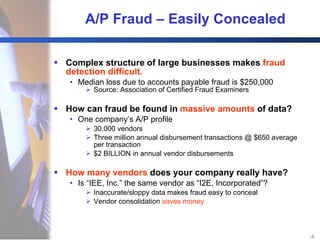

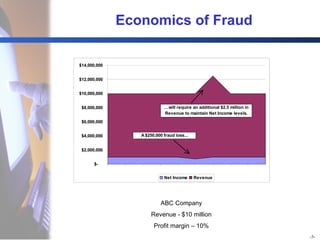

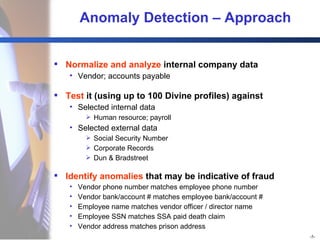

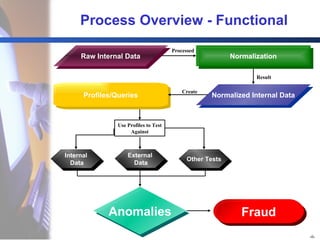

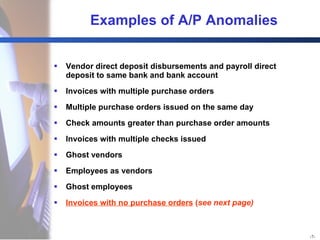

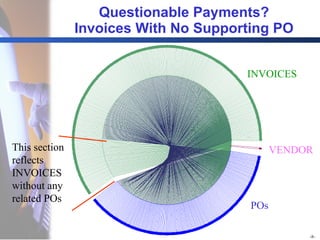

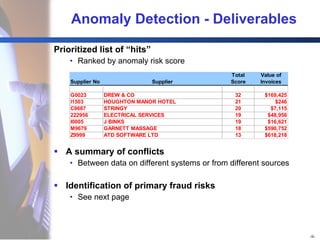

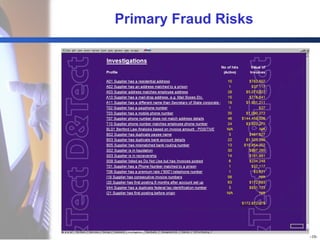

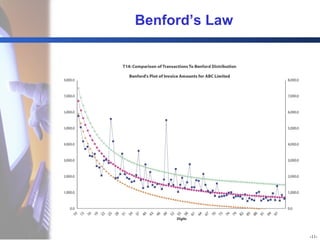

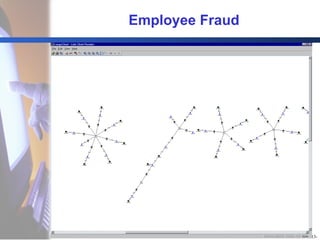

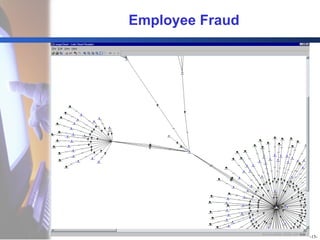

The document discusses vendor anomaly detection and fraud prevention. It notes that complex business structures make fraud difficult to detect, with the median loss from accounts payable fraud being $250,000. Anomaly detection can identify fraud like ghost vendors, duplicate payments, and fraudulent invoices by normalizing and analyzing a company's internal vendor and payment data and comparing it to external sources to find anomalies that may indicate fraud. This approach can uncover fraud before costs become too large and help identify management control issues.