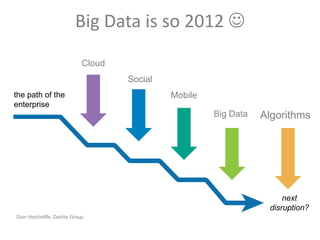

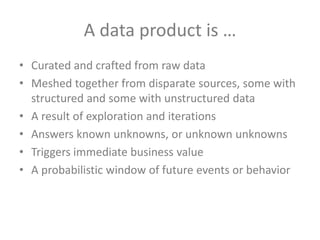

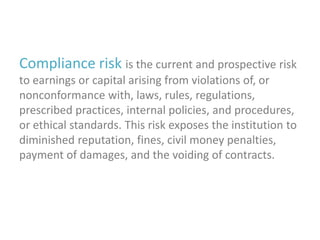

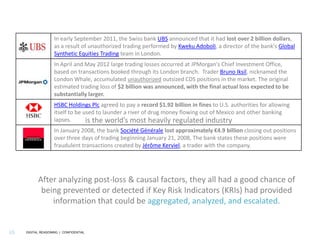

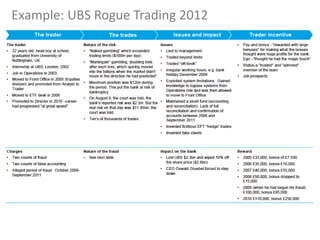

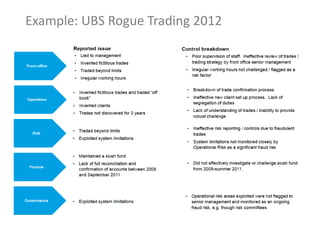

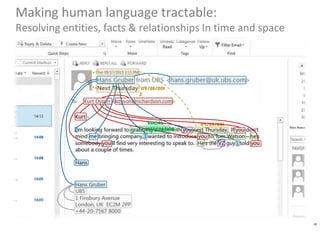

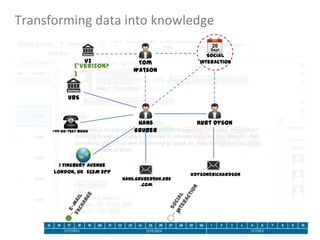

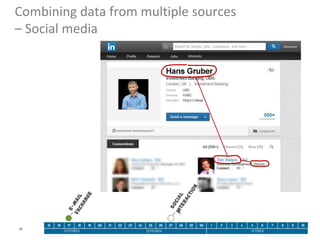

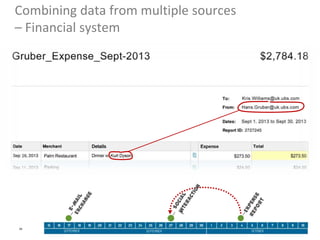

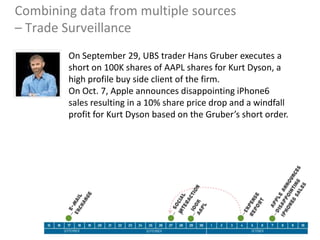

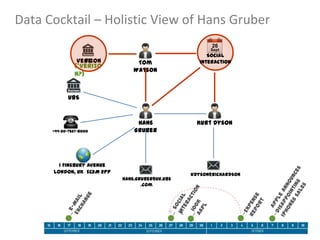

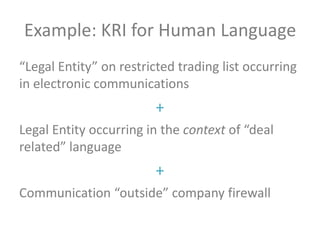

The document discusses the integration of analytics in organizations, emphasizing the importance of leveraging various data tools and technologies to extract insights and create data products. It highlights the challenges of compliance in the heavily regulated financial industry, illustrated through examples of significant trading losses due to unauthorized activities. The text underlines the utility of human language as a rich data source for understanding trader behavior and improving risk management through the development of key risk indicators.