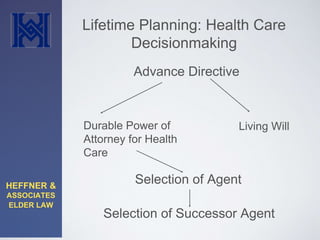

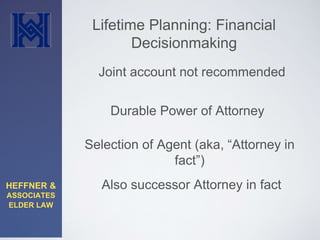

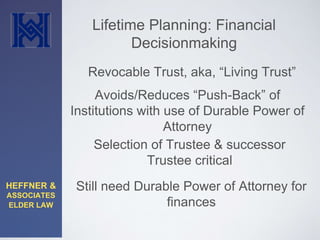

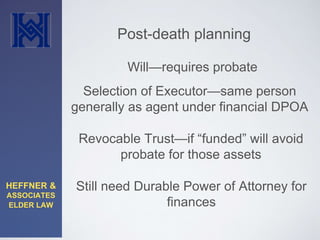

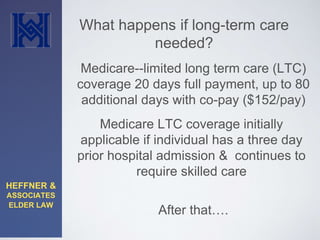

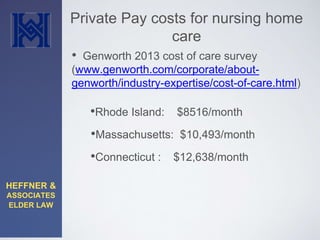

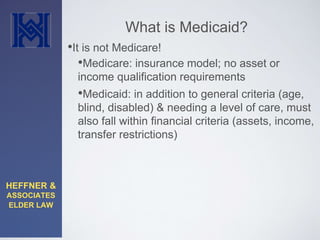

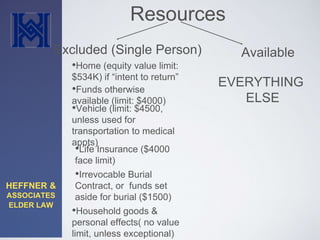

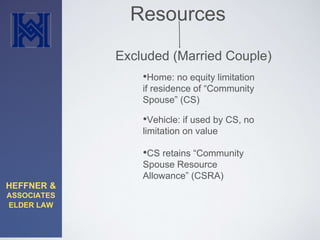

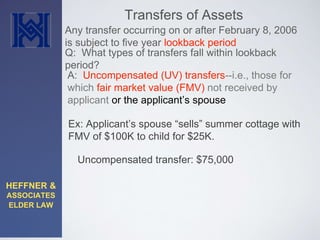

Heffner & Associates provides elder law estate and Medicaid planning services, emphasizing that their materials are for general education and not a replacement for legal consultation. The document outlines important aspects of lifetime planning, including healthcare and financial decision-making, as well as post-death planning and Medicaid information, particularly the distinction between Medicare and Medicaid eligibility. It also touches on asset transfers, the five-year lookback period for Medicaid, and resources for locating certified elder law attorneys.