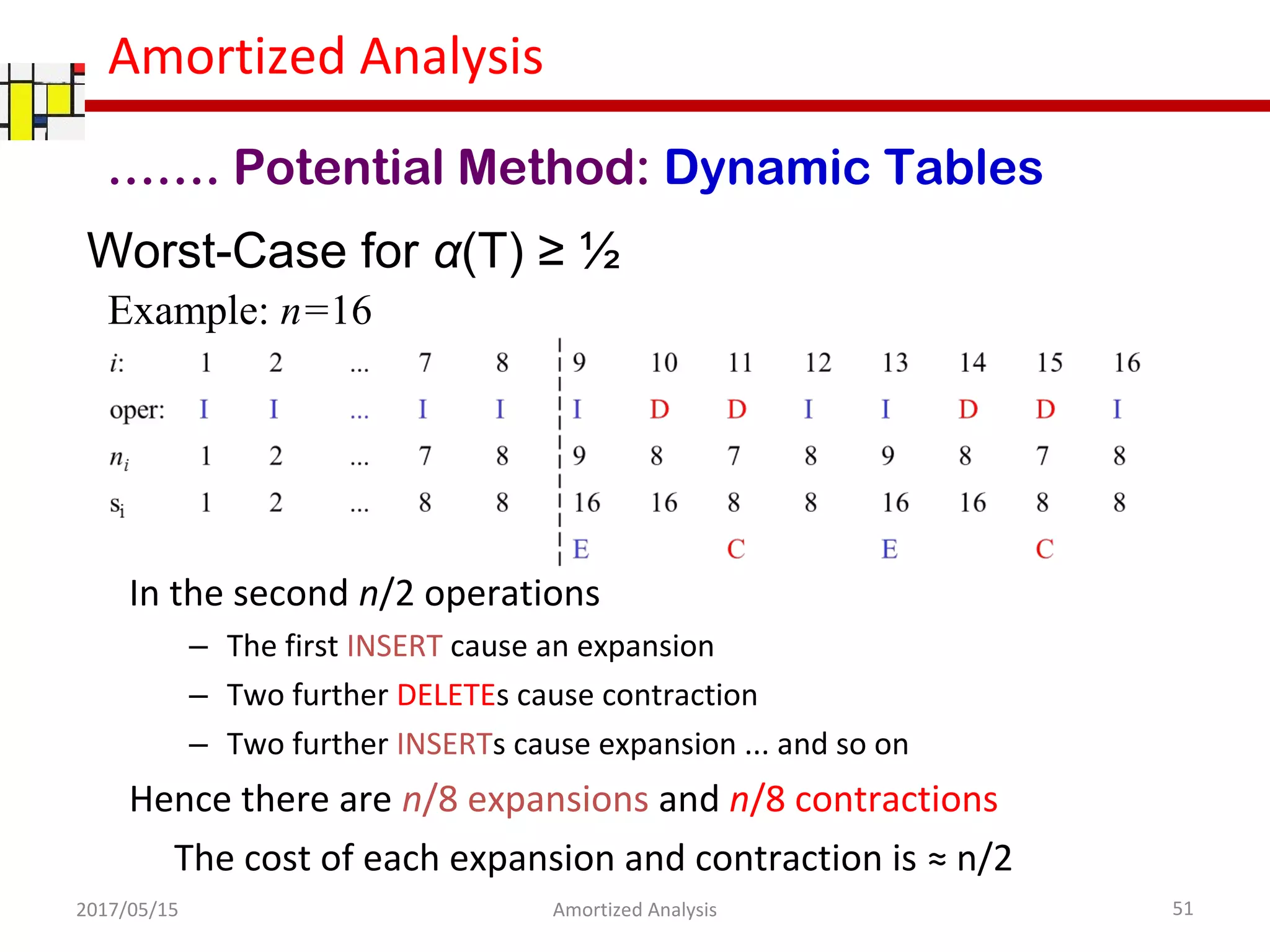

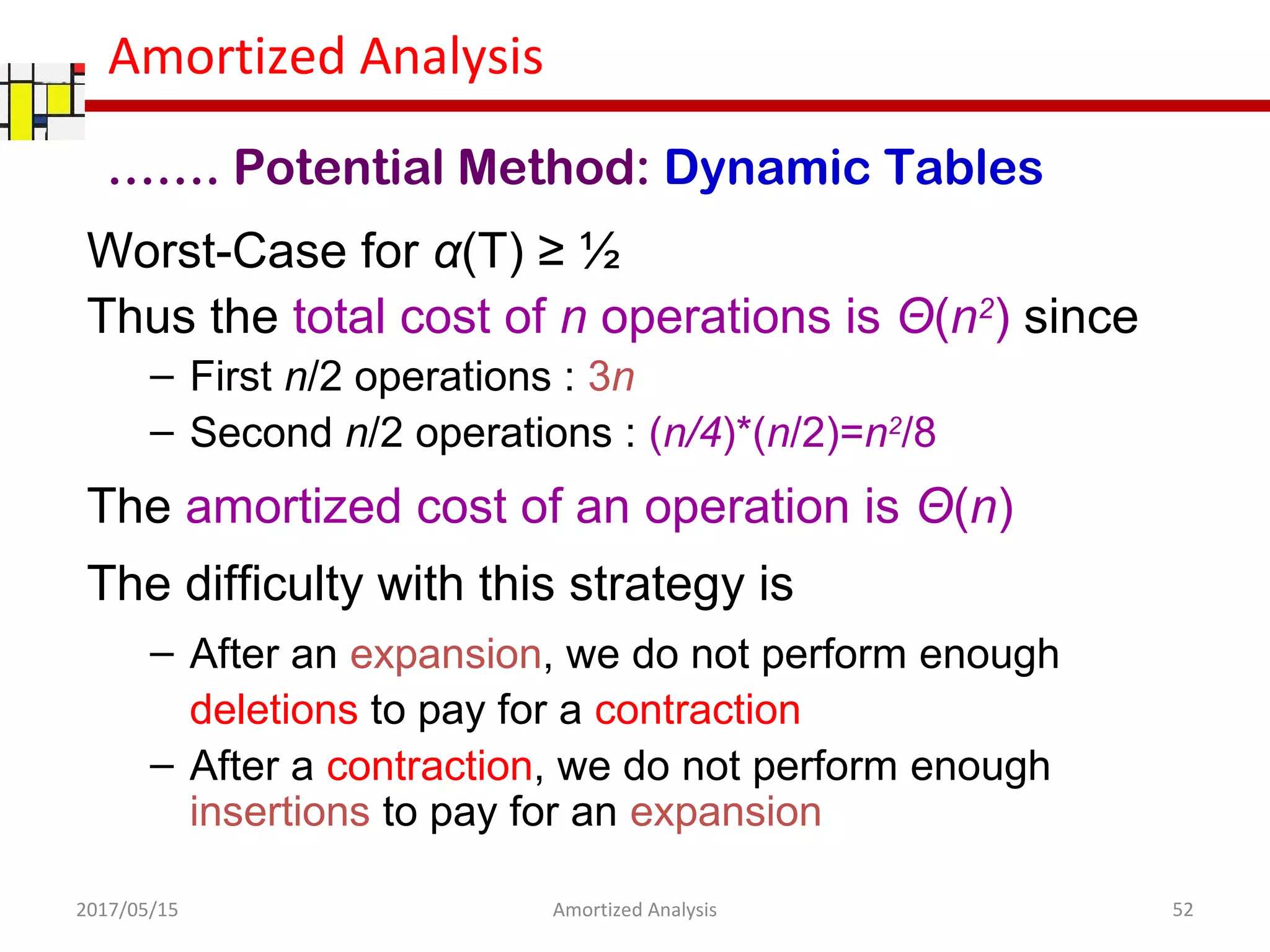

![Amortized Analysis

Worst-Case for α(T) ≥ ½

Consider the following worst case scenario

– We perform n operations on an empty table

where n is a power of 2

– First n/2 operations are all insertions , cost a

total of Θ(n)

at the end: we have num[T] = size[T] = n/2

– Second n/2 operations repeat the sequence

I D D I

that is I D D I I D D I I D D I ...

