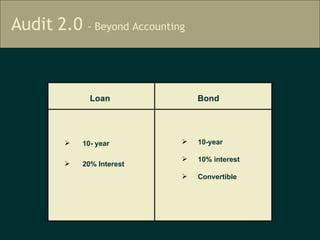

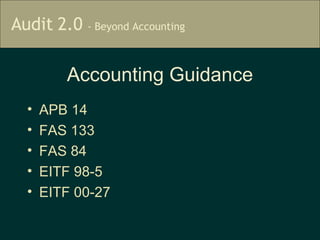

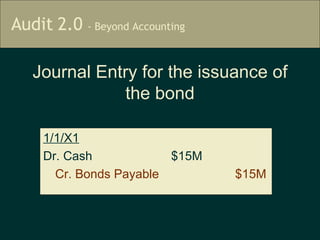

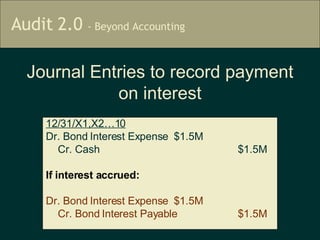

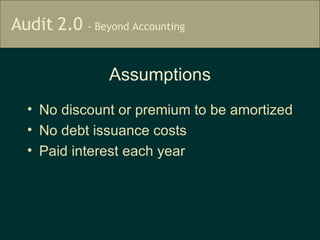

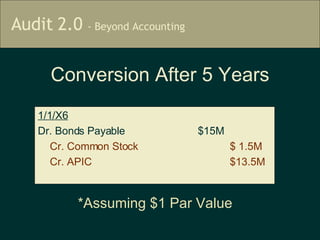

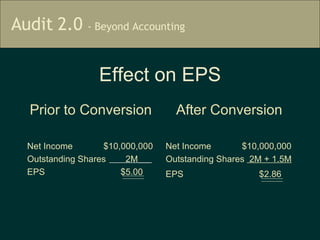

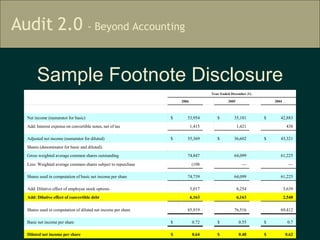

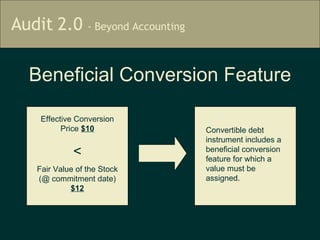

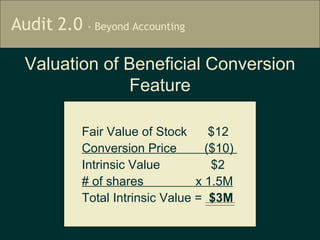

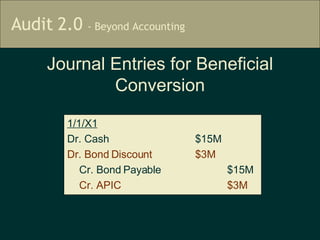

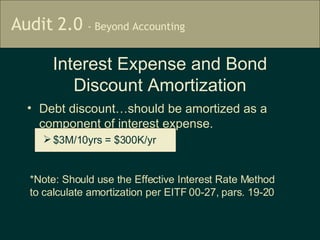

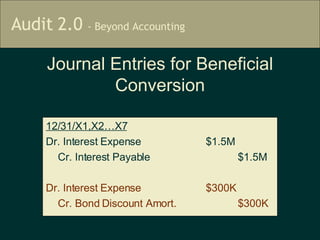

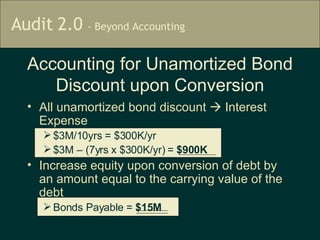

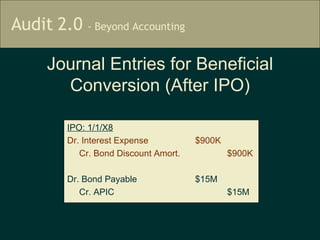

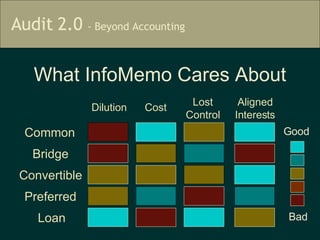

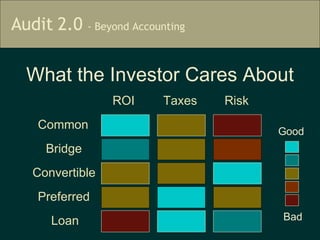

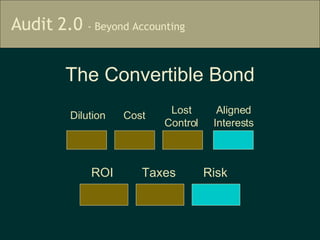

The document discusses financing options for a start-up company preparing to launch a mini-laptop, focusing on two options: a bank loan and a convertible bond loan. It provides detailed analyses of the terms, consequences, and accounting entries associated with each financing scenario, including impacts on earnings per share and the effect of beneficial conversion features. Ultimately, the recommendation is to pursue the convertible bond as the best option for financing.