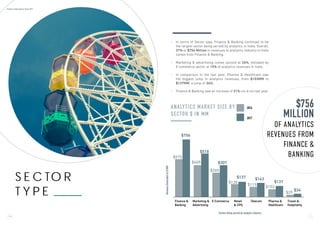

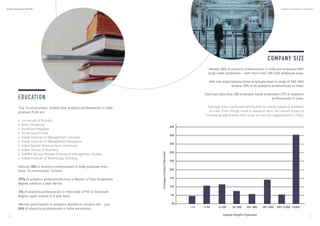

The 2017 Analytics India Industry Study highlights the significant growth of India's analytics sector, which is estimated to generate $2.03 billion annually with a 23.8% CAGR. Small and medium-sized enterprises (SMEs) are increasingly adopting big data technologies, contributing to a doubling of the big data industry by 2020. Major revenue sources include finance, banking, and marketing, while concerns regarding high costs and data culture continue to challenge broader adoption.