2017/05/15 50Amortized Analysis

……. Potential Method: Dynamic Tables](https://image.slidesharecdn.com/aoaamortizedanalysis-170604074340/75/Aoa-amortized-analysis-50-2048.jpg)

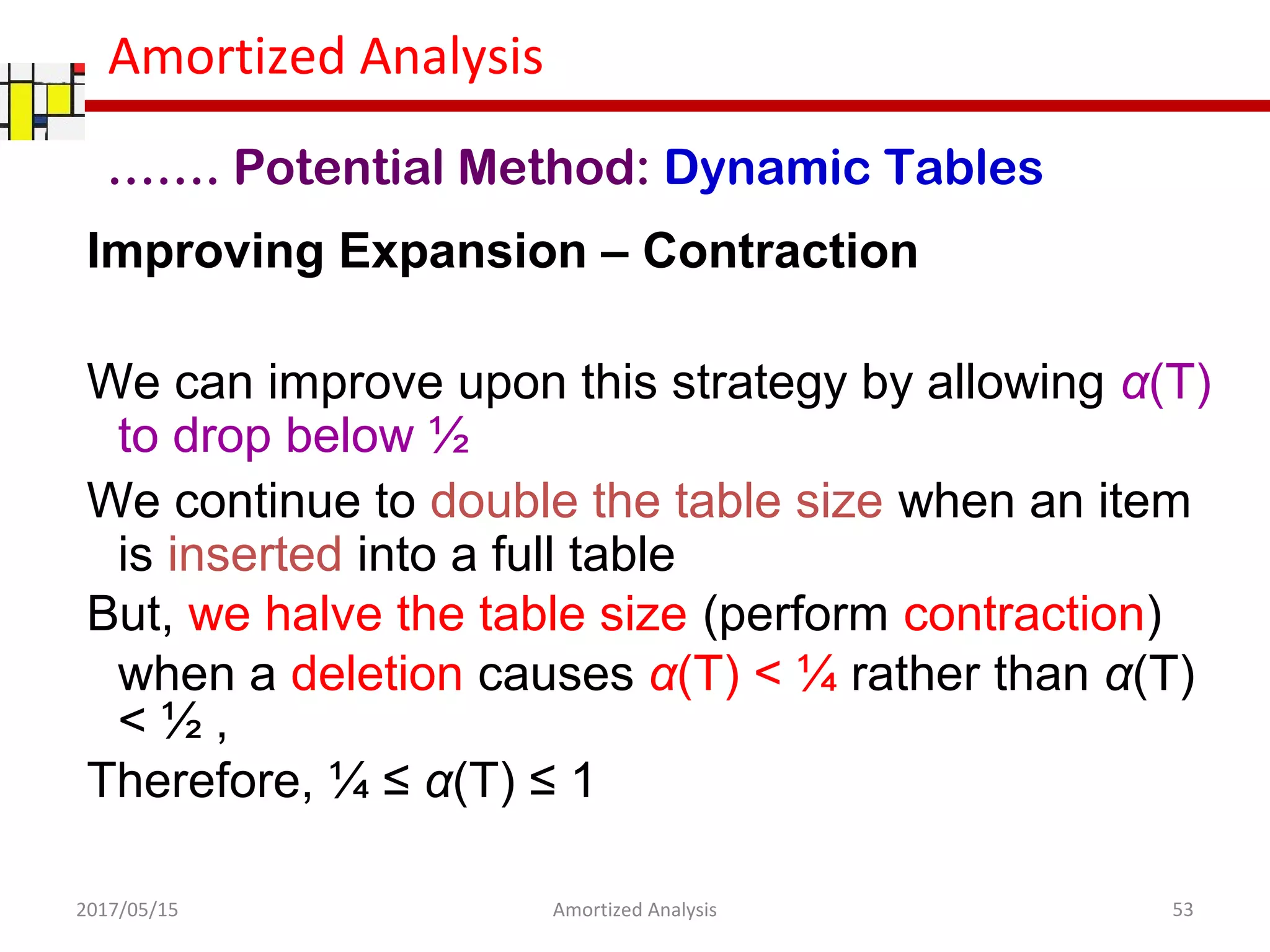

![Amortized Analysis

Define the potential function as follows

• Φ(T) = 0 immediately after an expansion or

contraction

• Recall that, α(T) = ½ immediately after and

expansion or contraction,

therefore the potential should build up to num[T]

as α(T) increases to 1 or decreases to ¼

• So that the next expansion or contraction can be

paid by the potential.

