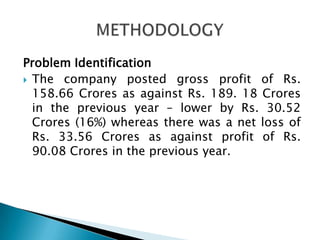

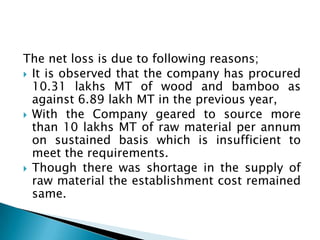

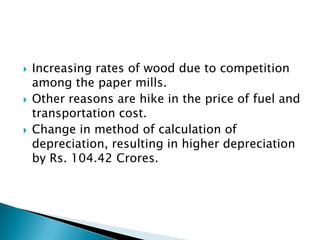

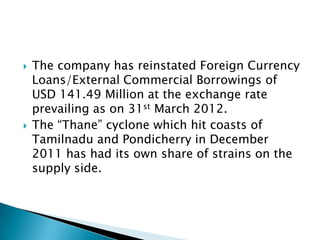

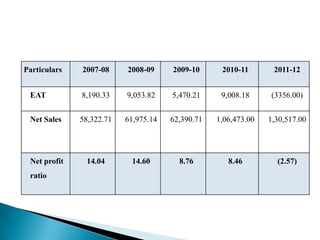

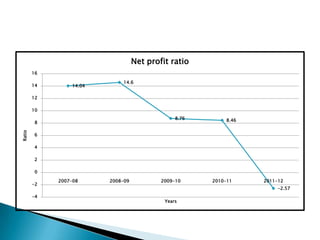

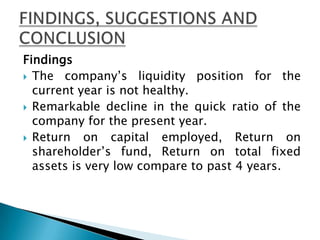

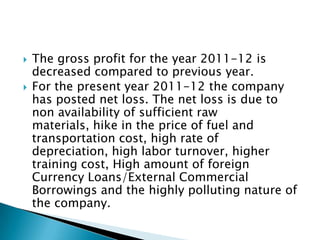

The document discusses the financial analysis methodology and provides an overview of West Coast Paper Mills (WCPM). It identifies issues like high raw material costs, depreciation rates, and foreign currency loans that contributed to WCPM posting a net loss in 2011-12 compared to profit the previous year. Suggestions include increasing current assets to improve liquidity, reducing costs, improving collection of debts, minimizing establishment costs, and acquiring more land for bamboo cultivation to source raw materials.