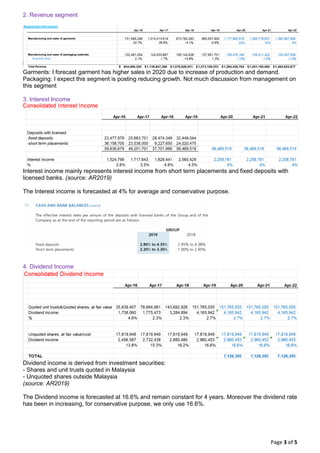

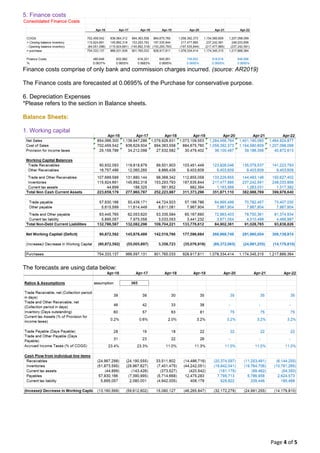

This report recommends buying Magni-Tech Industries Berhad stock with a 12-month target price of RM2.80 based on the company's expected 9.8% return. Magni-Tech is a Malaysia-based investment holding company engaged in garment manufacturing and packaging materials. The report cites merits for the recommendation such as expected increased demand for sportswear due to 2020 Olympics, the company's expansion plans, potential benefits from US-China trade wars, and strong financials with no debt. Risks include the weakening US dollar impacting earnings and rising labor costs in Vietnam. Financial forecasts estimate revenue and net profit growth through 2022 based on increased garment sales and conservative assumptions.