2017/05/15 55Amortized Analysis

……. Potential Method: Dynamic Tables](https://image.slidesharecdn.com/aoaamortizedanalysis-170604074340/75/Aoa-amortized-analysis-55-2048.jpg)

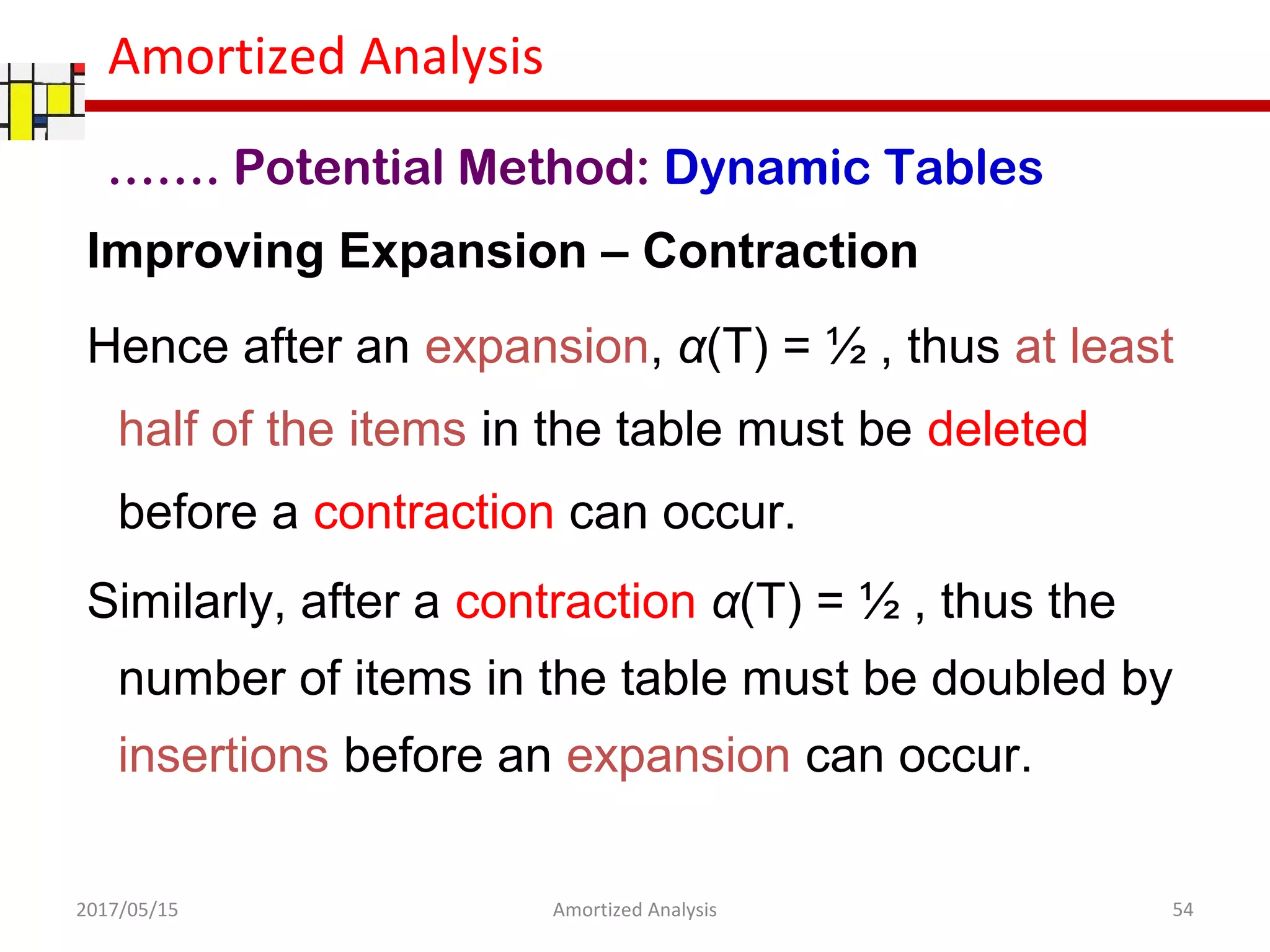

![Amortized Analysis

Description of New Φ: One such Φ is

• Φ(T) = 0 when α = ½

• Φ(T) = num[T] when α = ¼

• Φ (T)= 0 for an empty table (num[T] = size[T]=0)

• Φ is always nonnegative

2017/05/15 56Amortized Analysis

……. Potential Method: Dynamic Tables

<−

≥−

=Φ

2

1

(T)if][

2

size[T]

2

1

(T)if][][2

)(

α

α

Tnum

TsizeTnum

T](https://image.slidesharecdn.com/aoaamortizedanalysis-170604074340/75/Aoa-amortized-analysis-56-2048.jpg)