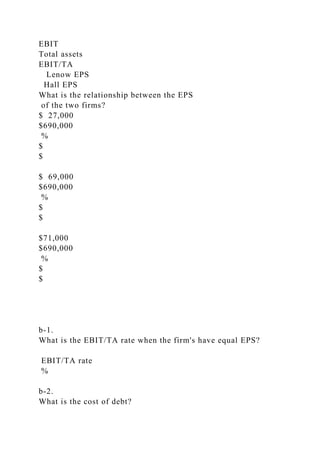

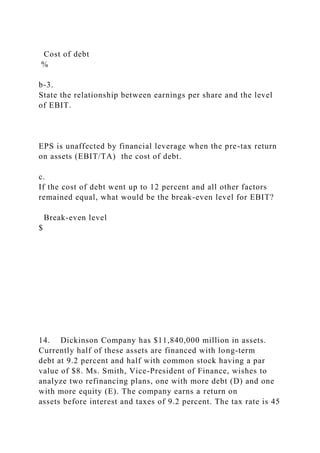

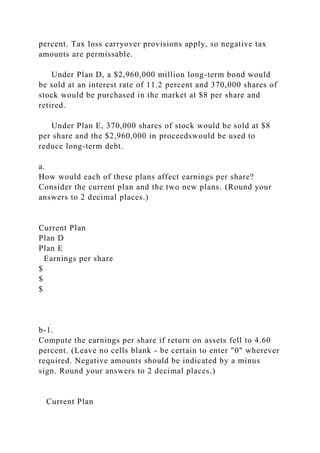

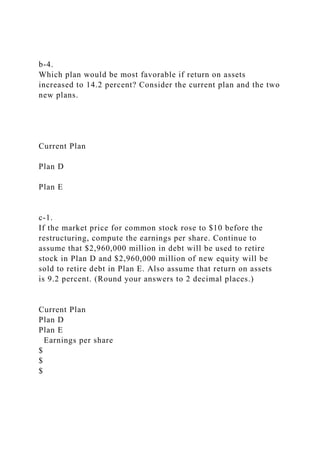

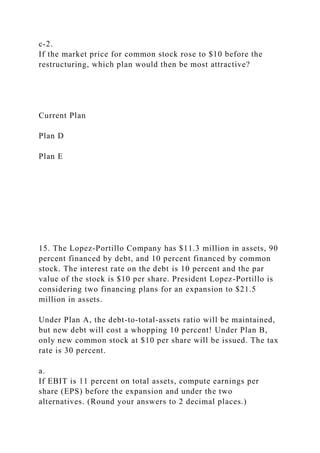

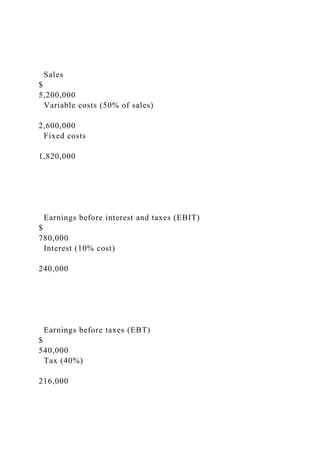

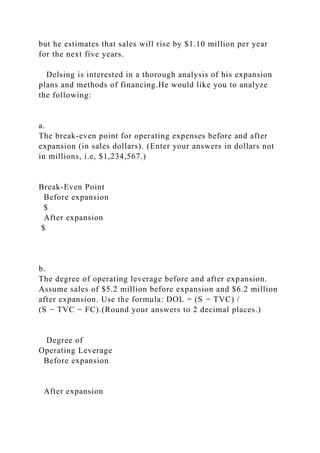

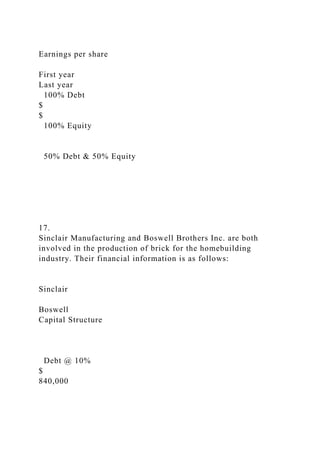

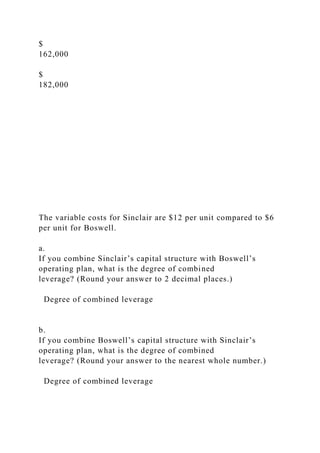

The document details a series of financial analyses for different companies, including projections of sales increases, evaluations of break-even points, degrees of leverage, and assessments of financing strategies using debt and equity. Key companies analyzed include Manning Company, Healthy Foods Inc., Lenow's Drug Stores, Dickinson Company, Lopez-Portillo Company, and Delsing Canning Company, each facing unique challenges and opportunities. The analyses focus on evaluating potential financing plans and the resulting impacts on earnings per share and overall financial health.