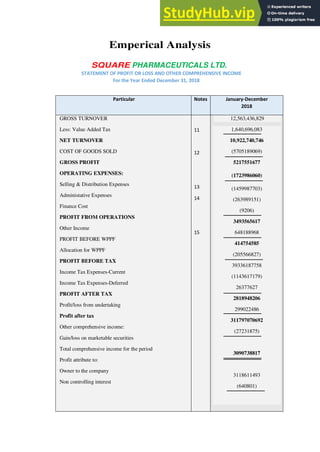

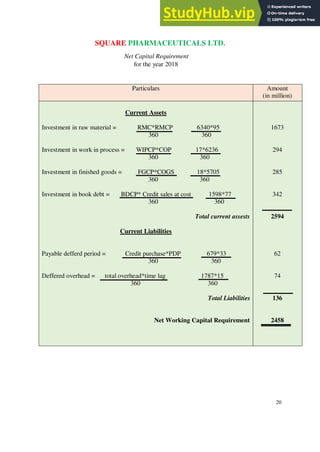

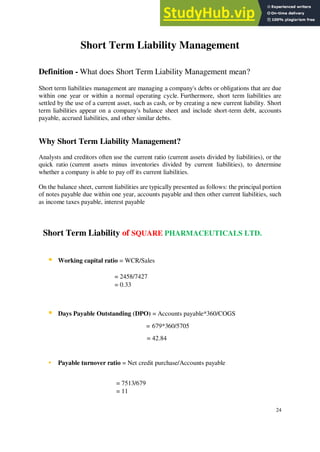

Square Pharmaceuticals Ltd is the largest pharmaceutical company in Bangladesh, achieving market leadership in 1985. It was established in 1958 and has grown significantly over the years. The company manufactures and exports medicines to over 42 countries. It has a diverse product portfolio and several subsidiaries. Square Pharma has a strong financial position as the largest pharmaceutical company in Bangladesh with a market share of about 16.95% and annual turnover of $540 million. The company aims to produce high quality healthcare products and deliver value to shareholders through ethical business practices. It has achieved various milestones in its growth and expansion over the past decades.