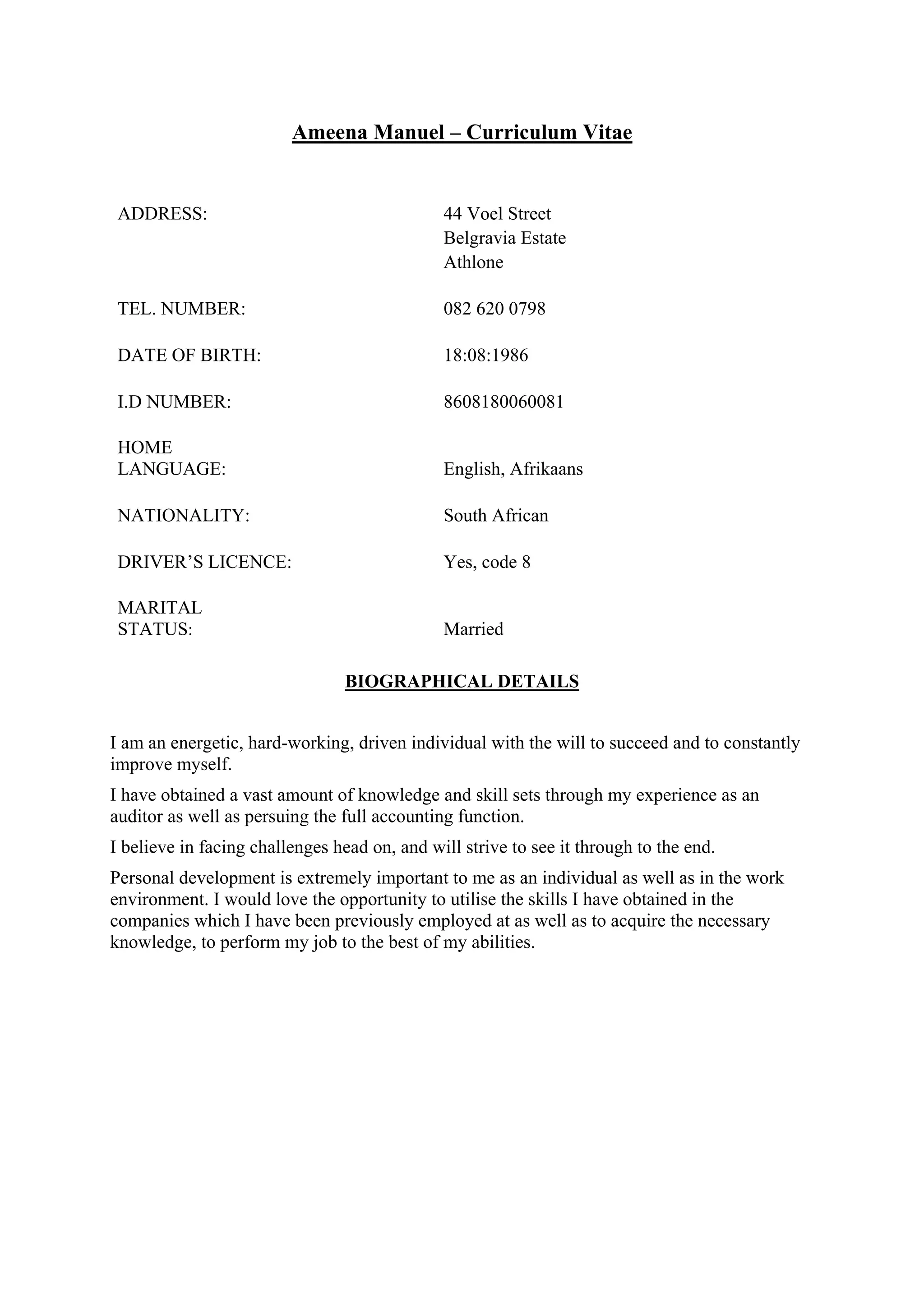

Ameena Manuel provides her curriculum vitae. She has over 10 years of experience working as an accountant and auditor. She received her BCom in Financial Accounting from Stellenbosch University in 2006. Her most recent role was as a consultant at KPMG since 2014, where she performed managed services and prepared financial statements. Previously, she worked as an accountant at Primedia Online from 2012-2014 and as a trainee accountant at LPH Chartered Accountants Inc. from 2008-2012. She has strong skills in accounting, financial analysis, and audit.