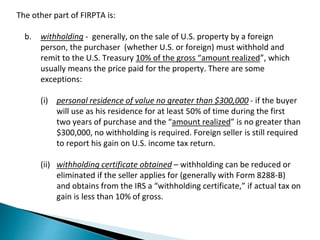

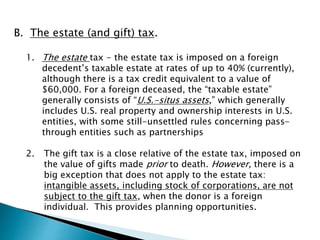

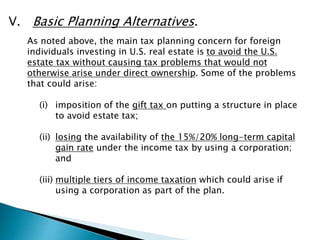

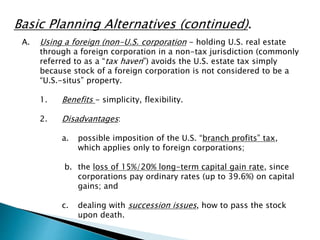

The document discusses the tax implications for foreign individuals investing in U.S. real estate, highlighting the importance of avoiding U.S. estate tax while managing withholding obligations under FIRPTA. It explains the definitions of foreign individuals, basic taxation rules, and various planning strategies, including the use of foreign corporations and irrevocable trusts. Additionally, it emphasizes the responsibilities and risks faced by withholding agents regarding tax withholding and compliance.

![D. Who is a “withholding agent”? The definition of “withholding agent”

differs somewhat based on whether the withholding is for rental

payments or for the proceeds of the sale of real property:

1. Rental payments - the IRS regulations define “withholding agent”

for this purpose rather broadly:

“Any person, whether U.S. or foreign, that has the control,

receipt, custody, disposal, or payment of an item of income of a

foreign person subject to withholding” [Reg. Sec. 1.1441-

7(a)(1)].

The regulations contemplate that there can be multiple

withholding agents with respect to any particular payment, but

withholding by one relieves the others from any obligation or

liability.

Thus, if a property manager for commercial real property collects

rental payments from tenants in Houston and remits the rent to a

foreign owner, both the tenant and the manager are “withholding

agents.” If the manager withholds, however, the tenant is

off the hook.](https://image.slidesharecdn.com/allentiller-141202155059-conversion-gate02/85/International-101-Next-Steps-in-the-Process-Allan-Tiller-15-320.jpg)